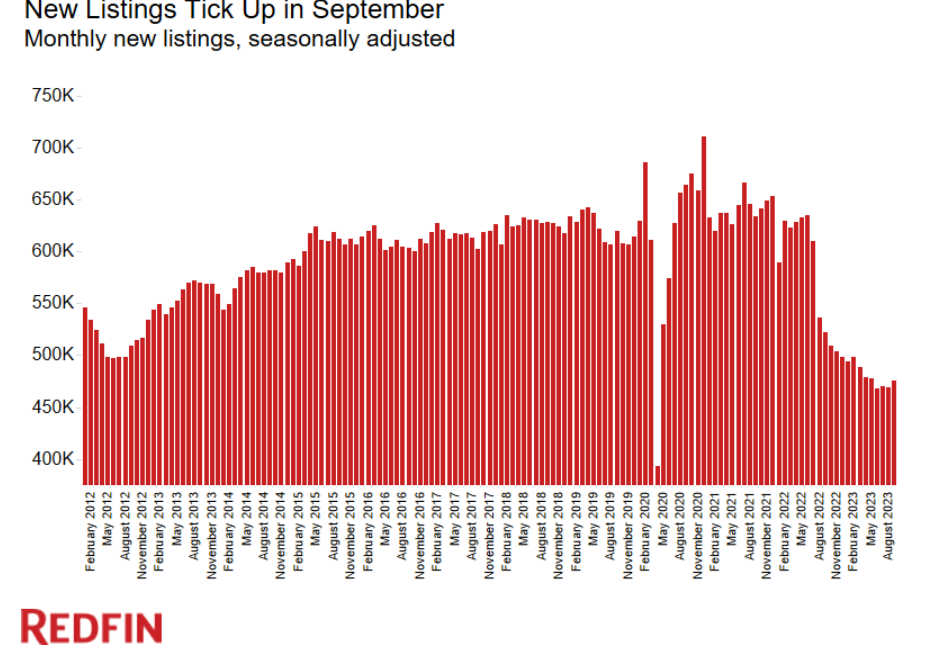

Redfin reports that new listings climbed 1.4% month-over-month in September, the largest increase since February 2022 on a seasonally adjusted basis—a glimmer of relief for homebuyers, who, for months, have been waiting for more homes to hit the market.

Redfin reports that new listings climbed 1.4% month-over-month in September, the largest increase since February 2022 on a seasonally adjusted basis—a glimmer of relief for homebuyers, who, for months, have been waiting for more homes to hit the market.

“A lot of Americans are sitting on piles of money in their homes, and some are opting to cash out even if it means giving up their low mortgage rate; they’re worried there’s a possibility home prices will fall if rates remain elevated. We expect rates to remain high for the foreseeable future,” said Redfin Chief Economist Daryl Fairweather. “But we also expect prices to stay high into next year. Housing supply is so strained that even a small uptick in listings lures buyers off the sidelines, bolstering sales.”

Still, new listings dropped 8.9% on a year-over-year basis in September, and remained far below pre-pandemic levels, as mortgage rates hit the highest level in more than two decades, with the average weekly 30-year-fixed rate clocking in at 7.2%. According to Freddie Mac’s latest Primary Mortgage Market Survey (PMMS), the 30-year fixed-rate mortgage (FRM) averaged 7.63% for the week ending October 19, up six basis points over last week’s average of 7.57%—marking the sixth consecutive week of increases in the 30-year FRM.

The overall supply of homes for sale (active listings) rose 1.9% month-over-month in September on a seasonally adjusted basis, the largest gain since last summer. But active listings fell 16.9% from a year earlier, and remained near the lowest level on record as homeowners continued to feel locked in to their low mortgage rates.

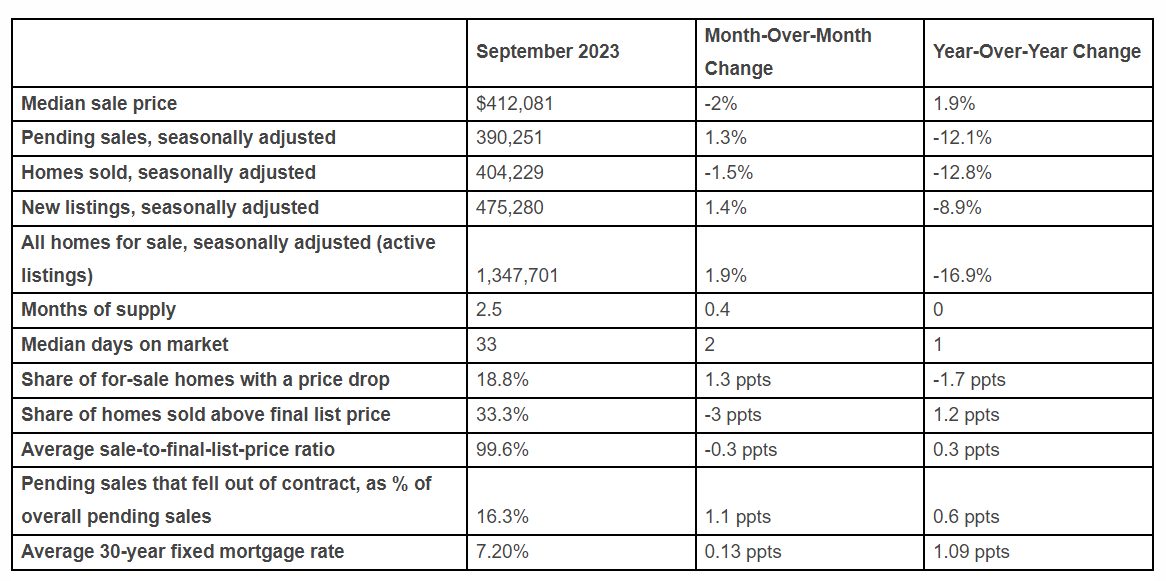

September 2023 Highlights: United States

Pending home sales rose 1.3% month-over-month to the highest level in nearly a year on a seasonally adjusted basis as more listings hit the market, but were down 12.1% from a year earlier. And while pending sales—the number of homes going under contract—improved in September, closed sales fell to the lowest level since the onset of the pandemic. They dropped 1.5% from a month earlier, and 12.8% from a year earlier on a seasonally adjusted basis.

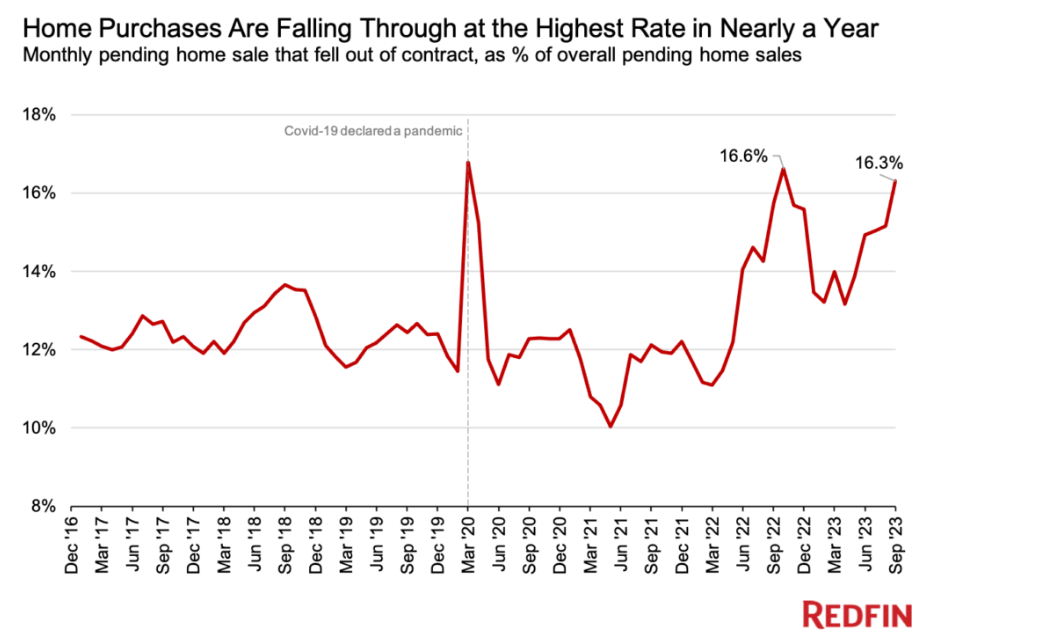

Pending sales ticking up, and closed sales ticking down can be explained partly by a high portion of buyers backing out of contracts due to rising mortgage rates. Roughly 53,000 U.S. home-purchase agreements were canceled in September, equal to 16.3% of homes that went under contract that month—the highest percentage since October 2022, when mortgage rates surpassed 7% for the first time in two decades. That compares with 15.2% a month earlier and 15.8% a year earlier.

“Buyers are extra cautious right now. They want to make sure they’re getting a good deal given how much mortgage payments have gone up, and when they don’t feel like they’re getting a good deal, they’re backing out,” said Heather Kruayai, a Redfin Premier Agent in Jacksonville, Florida, which saw the second highest rate of deal cancellations among the major metros Redfin analyzed. “Transactions are also falling apart due to skyrocketing insurance premiums and disagreements between buyers and sellers over necessary repairs. Overall, buyers hold a lot of the cards right now, and sellers are having to give out more concessions to close the deal.”

The median U.S. home sale price rose 1.9% year-over-year to $412,081 in September 2023, and fell 2% from a month earlier—typical for this time of year. Activity in the housing market is sluggish due to high mortgage rates, but prices remain near their record high because the buyers who are out there are competing for a limited number of homes.

Nearly two of every five homes (37.4%) that went under contract in September did so within two weeks, up from 32.6% a year earlier—a sign of homebuyer competition. Starter homes are particularly competitive right now, Redfin agents say, because housing affordability has fallen so dramatically.

Metro-Level Highlights: September 2023

- Pending sales: In Honolulu, pending sales fell 34.5% year-over-year, more than any other metro Redfin analyzed. Next came Birmingham, Alabama (-34.1%) and Colorado Springs, Colorado (-33.9%). Only three metros saw increases: North Port, Florida (5.4%), Detroit (3.3%), and Tampa, FL (2.3%).

- Closed sales: In Tacoma, Washington, closed home sales dropped 40.2% year-over-year, more than any other metro Redfin analyzed. Next came Oxnard, California (-28.6%) and Fresno, California (-28.5%). Closed sales rose most in North Port, Florida (42.8%); Cape Coral, Florida (17.6%); and Tampa (15%).

- Home prices: Median sale prices rose most from a year earlier in Rochester, New York (14.6%); Anaheim, California (13%); and Buffalo, New York (10.9%). They fell in 17 metros, with the steepest declines in Austin, Texas (-5.2%); North Port, Florida (-3.7%); and San Francisco (-2.5%).

- Listings: New listings fell most from a year earlier in Tacoma, Washington (-31.5%); Atlanta (-30.8%); and Houston (-29.9%). They rose most in North Port, Florida (33.6%); Cape Coral, Florida (30.6%); and Tampa (17.8%).

- Supply: Active listings fell most from a year earlier in Las Vegas (-41.7%); Stockton, California (-38.2%); and Tacoma, Washington (-35.2%). Active listings climbed most in Cape Coral, Florida (27.1%); New Orleans (26.5%); and North Port, Florida (26.4%).

- Competition: In Rochester, New York, 72.8% of homes sold above their final list price, the highest share among the metros Redfin analyzed. Next came San Jose (68.6%) and Worcester, Massachusetts (66.6%). The shares were lowest in North Port, Florida (8.9%); Cape Coral, Florida (10.3%); and Austin, Texas (12.2%).

- Speed: In Rochester, New York, 71.8% of homes that went under contract did so within two weeks—the highest share among the metros Redfin analyzed, followed by Grand Rapids, Michigan (64.3%); and Buffalo, New York (62.6%). The lowest shares were reported in Honolulu (5%); Lake County, Illinois (11.8%); and Chicago (11.8%).

Click here for more information on Redfin’s analysis of the September 2023 housing marketplace.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news