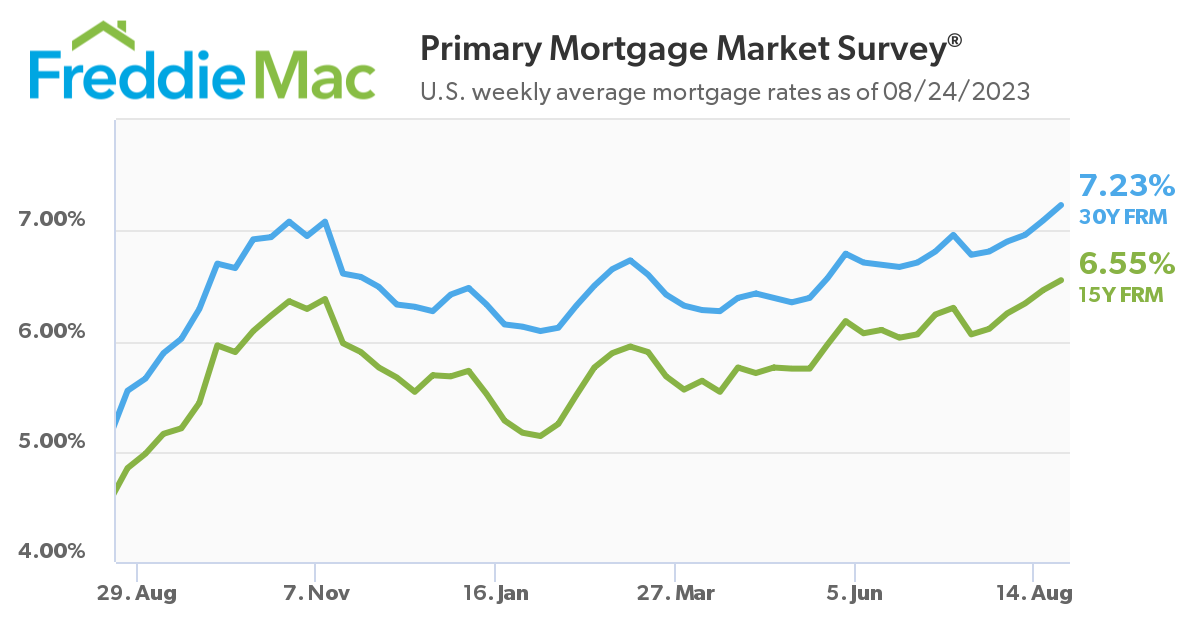

Freddie Mac reports that the 30-year fixed-rate mortgage (FRM) rose to its highest mark since 2001, as its latest Primary Mortgage Market Survey (PMMS) averaged 7.23% for the week ending August 24, 2023, up from last week when it averaged 7.09%. A year ago at this time, the 30-year FRM averaged just 5.55%.

Freddie Mac reports that the 30-year fixed-rate mortgage (FRM) rose to its highest mark since 2001, as its latest Primary Mortgage Market Survey (PMMS) averaged 7.23% for the week ending August 24, 2023, up from last week when it averaged 7.09%. A year ago at this time, the 30-year FRM averaged just 5.55%.

“This week, the 30-year fixed-rate mortgage reached its highest level since 2001, and indications of ongoing economic strength will likely continue to keep upward pressure on rates in the short-term,” said Sam Khater, Freddie Mac’s Chief Economist. “As rates remain high and supply of unsold homes woefully low, incoming data shows that existing homes sales continue to fall. However, there are slightly more new homes available, and sales of these new homes continue to rise, helping provide modest relief to the unyielding housing inventory predicament.”

Also this week, the 15-year FRM averaged 6.55%, up from last week when it averaged 6.46%. A year ago at this time, the 15-year FRM averaged 4.85%.

And with the continued rise in rates came the reaction from home buyers and the continued struggle with affordability, as the Mortgage Bankers Association (MBA) found that overall mortgage application volume fell 4.2% week-over-week, as new purchase apps hit levels not seen since April of 1995.

“It has been a challenging market for prospective buyers this summer, as high home prices, low housing supply, and high mortgage rates have diminished purchasing power,” said MBA President and CEO Robert D. Broeksmit, CMB. “Last week’s jump in mortgage rates above 7% caused purchase activity to fall to a 28-year-low. MBA expects mortgage rates later this year to fall off recent highs, which could bring some buyers back into the market.”

Redfin recently conducted a study on affordability and found that a homebuyer on a $3,000 monthly budget can afford a $429,000 home with a 7.4% mortgage rate, roughly the daily average on August 23. Year-over-year, that buyer has lost $71,000 in purchasing power since August 2022, when they could have bought a $500,000 home with an average rate of about 5.5%.

In further examining affordability, Redfin reports that the monthly mortgage payment on the typical median-priced U.S. home, which costs about $380,000, is roughly $2,700 with a 7.36% mortgage rate. The monthly payment would be $400 lower—around $2,300—with last year’s 5.5% rate.

And as pandemic-era rules from employers continue to go by the wayside, Realtor.com Chief Economist Danielle Hale notes that a new type of home buyer has emerged, one seeking homes in close proximity of major employment hubs, as return-to-office policies are put in place.

“Interest rate uncertainty paired with still-high costs and new shifts in the way we work have led to an interesting split in the housing market,” noted Hale. “While affordability continues to be a top consideration for many home shoppers, the Realtor.com 2023 Hottest Zip Codes Report shows that another type of home shopper has also been active in 2023. Areas with high quality housing in close proximity to major job centers have joined affordable markets on the list of Hottest ZIP Codes, suggesting that in-office demands are causing some shoppers to focus on commute-length."

For the first time since 2018, the suburbs of five major metropolitan areas–Boston, New York, Chicago, Detroit, and St. Louis–landed on the annual Realtor.com Hottest ZIP Codes of 2023 Report, marking a renewed interest in more commutable homes as much of the country's workforce returns to in-person work.

"As many companies continue to call employees back to the office, we're seeing a surge in home shoppers who are seeking a desirable combination of cost and convenience within commuting distance of major metropolitan areas," added Hale. "In addition to affordable markets, this year's list also features some higher priced areas close to large urban cores, which will likely appeal to buyers who are concerned with finding the right mix of size and amenities within reach of a nearby city center."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news