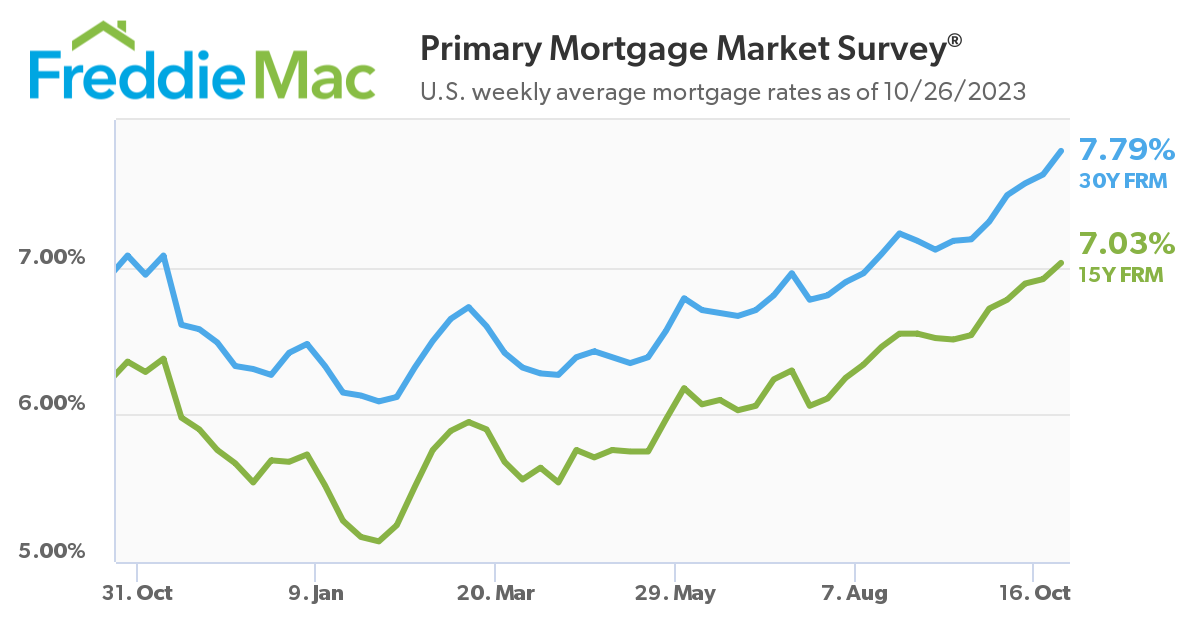

For the seventh consecutive week, mortgage rates edged upward, as Freddie Mac reports in its latest Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) averaged 7.79% as of October 26, 2023, up 16 basis points from last week when it averaged 7.63%. A year ago at this time, the 30-year FRM averaged 7.08 percent.

For the seventh consecutive week, mortgage rates edged upward, as Freddie Mac reports in its latest Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) averaged 7.79% as of October 26, 2023, up 16 basis points from last week when it averaged 7.63%. A year ago at this time, the 30-year FRM averaged 7.08 percent.

“For the seventh week in a row, mortgage rates continued to climb toward eight percent, resulting in the longest consecutive rise since the Spring of 2022,” said Sam Khater, Freddie Mac’s Chief Economist. “Rates have risen two full percentage points in 2023 alone and, as we head into Halloween, the impacts may scare potential homebuyers. Purchase activity has slowed to a virtual standstill, affordability remains a significant hurdle for many, and the only way to address it is lower rates and greater inventory.”

Also this week, the 15-year FRM averaged 7.03%, up 11 basis points from last week, when it averaged 6.92%. A year ago at this time, the 15-year FRM averaged 6.36%.

And as mortgage rates march onward and upward toward the 8% mark to heights last seen 23 years ago, the Mortgage Bankers Association (MBA) reports that overall application volume fell 1% week-over-week, according to its latest Weekly Mortgage Applications Survey for the week ending October 20, 2023. The MBA’s Refinance Index rose 2% from the previous week, and was 8% lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2% from one week earlier, while the unadjusted Purchase Index decreased 2% compared to the previous week, and was 22% lower than the same week one year ago.

“Mortgage rates continued to climb, edging closer to 8%, which contributed to another week of subdued borrower demand,” said MBA President and CEO Bob Broeksmit. “Affordability challenges and too few homes for sale remain the one-two punch that is keeping many prospective buyers on the sidelines. We expect mortgage volume to decline nearly 30% this year to $1.64 trillion, before an expected 19% rebound in 2024, as rates finally start to trend downward.”

According to the latest data analysis from the U.S. Census Bureau and the U.S. Department of Housing & Urban Development (HUD), sales of new single‐family houses in September 2023 were at a seasonally adjusted annual rate of 759,000, 12.3% above the revised August 2023 rate of 676,000, and 33.9% above the September 2022 estimate of 567,000.

And despite the ascent in rates, many buyers are making homeownership possible in lieu of the high rate environment.

“Though high mortgage rates and still-high prices weigh on home shoppers, recent new home sales data shows that buyers are finding a way to navigate the challenging environment,” said Realtor.com Senior Economic Research Analyst Hannah Jones. “New home sales jumped 12.3% month-over-month in September, as buyers locked in a mortgage before rates could climb any higher. Affordable new home sales also ticked up in the month, suggesting that builders are responding to demand for lower-priced homes. The existing home market still suffers from low inventory as many current homeowners choose not to list their home for sale, opting out of forfeiting their lower-rate mortgage for a loan at today’s rate. Existing home sales fell to a decade-plus low in September, and competition over scarce inventory pushed prices higher year-over-year.”

HUD and the Census Bureau also reported median sales price of new houses sold in September 2023 was $418,800, with the average sales price nationwide of $503,900.

In terms of inventory, the seasonally‐adjusted estimate by HUD and the Census Bureau of new homes for sale at the end of September 2023 was 435,000—representing a supply of 6.9 months at the current sales rate.

“The national picture of the housing market may look quite different from your local area as today’s market continues to vary significantly by geography,” added Jones. “Affordable housing markets, such as many featured on this quarter’s WSJ/Realtor.com Emerging Housing Markets list, continue to see significant price growth, despite relatively tame national price growth. Even with climbing prices, many of today’s sought-after markets remain lower priced than the national median, garnering significant attention from shoppers in high-priced metros. Low-priced housing markets in areas with strong economies are likely to continue to capture the nation’s attention until housing affordability improves on a larger scale.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news