Through an analysis of the U.S. Census Bureau’s latest Population Survey data conducted by the National Rental Home Council (NRHC), 2,487,095 households in the U.S. moved to a single-family rental (SFR) home over the past year, an increase of 5.3% from 2022.

Through an analysis of the U.S. Census Bureau’s latest Population Survey data conducted by the National Rental Home Council (NRHC), 2,487,095 households in the U.S. moved to a single-family rental (SFR) home over the past year, an increase of 5.3% from 2022.

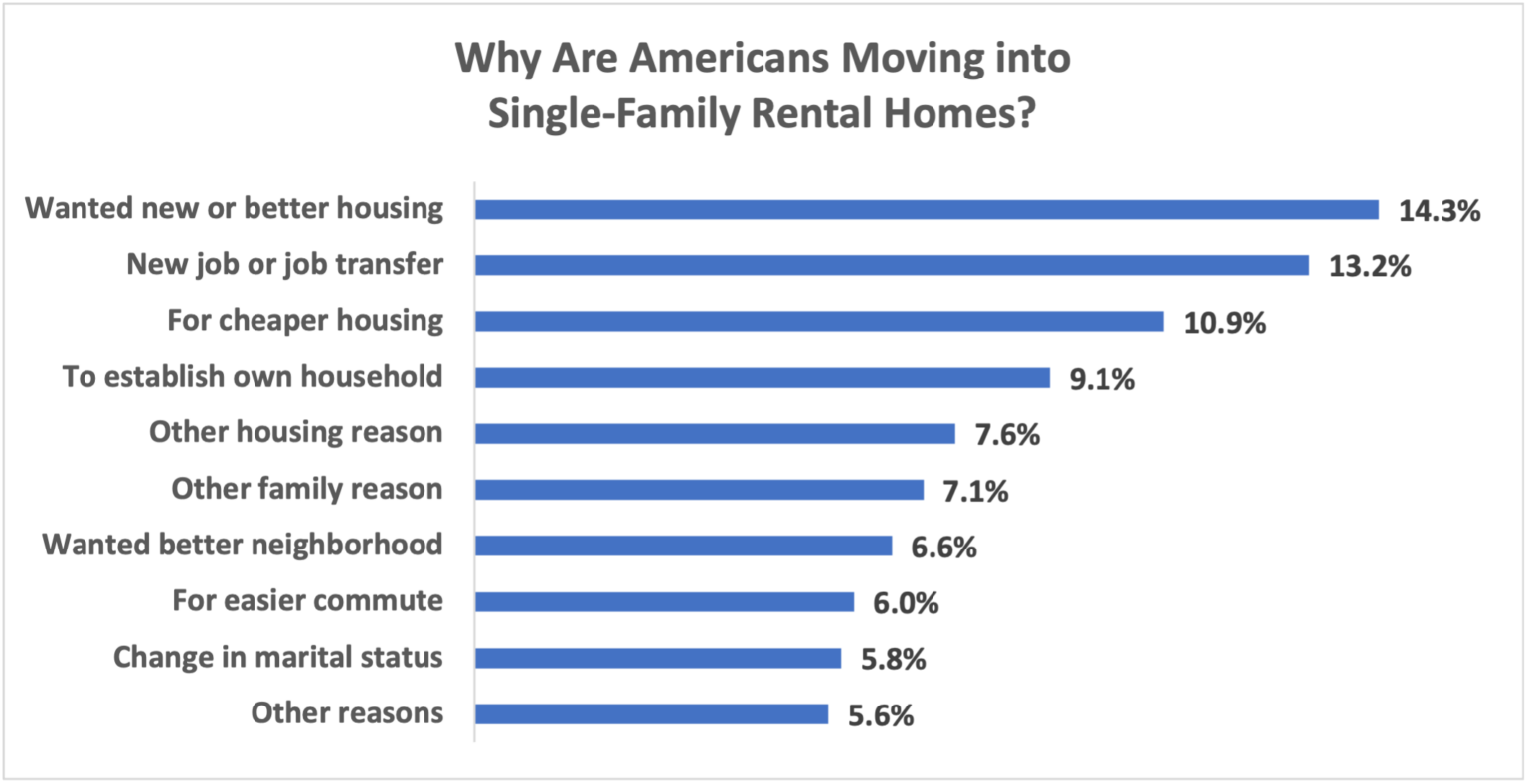

The Census Bureau data also reveals that Americans are moving to single-family rental homes for reasons that may differ from years past, as 13.2% of households moved to an SFR home because of a new job or job transfer, 3.4 percentage points higher than reported in 2022. Households moving seeking a better neighborhood (+2.4 percentage points), and cheaper housing (+1.6 percentage points) also saw notable increases over the previous year.

“Single-family rental homes continue to provide families and households with an important option for meeting their housing needs,” said David Howard, CEO of NRHC. “At a time when housing markets across the country are challenged by ongoing supply constraints and affordability concerns, single-family rental homes serve to enhance and expand the diversity of housing opportunities available to American families.”

NRHC is a nonprofit trade association representing the SFR home industry. NRHC members provide families and individuals with access to high-quality, single-family rental homes that contribute to the vitality and vibrancy of neighborhoods and communities.

The latest Primary Mortgage Market Survey (PMMS) from Freddie Mac found the 30-year fixed-rate mortgage (FRM) averaging 7.49%, up 18 basis points from the previous week’s average of 7.31%, thus furthering affordability issues for many prospective buyers.

And as Sam Khater, Freddie Mac’s Chief Economist, notes, “Several factors, including shifts in inflation, the job market and uncertainty around the Federal Reserve’s next move, are contributing to the highest mortgage rates in a generation. Unsurprisingly, this is pulling back homebuyer demand.”

With affordability continuing to factor into attaining the American dream of homeownership, prospective buyers nationwide remain locked-in to their current situation, either priced out of the market or forced to continue to rent. This is causing a ripple effect in the number of homes available for sale, further depleting the nation’s housing supply, but benefiting the SFR market. Many are turning to SFR for their housing needs as they are forced to the sidelines by continued affordability issues.

“As mortgage rates hover around the 20-year-high territory in recent weeks, homeowners are less likely to put their homes on the market, leading to a consistent decline in the number of newly listed homes,” said Jiayi Xu, Economist at Realtor.com. “In fact, more than 60% of homebuyers have encountered challenges related to inventory, struggling to find homes that align with their budget or meet their specific needs. While declining pending home sales and new home sales signaled a slowdown in buyer activities, the increasing home listing prices and shorter days spent on market suggested that homebuyers are competing over the limited inventory.”

Further exacerbating the struggle for buyers in today’s market, CoreLogic reports that home price gains recorded their highest level since February 2023, coming in at an appreciation rate of 3.7% during the month of August, as U.S. home prices have now increased year-over-year for 139 consecutive months.

“While continued mortgage rate increases challenge affordability across U.S. housing markets, home price growth is in line with typical seasonal averages, reflecting strong demand bolstered by a healthy labor market, strong wage growth and supporting demographic trends,” said Selma Hepp, Chief Economist for CoreLogic. “Still, with a slower buying season ahead and the surging cost of homeownership, additional monthly price gains may taper off.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news