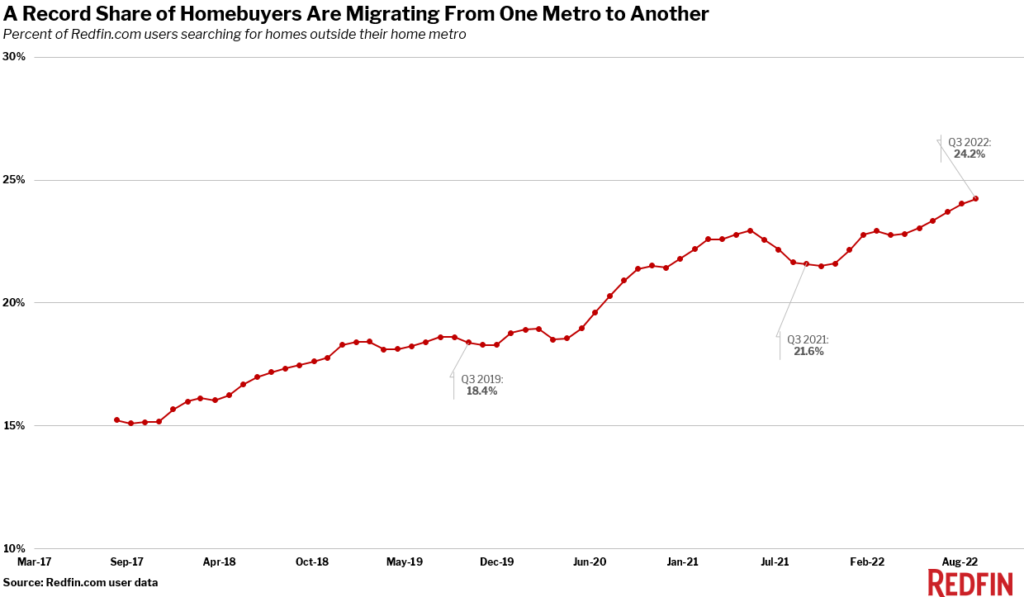

According to a new analysis by Redfin, more homebuyers than ever are looking to move to a different metro area in the third quarter of 2022 as numbers of these buyers hit 24.2%, up from 21.6% a year ago, and 18% before the pandemic.

According to a new analysis by Redfin, more homebuyers than ever are looking to move to a different metro area in the third quarter of 2022 as numbers of these buyers hit 24.2%, up from 21.6% a year ago, and 18% before the pandemic.

Leveraging a vast amount of internal data from users on their platform, Redfin also found that affordability is another priority for homebuyers as mortgage rates have doubled since last year to 7%. Those rates, in addition to inflation and still-high home prices, have discouraged prospective buyers from making the move.

However, for those that are still in the market, moving to an affordable place—such as Sacramento, California or Las Vegas, Nevada—is a top priority.

“With a recession looming and household expenses high, many people can’t afford to buy a home in an expensive area and/or want to save money in case of an emergency, which makes relocating somewhere more affordable an attractive option,” said Redfin Economics Research Lead Chen Zhao. “Migration will likely slow in the coming months because the softening labor market and job losses will push more people to stay put or move in with family, though some may need to relocate for new employment opportunities. Plus, many remote workers who wanted to relocate already have.”

Redfin’s data showed that most of its users looked to move to Sacramento, followed by Miami, Las Vegas, San Diego and Tampa. Popularity is determined by net inflow, which is the number of people looking to move into a metro minus the number of people looking to leave.

“More than half of my buyers in Sacramento are from outside the area,” said local Redfin agent Samantha Rahman. “They’re mostly remote workers coming from the Bay Area who may need to commute to the office a few times a month but are saving significantly on housing costs. It makes even more sense to relocate to a more affordable region now than it did when mortgage rates were low, as lower-priced homes offset some of the expense of high rates and rack up less interest.”

Where are people looking to get away from? Data shows that people are leaving San Francisco, New York, Boston, and Washington D.C.

Click here to read Redfin’s report in its entirety.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news