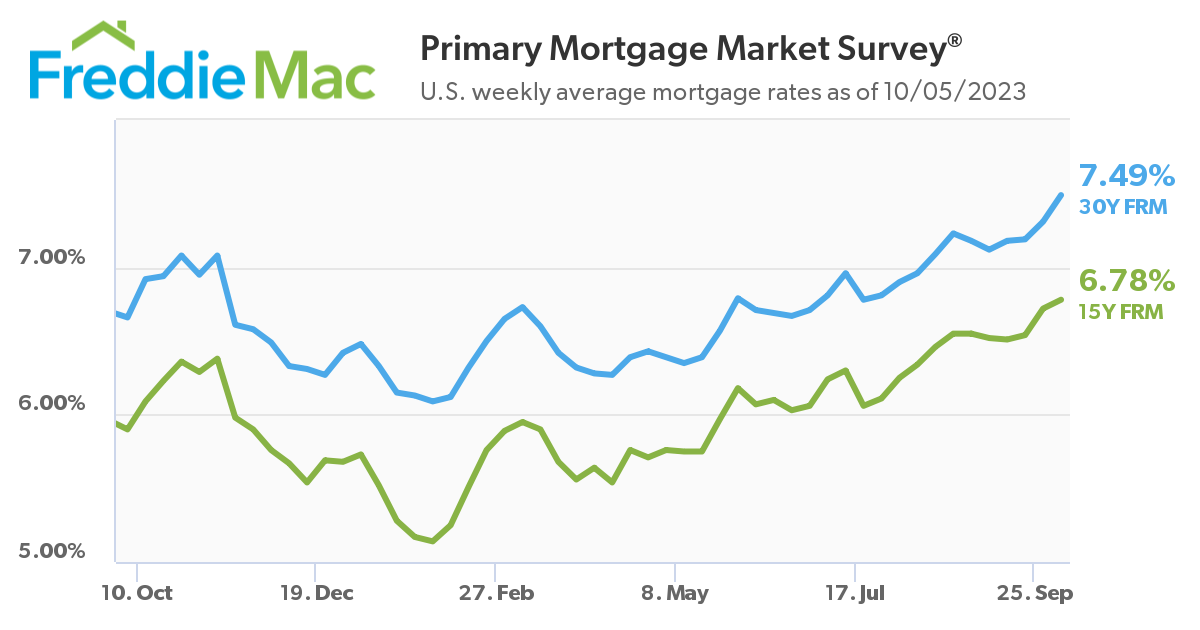

According to the latest Primary Mortgage Market Survey (PMMS) from Freddie Mac, the 30-year fixed-rate mortgage (FRM) averaged 7.49% for the week ending October 5, 2023, up 18 basis points from last week’s average of 7.31%. A year ago at this time, the 30-year FRM averaged 6.66%.

According to the latest Primary Mortgage Market Survey (PMMS) from Freddie Mac, the 30-year fixed-rate mortgage (FRM) averaged 7.49% for the week ending October 5, 2023, up 18 basis points from last week’s average of 7.31%. A year ago at this time, the 30-year FRM averaged 6.66%.

Also this week, the 15-year FRM averaged 6.78%, up from last week when it averaged 6.72%. A year ago at this time, the 15-year FRM averaged 5.90%.

“Mortgage rates maintained their upward trajectory as the 10-year Treasury yield, a key benchmark, climbed,” said Sam Khater, Freddie Mac’s Chief Economist. “Several factors, including shifts in inflation, the job market and uncertainty around the Federal Reserve’s next move, are contributing to the highest mortgage rates in a generation. Unsurprisingly, this is pulling back homebuyer demand.”

With the rise in rates came yet another fall back in mortgage application volume as purchase mortgage applications hit a near-30-year-low, according to the Mortgage Bankers Association (MBA). The MBA’s Weekly Mortgage Applications Survey for the week ending September 29, 2023, found a 6% week-over-week decline in overall mortgage application volume, as the purchase market fell to levels last reported in 1995.

“Mortgage rates at 23-year highs have continued to depress the housing market,” said MBA President and CEO Robert D. Broeksmit. “Purchase applications declined again last week, falling to the lowest level since 1995. Despite the recent jump in rates, we still anticipate that the 30-year fixed-rate mortgage will drop before the end the year, providing some relief to prospective homebuyers heading into 2024.”

As affordability continues to elude many, prospective buyers nationwide remain locked-in to their current situation, either priced out of the market or forced to continue to rent. This is causing a ripple effect in the number of homes available for sale, further depleting the nation’s housing supply.

“As mortgage rates hover around the 20-year-high territory in recent weeks, homeowners are less likely to put their homes on the market, leading to a consistent decline in the number of newly listed homes,” said Jiayi Xu, Economist at Realtor.com. “In fact, more than 60% of homebuyers have encountered challenges related to inventory, struggling to find homes that align with their budget or meet their specific needs. While declining pending home sales and new home sales signaled a slowdown in buyer activities, the increasing home listing prices and shorter days spent on market suggested that homebuyers are competing over the limited inventory.”

The convergence of forces working against buyers is causing another level of complexities and anxiety amongst home shoppers, as Redfin found in a recent study that nearly two-thirds of recent homebuyers (59%) felt that purchasing a home is more stressful than dating.

“Getting ghosted by your date is stressful, but purchasing a home in today’s market comes with its own unique set of anxieties,” said Redfin Chief Economist Daryl Fairweather. “Buyers are increasingly ghosting sellers as housing costs climb, and high mortgage rates are prompting many homeowners to stay put instead of selling—meaning house hunters have a record low number of homes to swipe right on.”

Redfin found that, of the life events respondents had to choose from, there were just two that respondents found more nerve-wracking than buying a home: 57% said divorce is more stressful, while 56% cited finding a new job was more stressful.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news