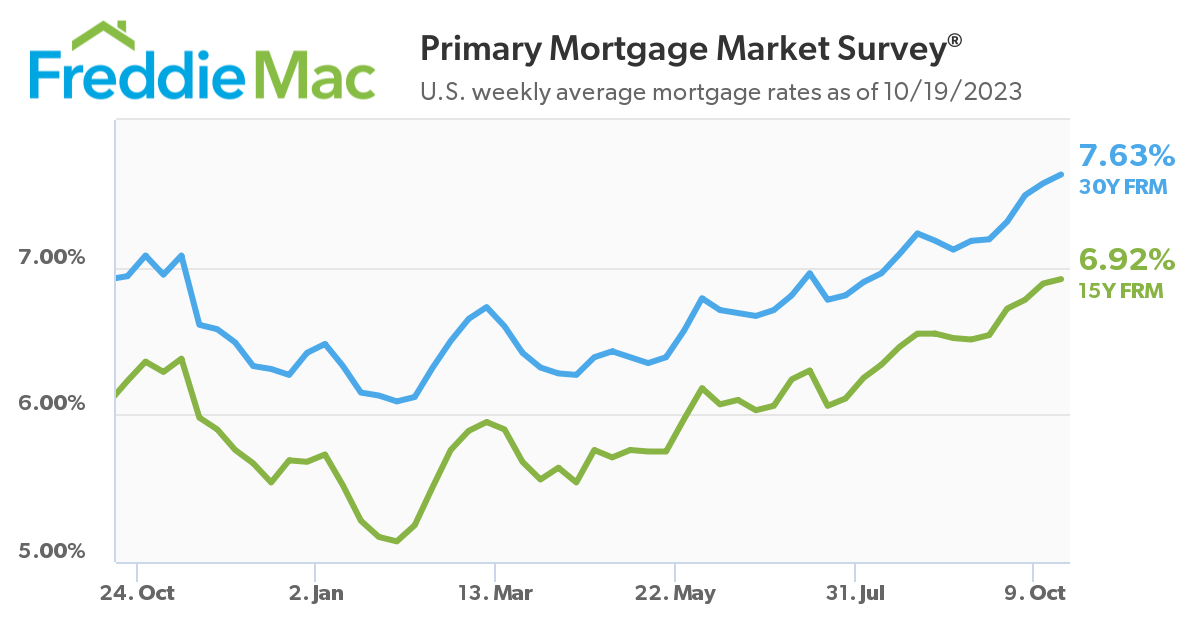

Further stretching affordability for potential buyers, Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows that the 30-year fixed-rate mortgage (FRM) averaged 7.63% for the week ending October 19, up six basis points over last week’s average of 7.57%. This marks the sixth consecutive week of increases in the 30-year FRM. A year ago at this time, the 30-year FRM averaged 6.94%.

Further stretching affordability for potential buyers, Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows that the 30-year fixed-rate mortgage (FRM) averaged 7.63% for the week ending October 19, up six basis points over last week’s average of 7.57%. This marks the sixth consecutive week of increases in the 30-year FRM. A year ago at this time, the 30-year FRM averaged 6.94%.

“Mortgage rates continued to approach 8% this week, further impacting affordability,” said Sam Khater, Freddie Mac’s Chief Economist. “In this environment, it’s important that borrowers shop around with multiple lenders for the best mortgage rate. With research showing down payment is the single largest barrier to first-time homebuyers attaining homeownership, borrowers should also ask their lender about down payment assistance. Launched this week, Freddie Mac’s DPA One tool helps lenders and homebuyers identify and take advantage of down payment assistance programs nationwide.”

Also this week, the 15-year FRM averaged 6.92%, up from last week when it averaged 6.89%. A year ago at this time, the 15-year FRM averaged 6.23%.

“Not only are homebuyers feeling the impact of rising rates, but home builders are as well. Incoming data shows that the construction of new homes rebounded in September, but as rates keep rising, home builders appear to be losing confidence,” added Khater. “As a result, we expect construction to trend down in the short-term.”

The National Association of Home Builders (NAHB) reports that continued high mortgage rates above the 7%-mark are eroding builder confidence, as sentiment levels have dropped below the key break-even measure of 50 for the first time in five months. Builder confidence in the market for newly built single-family homes in September 2023 fell five points to 45, according to the NAHB/Wells Fargo Housing Market Index (HMI).

"The Freddie Mac fixed rate for a 30-year loan climbed 0.06 percentage points to 7.63% this week, with the 10-year Treasury yield surpassing 4.9% for the first time since 2007,” said Jiayi Xu, Economist at Realtor.com. “This rise can be attributed to September’s hotter than expected retail sales data and a stronger than expected labor market. While under typical circumstances, such positive data would be a reason for cheer among investors and businesses, it has now raised concerns regarding the inflation outlook and the likelihood of further Federal Reserve interest rate hikes, which increase the possibility of mortgage rates hitting 8% in the coming months.”

As rates push higher, the Mortgage Bankers Association (MBA) reports that overall mortgage application volume decreased 6.9% from one week earlier, according to the association’s latest Weekly Mortgage Applications Survey for the week ending October 13, 2023.

“Mortgage application activity is now at its lowest level in 29 years as high mortgage rates, limited housing inventory, and affordability challenges continue to constrain borrowers,” said MBA President and CEO Bob Broeksmit. “While 2023 has been a tough time for the housing market, MBA expects that mortgage rates will moderate heading into 2024, which should bring some relief to those looking to buy a home.”

Redfin reports that new listings of U.S. homes for sale have ticked up 2% since the start of September, and haven’t fallen as much from summer to fall as they typically do. This is due in part to more homeowners putting their homes on the market, despite being locked into relatively low mortgage rates, as the total number of homes for sale is down 14% from a year earlier during the four weeks ending October 8—the smallest decline since July.

While on another front, many are “locked-in” to their current rate and are unable to jump into the current market due to the near-8% rate environment.

“With mortgage rates remaining near 20-plus-year highs in recent weeks, homeowners are hesitant to list their properties, resulting in a continual drop in the number of newly listed homes,” added Xu. “This ongoing trend poses difficulties for prospective first-time home buyers in their quest to find a suitable home. In September 2023, the active inventory for entry-level homes, ranging in size from 750- to 1750-square feet, was down -6.5% year-over-year, and -34.1% lower than four years ago (pre-pandemic). Furthermore, high mortgage rates have exacerbated the affordability struggles faced by first-time home buyers who lack the advantage of near-record high home equity to leverage. While the median listing price for a starter home stood at $300,000 in September 2023, the same level as September 2022, today’s first-time homebuyers would now need an annual household income of $81,360 to afford such a home, assuming a 6% down payment and a 0.51% private mortgage insurance rate. This figure is $8,120 higher than the recommended annual income from just a year ago. In contrast, the suggested annual household income needed to afford a $300,000 home with the same down payment and private mortgage insurance rate, but at September 2019’s mortgage rates, stood at $56,160."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news