Throughout the U.S., homeownership is seen a big part of the classic American dream, and deemed the pinnacle of success to many. But for a great deal of Americans, saving up for their first home can take a long time, especially in today’s volatile housing market.

A new survey from Shane Co.'s The Loupe revealed American homeowners rent for an average of five years before purchasing a home, as 37% of respondents intentionally delayed their homebuying journey due to affordability, being intimidated by the homebuying process, or other personal reasons.

While five years may seem like a long time to rent, the housing market remains volatile and can be prohibitively expensive in many areas of the country.

While Americans are likely to have to rent longer before pulling the trigger on purchasing their first home, as new research showed renting is often more affordable than a mortgage and gives people time to save up for a down payment.

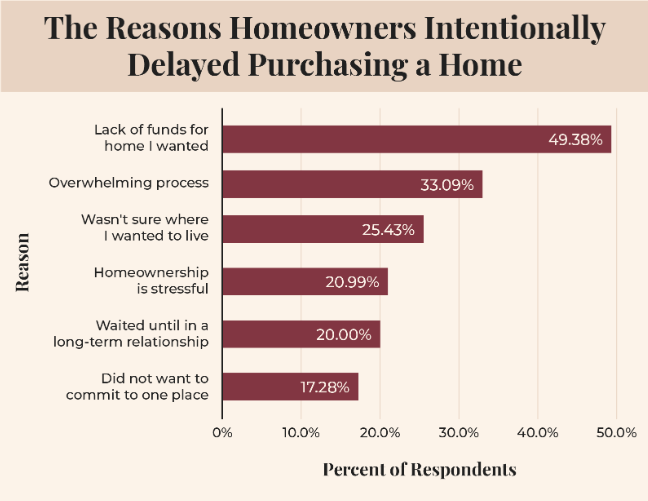

Reasons Homeowners Intentionally Delayed Purchasing a Home

The study found the top reason Americans delayed purchasing a home was a lack of funding, as nearly 50% of respondents cited affordability as a primary cause for halting their homebuying process.

Some 33.09% cited that the process was too overwhelming, followed by uncertainty in where they wanted to live (25.43%). An estimated 20.99% of Americans feel homeownership is too stressful, while 20% said they waited until they got into a long-term relationship to purchase a home.

More than 17% said they simply did not want to commit to one place, stopping their home search altogether.

According to the report, over 1 in 4 Americans believe it's not possible to afford a home in the current housing market as a single person, while 58% of Americans feel pressured to buy a home after they get married. In fact, data found that only 24% of married homeowners owned their home prior to marriage.

But once they’re in a long-term relationship, homebuying isn’t always an option right away. On average, couples rented with their partner for 3.5 years before buying a home.

States Where Residents Are Most and Least Likely to Stay in Their Hometowns

While 37.30% of average homeowners stay in their hometown, many more are likely choosing not to shy away from their familiar territory.

The states where residents are most likely to stay are:

- Connecticut (52%)

- Pennsylvania (52%)

- Louisiana (50%)

- Illinois (48%)

- Delaware (47.83%)

The states where residents are least likely to stay are:

- Iowa (26%)

- Texas (26%)

- Virginia (26%)

- Arizona (22%)

- North Carolina (18%)

When it comes to how long people should rent before buying a home, New Yorkers give people the most time.

They said people should rent for an average of three years and nine months before purchasing, which is unsurprising when you consider the average home price in New York is over $620,000 according to Zillow.

North Carolinians came in with the second-highest average answer of three years and eight months. Given that it’s also a state where people don’t plan on sticking around, this makes sense so that they have time to save up for a place they want.

For many, homeownership is the next big item on the checklist after getting married. But, based on the survey results, the rent-to-buy timeline can vary a great deal depending on who and where you are.

While many continue to grapple with housing supply and affordability, buying a home is a big investment, and not a process that should be rushed.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news