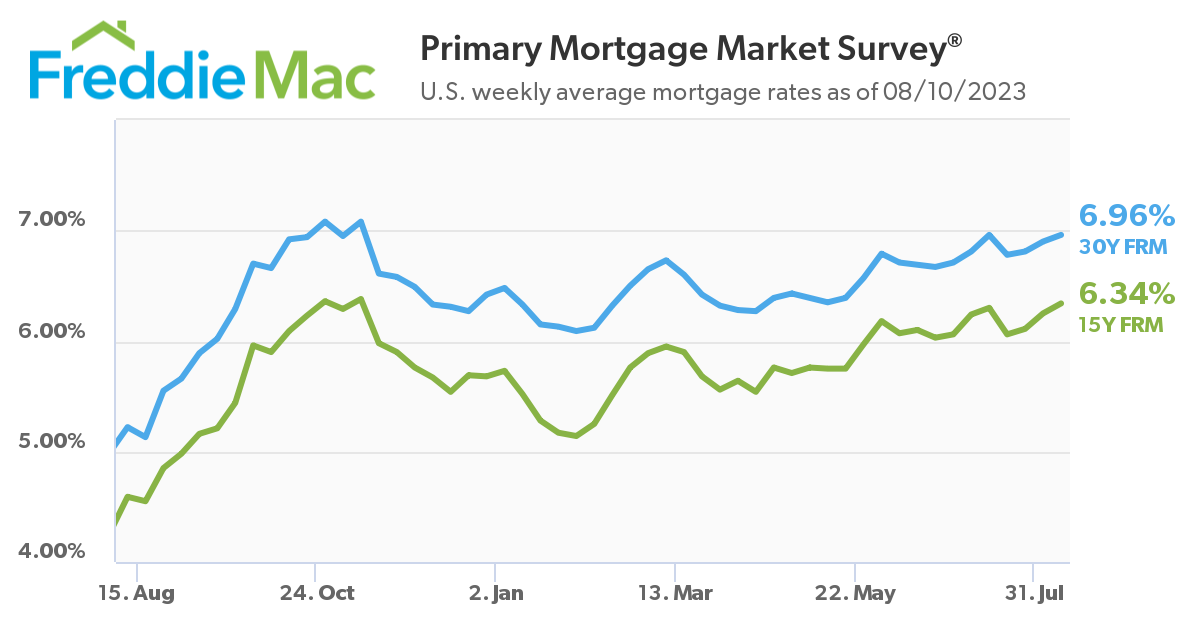

Mortgage rates are creeping up on the 7% mark, as Freddie Mac reports in its latest Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) averaged 6.96%, up from last week when it averaged 6.90%. A year ago at this time, the 30-year FRM averaged 5.22%.

Mortgage rates are creeping up on the 7% mark, as Freddie Mac reports in its latest Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) averaged 6.96%, up from last week when it averaged 6.90%. A year ago at this time, the 30-year FRM averaged 5.22%.

“For the third straight week, mortgage rates continued creeping up and are now just shy of seven percent,” said Sam Khater, Freddie Mac’s Chief Economist. “There is no doubt continued high rates will prolong affordability challenges longer than expected, particularly with home prices on the rise again. However, upward pressure on rates is the product of a resilient economy with low unemployment and strong wage growth, which historically has kept purchase demand solid.”

Also last week, the 15-year FRM averaged 6.34%, up from last week when it averaged 6.25%. A year ago at this time, the 15-year FRM averaged 4.59%.

The uptick in rates pushed mortgage application volume down further as the Mortgage Bankers Association (MBA) reported week-over-week volume declines, the third straight week of declines.

“Mortgage rates trended higher last week to 7%, as financial markets responded to ongoing economic volatility and the downgrading of the U.S. government’s credit rating,” added MBA President and CEO Bob Broeksmit. “Due to these higher rates, there was a significant pullback in mortgage application activity. Both prospective buyers and sellers are feeling the squeeze of higher rates as well as low housing inventory, which has prompted a pronounced slowdown in activity this summer.”

As Broeksmit mentioned, just two months after placing Fannie Mae and Freddie Mac (the GSEs) on ‘Rating Watch Negative,’ last week, Fitch Ratings downgraded Fannie Mae's and Freddie Mac's (GSEs) Long-Term Issuer Default Ratings (IDR) and senior unsecured debt ratings to 'AA+' from 'AAA' and downgraded their respective Government Support Ratings (GSR) to 'aa+' from 'aaa.’ Fitch cited concern over the country's deteriorating finances as precipitating the downgrade, and expressed major doubts about the government's ability to tackle the growing debt burden because of the sharp political divisions, exemplified by the brinkmanship over the debt ceiling that brought the government close to a disastrous default.

As Realtor.com Economist Jiayi Xu notes, first-time buyers are struggling with lingering affordability issues, but homeowners are on solid footing.

“While elevated mortgage rates continue to pose a significant challenge to affordability, today’s homeowners are still in a relatively good position as they could leverage near-record high home equity to reduce the size of mortgage loans,” said Xu. “What's more, a recent cross-market report from Realtor.com reveals that home shoppers are also addressing affordability concerns by expanding their search to markets outside of where they live.”

In the continued struggle for affordability, Realtor.com found that, in Q2 of 2023, an average of 60.3% of all Realtor.com listing page views from the top 100 metros went to homes located outside the metropolitan areas where shoppers live. This trend indicates that Americans are on the move. This trend was also an increase of 0.7 percentage points from the first quarter of 2023, and an increase of 4.1 percentage points year-over-year.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news