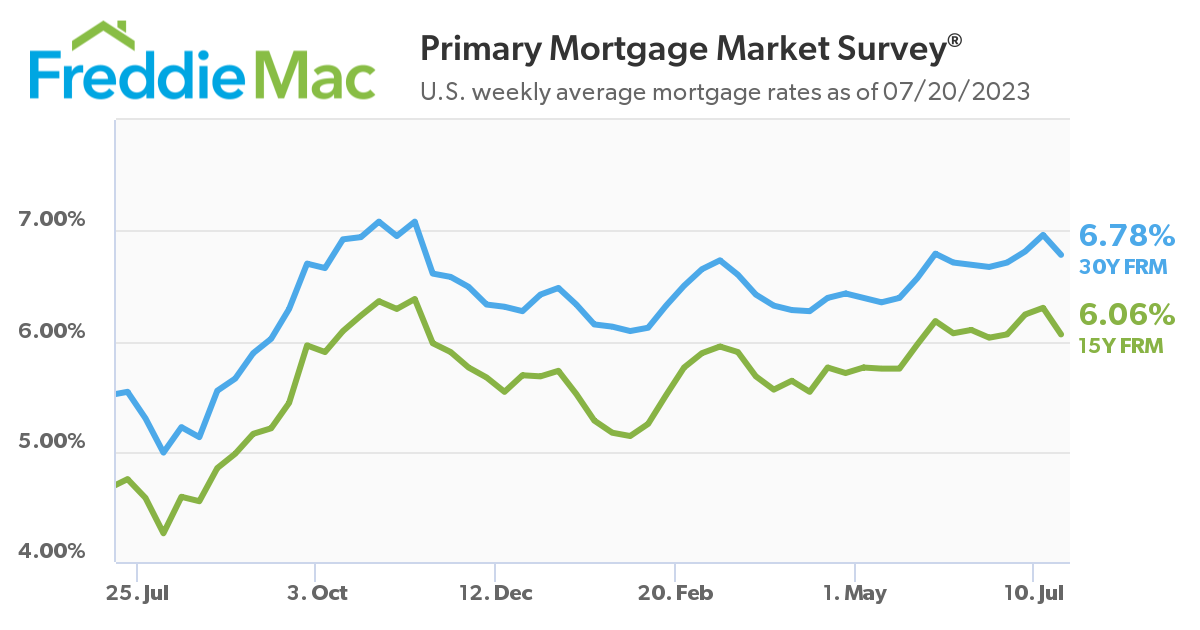

Freddie Mac, in its latest Primary Mortgage Market Survey (PMMS), reports that the 30-year fixed-rate mortgage (FRM) averaged 6.78% as of July 20, 2023, down from last week when it averaged 6.96%. A year ago at this time, the 30-year FRM averaged 5.54%.

Freddie Mac, in its latest Primary Mortgage Market Survey (PMMS), reports that the 30-year fixed-rate mortgage (FRM) averaged 6.78% as of July 20, 2023, down from last week when it averaged 6.96%. A year ago at this time, the 30-year FRM averaged 5.54%.

Also this week, the 15-year FRM averaged 6.06%, down from last week when it averaged 6.30%. A year ago at this time, the 15-year FRM averaged 4.75%.

“As inflation slows, mortgage rates decreased this week,” said Sam Khater, Freddie Mac’s Chief Economist. “Still, the ongoing shortage of previously owned homes for sale has been a detriment to homebuyers looking to take advantage of declining rates. On the other hand, homebuilders have an edge in today’s market, and incoming data shows that homebuilder sentiment continues to rise.”

LendingTree's Senior Economist Jacob Channel added, "To put into perspective what this drop means for new borrowers, consider that on a 30-year, fixed mortgage worth $350,000, a rate of 6.96% results in a monthly payment of about $2,319 (excluding additional costs like taxes and insurance). At the most recent rate of 6.78%, that monthly payment is $2,277. This translates to savings of $42 a month, to $504 a year and $15,120 over the 30-year lifetime of the loan."

Builder confidence in the market for newly built single-family homes in July 2023 posted a one-point gain to 56, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), making June the seventh consecutive month that builder confidence has increased, and marks the highest level the gauge has reached since June 2022.

And as mortgage rates still factor into the affordability equation for many, the struggle of the nation’s housing inventory has breathed new life into new construction as described by NAHB Chairman Alicia Huey.

“The lack of resale inventory means prospective home buyers who have not been priced out of the market continue to seek out new construction in greater numbers,” said Huey, a custom home builder and developer from Birmingham, Ala. “At the same time, builders are troubled over rising mortgage rates approaching 7%, and continue to grapple with supply-side challenges, including ongoing scarcity of electrical transformer equipment, and growing concerns about lot availability.”

With the rise in builder confidence comes a slight uptick in overall mortgage application volume, with the Mortgage Bankers Association (MBA) reporting a 1.1% week-over-week rise in app volume despite rates still in the 7% range.

All eyes will be on next week’s Federal Open Market Committee (FOMC) of the Federal Reserve to see what course of action they will next take. Ending the most aggressive series of rate hikes in history at their June 2023 meeting, the Fed paused raising the nominal interest and letting it sit at a range of 5.00% to 5.25% due to the continued easing of inflation.

“The Freddie Mac fixed rate for a 30-year mortgage dipped 0.18 percentage points this week to 6.78%, backing away from the 7% threshold and offering some relief to hopeful home shoppers,” noted Realtor.com Economic Research Analyst Hannah Jones. “After June’s relatively positive inflation data, the market’s attention has turned to the upcoming FOMC meeting. Though inflation has slowed, the level remains well above the 2% target, and investors expect the Fed to hike interest rates in pursuit of this target. While the Federal Funds rate does not directly impact mortgage rates, it installs a floor beneath the cost of borrowing, meaning mortgage rates are likely to remain elevated for the time being.”

Redfin reported earlier this week that high home prices, fueled by a lack of inventory and rates, have pushed the typical homebuyer’s monthly payment to a record $2,656. Daily mortgage rates have been dropping due to cooling inflation, but housing payments are likely to remain elevated because even slightly lower rates may escalate competition for the few homes on the market and push up prices for the foreseeable future.

And what does the remainder of 2023 hold for the housing market? Only time will tell as the industry awaits Fed actions this coming week, as it may or may not resume actions and increase the nominal interest rate.

“As markets prepare for next week’s FOMC meeting and the probable resulting interest rate hike, strong employment data and cooling inflation suggest that the economy’s progress towards stability is on the right track,” said Jones. “However, home shoppers are still feeling the pressure of recently climbing mortgage rates, as well as limited affordable inventory. Sellers remain hesitant to engage with today’s market, creating competition for the relatively few homes on the market in many areas. The current market dynamics are likely to persist until affordability and inventory gains are made. Despite slowing price growth nationally, some low-priced markets continue to see high levels of price growth and a quick market pace, exemplifying how much housing market dynamics vary by locale.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news