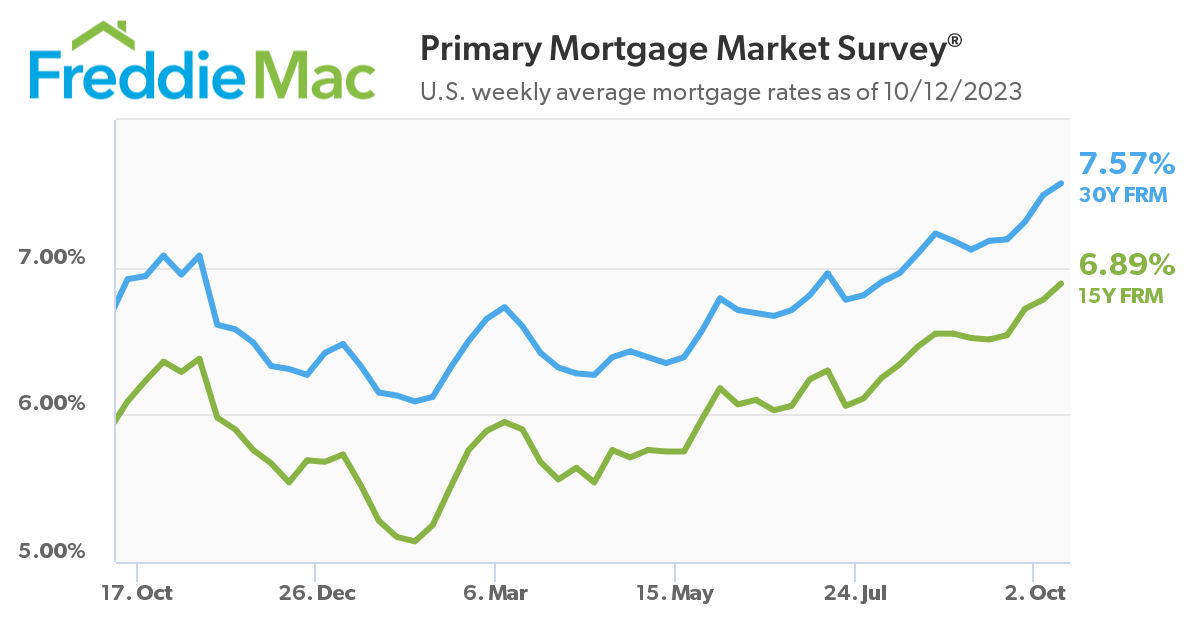

For the fifth straight week, Freddie Mac has reported a steady rise in the 30-year, fixed-rate mortgage (FRM), as the latest Primary Mortgage Market Survey (PMMS) shows the 30-year FRM averaging 7.57%, up eight basis points over last week’s average of 7.49%. A year ago at this time, the 30-year FRM averaged 6.92%.

For the fifth straight week, Freddie Mac has reported a steady rise in the 30-year, fixed-rate mortgage (FRM), as the latest Primary Mortgage Market Survey (PMMS) shows the 30-year FRM averaging 7.57%, up eight basis points over last week’s average of 7.49%. A year ago at this time, the 30-year FRM averaged 6.92%.

Also rising this week was the 15-year FRM, which averaged 6.89%, up 11 basis points from last week’s reading of 6.78%. A year ago at this time, the 15-year FRM averaged 6.09%.

“For the fifth consecutive week, mortgage rates rose as ongoing market and geopolitical uncertainty continues to increase,” said Sam Khater, Freddie Mac’s Chief Economist. “The good news is that the economy and incomes continue to grow at a solid pace, but the housing market remains fraught with significant affordability constraints. As a result, purchase demand remains at a three-decade low.”

Freddie Mac’s PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down, and have excellent credit.

As rates continue to drift upward, the Mortgage Bankers Association (MBA) reports that overall application volume, while still at near-30-year lows, rose slightly 0.6% week-over-week on the strength of the adjustable-rate mortgage (ARM) share of activity, which increased to 9.2% of total applications.

“Mortgage applications increased for the first time in three weeks, pushed higher by a 15% jump in ARM applications,” said MBA President and CEO Bob Broeksmit. “With mortgage rates well above 7%, some prospective homebuyers are turning to ARMs to lower their monthly payment in the short term amidst these high mortgage rates.”

Despite the slight uptick in application volume, affordability continues for many, as many are turning their parents and extended family into co-buyers or roommates in order to find a place they can call home, according to a recent survey from Realtor.com and Censuswide. Of those surveyed who are planning to buy a home within the next 12 months, nearly half of all respondents are looking toward their parents to help them prepare for buying a home, with nearly one-third (29%) saying they've already moved in with their parents to help save money in preparation for buying a home, and 22% considering doing so.

“Prospective buyers have had to get creative to prepare financially for homeownership,” noted Realtor.com Senior Economic Research Analyst Hannah Jones. “In a recent survey, Realtor.com found that almost a third of respondents reported that they have moved in with their parents or other family members in order to save for a home purchase. Unsurprisingly, younger respondents were the most likely to consider this route. Young buyers, many of whom are first time buyers, are in a uniquely challenging position. While many repeat buyers can leverage existing home equity in today’s expensive market, younger shoppers may have a harder time coming up with the money for a home purchase. At today’s mortgage rate, a household income of at least $120,000 is recommended to purchase a median-price U.S. home, assuming a 20% down payment. On the upside, the median rent for a 0-2 bedroom home has fallen on an annual basis for the past four months, offering would-be buyers more affordable rental options to take time and evaluate their decision to purchase a home.”

In August, the MBA also reported that the national median payment applied for by purchase applicants increased to $2,170 in August 2023, up slightly from $2,162 reported in July—according to the MBA’s Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time relative to income using data from MBA’s Weekly Applications Survey (WAS).

“Prospective homebuyers’ budgets continue to be impacted by the combination of high home prices and mortgage rates that remain higher than 7%,“ said Edward Seiler, Ph.D., MBA’s Associate VP, Housing Economics, and Executive Director, Research Institute for Housing America. “If mortgage rates shift lower in 2024, as we anticipate, the combination of rising inventory levels and lower rates should lead to stronger demand for buying a home.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news