According to findings from a new survey by LendingTree, in the past year, 68% of homeowners started or completed home improvement projects, while 63% plan to begin one in the next year. For the study, LendingTree surveyed nearly 2,200 U.S. homeowners.

According to findings from a new survey by LendingTree, in the past year, 68% of homeowners started or completed home improvement projects, while 63% plan to begin one in the next year. For the study, LendingTree surveyed nearly 2,200 U.S. homeowners.

As mortgage rates continue to linger above the 7% mark, the majority of homeowners are tackling improvement projects to spruce up their homes. Among generations, millennial homeowners have been the busiest, with 78% working on upgrades in the past year, and 72% planning to do so in the next 12 months.

“One could be that they’re buying less expensive homes that need more work,” said LendingTree Senior Economist Jacob Channel. “While there are certainly well-off millennials, members of the generation typically don’t have much wealth compared to their older peers. Owing to this, the only homes that some can afford might be fixer-uppers. Also, millennials may just have more energy to spend on home improvement projects than their older peers.”

Among all planned or completed projects, interior painting, landscaping, and bathroom remodels were found to be the most popular. Among those who’ve started, completed, or are planning to start a home project, 61% will focus on interior painting, 54% will work on landscaping, and 47% will upgrade their bathrooms.

The most popular way to pay for these projects typically is with savings, with 40% of homeowners doing new window work are primarily paying with savings—the highest among the projects LendingTree highlighted. Windows were followed by remodeling unused living spaces or basements, upgrading electrical wiring, and adding new roofs, all coming in at 39%. Of these four projects, adding a new roof incurs the highest estimated cost at $9,525, on average.

Millennial homeowners ages 27 to 42 are the most likely age group to take on an improvement project, with 78% working on upgrades in the past year and 72% planning to do so in the next 12 months, followed by:

- Gen Zers (ages 18 to 26): 70% have started or completed a project in the past 12 months, while 64% plan to start one in the next 12 months.

- Gen Xers (ages 43 to 58): 65% have started or completed a project in the past 12 months, while 59% plan to start one in the next 12 months.

- Baby boomers (ages 59 to 77): 54% have started or completed a project in the past 12 months, while 53% plan to start one in the next 12 months.

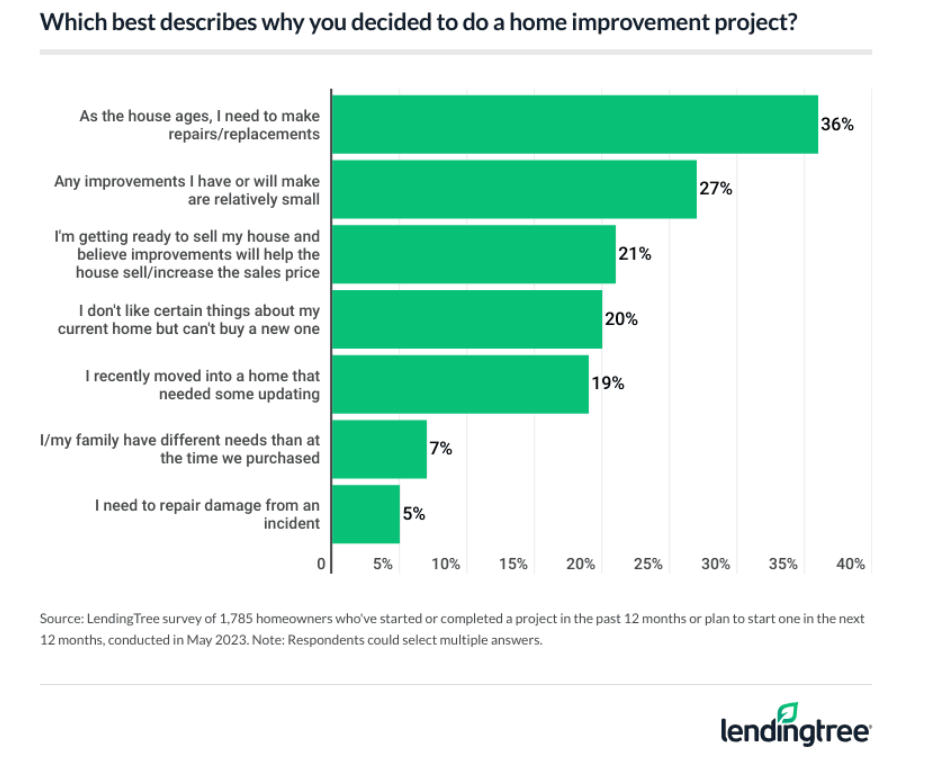

Reasons for beginning these projects vary among homeowners. When asked why they’ve worked on a project in the past year or plan to work on one in the next year, 36% say they need to make repairs as their home ages, while 27% said their improvements were relatively small, and 21% said they’re doing repairs in preparation to sell their home. Across generations, millennials are most likely to be preparing to sell at 29%, while baby boomers were the least likely to make improvements for this reason, with just 10% making improvements because they’re preparing to sell.

According to Channel, these projects are likely popular because they involve servicing easily visible and/or high-traffic home areas.

“The more eyes that something has on it, the more likely people might want to make it as presentable as possible,” added Channel. “Similarly, the more often a person uses something, like their kitchen or bathroom, the more incentive they have to make sure that it’s working as well as it can. On top of that, some of these projects might be more manageable than others, so people might be more willing to take them on.”

For the study, LendingTree commissioned Qualtrics to conduct an online survey of 2,162 U.S. homeowners ages 18 to 77 from May 17-19, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

Click here for more information and details on LendingTree’s survey on home improvement trends.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news