Renting is a common housing arrangement for many Americans, but not all renters like sharing their space with other people. In fact, the number of lone renters is on the rise.

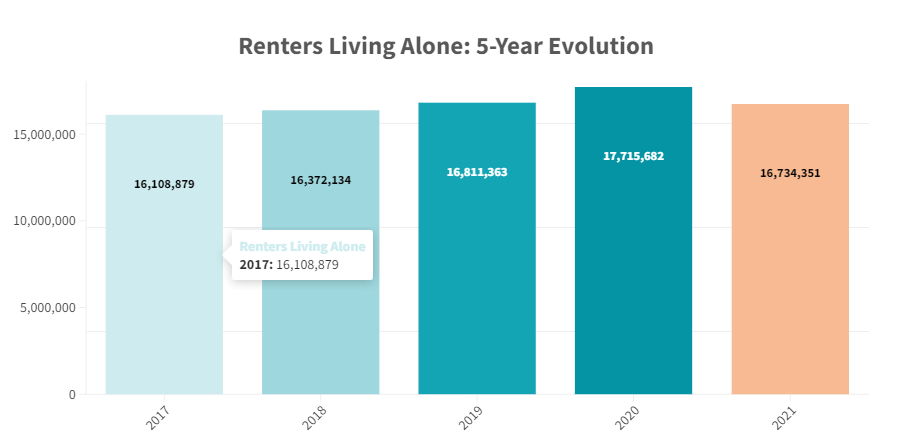

Between 2016 and 2021, renters living alone gained about 1 million people, reaching 16.7 million (up 6.7%). That’s the fastest-rising renter group during those five years, having accelerated significantly during 2020.

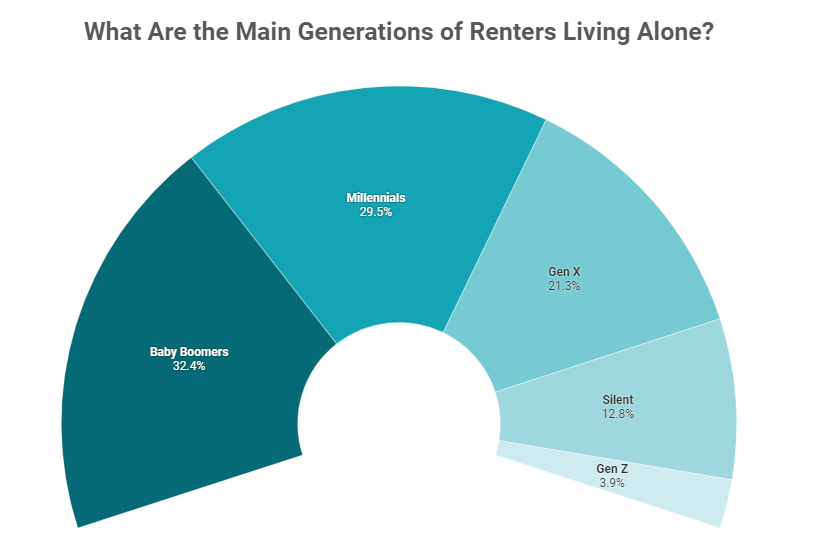

Baby Boomers and Millennials are the biggest fans of solo renting, while very few Gen Zers are venturing on their own. That’s mainly because living alone comes at a premium cost: To rent an apartment alone, a renter needs an extra annual income of $8,600 compared to the average renter.

Top 10 Metros With the Smallest Income Gap Between Solo Renters vs. Average Renters:

- Akron, OH

- Pittsburgh

- Providence, RI

- Toledo, OH

- Dayton, OH

- Knoxville, TN

- Cleveland

- Omaha, NE

- Worcester, MA

- Rochester, NY

Top 10 Metros With Highest Rise in Renters Living Alone:

- Salt Lake City

- McAllen, TX

- Austin, TX

- San Antonio

- Charlotte, NC

- Fresno, CA

- Jacksonville, FL

- Albuquerque

- Dallas

- Raleigh, NC

Salt Lake City saw the biggest increase in solo renters between 2016 and 2021, while Philadelphia and Indianapolis recorded the largest shares of people renting by themselves.

At the same time, living alone as a renter is easiest (from a financial point of view) in Akron and other places in Ohio.

Renting alone has become increasingly popular in recent years. In fact, the number of solo renters reached a record high of 17.7 million in 2020, as the pandemic spread and more people adopted distancing.

On the other hand, renters living with roommates saw a different pattern: They peaked at 6.3 million in 2019, and only partially bounced back to 5.8 million after the pandemic. Meanwhile, people living with family in rented apartments dropped from 71.3 million in 2016 to 68.1 million in 2021.

With that in mind, we wanted to get a clearer view of the evolution of renting alone across the country in recent years, including the breakdown by generation, which metros saw the biggest increases in the number of renters living alone, and where it was easiest and hardest to rent alone.

Baby boomers make up the biggest slice of solo renting, followed by millennials

Baby Boomers make up the largest population of renters living alone in the U.S. (an estimated 32.4%, or 5.3 million), whereas just half a million share their rental home with a roommate. This can be largely attributed to the fact that aging in place is more feasible these days, especially with the rise of smart home technologies and easy access to online shopping and services.

What's more, Baby Boomers renting alone need an income of just under $50,000 to maintain a solo renter lifestyle. That's approximately $16,300 more than what the average renter needs in order to afford to rent, based on individual income estimates from the U.S. Census Bureau.

Next, although the majority of Millennials are now homeowners, they remain the dominant generation of renters, and about 4.8 million of them are opting for solo living arrangements, either by choice or by necessity. Thus, Millennials represent 29.5% of Americans renting by themselves.

In addition, Millennials renting alone boast an average income of $55,973, which is about $22,300 above the average renter's income. That’s a clear indication of how much they value having their own space and freedom—without having to deal with the inconvenience of sharing their rental homes with others.

Gen X represents 3.5 million solo renters enjoying privacy at home as hybrid work persists. They are followed by the Silent Generation (totaling 2.1 million solo renters) and Gen Zers (640,000).

Solo renters surge the most in Salt Lake City, but Texas dominates the top 10

Salt Lake City saw the biggest increase in the share of renters living alone between 2016 and 2021 among all metros analyzed—up by as much as 24.9% for a total of 50,265 renters. That said, lone renters here account for 15% of the metro’s entire population of renters.

Plus, with healthcare, technology, and energy thriving in Salt Lake City, it’s easy to see why so many renters are choosing to call this growing city home. Granted, the cost of living in Salt Lake City is slightly higher than the national average, but it’s still relatively affordable compared to other big metros.

Next comes McAllen, TX, which attracts renters with its extremely reasonable cost of living, affordable housing, and growing economy. Here, the share of lone renters grew 24.2% to a total of 19,579 in 2021, or 8% of the metro’s renter population.

Staying in the Lone Star State, solo renters in Austin grew 23.9%, from 114,510 to 141,923 in five years. With that, this category now represents 18% of the city’s population of renters. And, with its booming tech industry, many professionals in “Silicon Hills” enjoy the convenience of renting alone.

At the same time, San Antonio’s share of solo renters saw a 21.7% spike, pushing the number of renters living alone throughout the metro to 125,638, or 15% of its entire renter population. Dallas completes the list of Texas cities dominating the top 10, due to its 16% increase between 2016 and 2021. As such, lone renters in the Big D now total 402,404, making up 15% of all renters in the metro.

Interestingly, among all metros analyzed, Philadelphia and Indianapolis boast the largest share of renters living alone—both at 20%—after their numbers increased by 12.7% and 12%, respectively, in those five years. Currently, solo renters total about 352,000 in Philadelphia and almost 122,000 in Indianapolis.

Lone renters get the best bang for their buck in Ohio, with Akron emerging as the best metro to rent alone

Living alone as a renter can be challenging financially. However, there are some places in the U.S. where solo renters can afford to live comfortably and enjoy a good quality of life without breaking the bank. To that end, we ranked the locations where the gap between the income of lone renters and the income of average renters is the smallest. In this case, Ohio claims four spots among the top 10 metros where it’s easiest on the wallet to live as a solo renter.

Akron, OH, is the nation’s best metro for lone renters from a financial standpoint, earning an extra $261 per month compared to regular renters). More precisely, those renting in Akron alone have an average annual income of $30,520, while the average renter makes $27,384 per year. That said, 42,515 (or 21%) of all renters here live alone and enjoy Akron’s low cost of living, budding startup scene, and all of the attractions it has to offer.

Pittsburgh is the #2 metro in the U.S. where it’s easiest to rent alone. Making up more than 25% of the city’s population of renters, those renting alone in Pittsburgh have an average yearly income of $36,706. That’s just $3,382 (or 10%) more than what regular renters make per year.

Further northeast, in Providence, RI, renters living without roommates represent 20% of the metro’s renter population. On average, their annual income is $36,354, which is 13% higher than a regular renter’s income in the area. This means that lone renters in Providence make an extra $4,380 per year, or $365 per month.

California claims half of the top 20 places where it’s hardest to rent alone, led by San Jose

Living alone in a rental apartment in California can be challenging, and most renters have to share their space with roommates or family members to afford the sky-high costs of living and housing. Thus, unsurprisingly, 10 of the top 20 metros where it’s hardest to rent alone are located in the Golden State.

First, with solo renters representing just 9% of all people renting in San Jose, CA, those seeking privacy here in Silicon Valley’s largest city have an average income of $93,288. Renters who live alone make 37% more than the average renter here. In net figures, that’s a difference of $29,376 per year or $2,448 per month. By comparison, in San Jose, those living with roommates or family in rented units have an average income of $63,912.

Meanwhile, lone renters in Santa Barbara, CA—who make up 9% of the metro’s population of renters—have an annual income of $61,912, which is about 42% higher than what the average renter makes ($36,456 per year). And, in Salinas, CA, solo renters have an average income of $56,834, which is about 57% more than what the average renter makes per year.

Similarly, in Los Angeles, those renting alone make up 11% of all apartment dwellers in the area and have an annual income of $54,156, while the average renter makes $36,181 per year. In other words, to afford to rent by yourself in the City of Angels, you need to make an extra $17,975 per year, or around $1,500 per month.

By comparison, renting alone in San Francisco requires a higher income than in Los Angeles ($73,329, on average). That’s approximately 25% higher than the average renter's income in the area.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news