A new LendingTree study shows that an unfortunate, but necessary aspect of homeownership is the need to pay for home improvements. What these improvements look like and how much they cost can vary significantly, and some projects may only be doable with a loan.

LendingTree analyzed the 2022 Home Mortgage Disclosure Act (HMDA) data to determine where the most home improvement loans are originated. Specifically, they looked at the number of first- and second-lien mortgages used to pay for home improvements for every 100,000 owner-occupied homes in each state.

While home improvement loans are relatively rare compared to the number of owner-occupied homes in a given state, they can offer significant amounts of money to those who receive them.

Key Findings:

- Across the 50 states, an average of 361.2 home improvement loans are originated for every 100,000 owner-occupied houses.

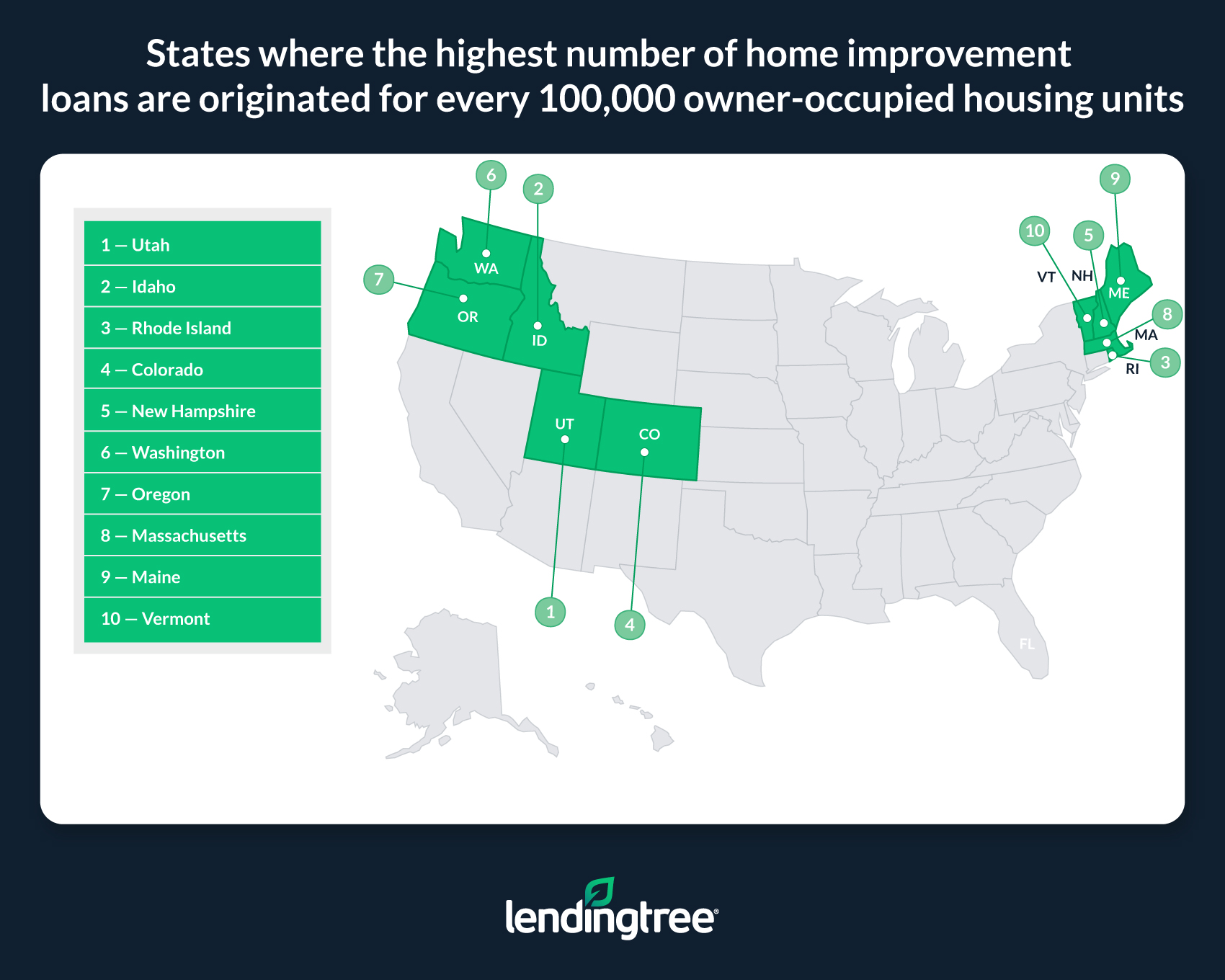

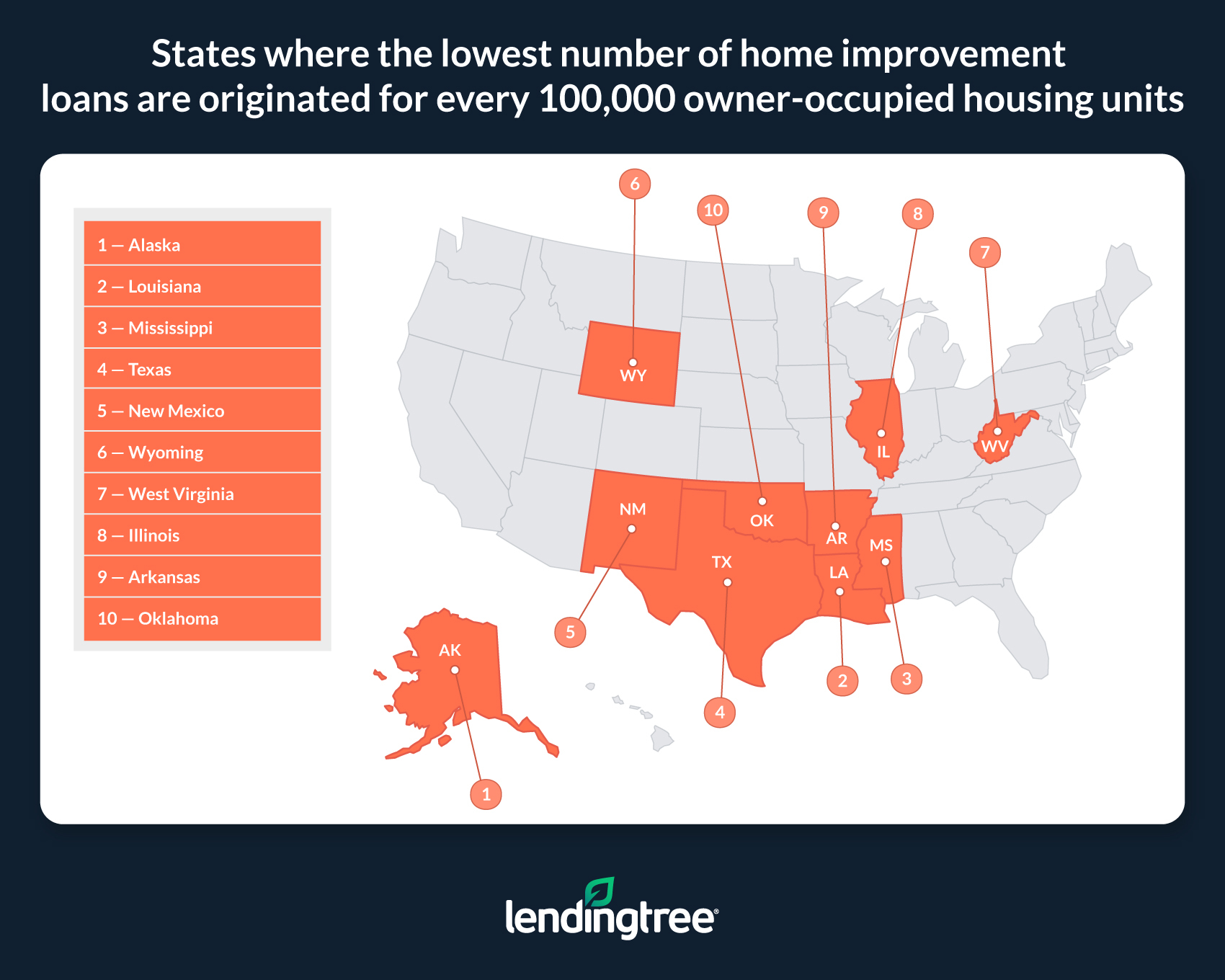

- Relative to the number of owner-occupied housing units, the most home improvement loans originate in Utah, Idaho, and Rhode Island, while the fewest originate in Alaska, Louisiana, and Mississippi. Across Utah, Idaho, and Rhode Island, an average of 726.1 home improvement loans are originated for every 100,000 owner-occupied homes. For Alaska, Louisiana, and Mississippi, that figure is 93.6.

- Second-lien mortgages are the most common type of mortgage used to finance home improvement loans. On average, 77.8% of new home improvement loans across the 50 states are second-lien mortgages. In other words, homeowners are more likely to choose options like home equity loans or home equity lines of credit than cash-out refinances.

- First-lien mortgages (like cash-out refinances) used for home improvements are much less common than their second-lien counterparts. On average, 22.2% of newly originated home improvement loans are first-lien. If mortgage rates fall over the coming years, the share of first-lien mortgages used for home improvements will likely increase.

- Home improvement loan amounts are highest in Hawaii, California, and Massachusetts. The average home improvement loan amounts in these states are $213,373, $193,150, and $145,965, respectively. In contrast, home improvement loan amounts are lowest in Iowa, North Dakota, and Nebraska, averaging $65,579, $71,460, and $72,211, respectively.

- Like loan amounts, monthly payments on home improvement loans can vary significantly by state. At $1,212, $1,137, and $1,099, average monthly payments are highest in Louisiana, Hawaii, and California. They’re lowest in West Virginia, Ohio, and Pennsylvania, averaging $426, $508, and $553, respectively.

Top 10 states where the highest number of home improvement loans are originated for every 100,000 owner-occupied housing units:

- Utah

- Idaho

- Rhode Island

- Colorado

- New Hampshire

- Washington

- Oregon

- Massachusetts

- Maine

- Vermont

No. 1: Utah

- Number of owner-occupied housing units: 2,506,804.

- Number of home improvement loans for every 100,000 owner-occupied housing units: 818.7.

- Share of home improvement loans that are second-lien mortgages: 90.3%.

- Share of home improvement loans that are first-lien mortgages: 9.7%.

- Overall average loan amount for home improvement loans: $117,835.

- Overall average monthly payment for home improvement loans: $1,063.

Top 10 states where the lowest number of home improvement loans are originated for every 100,000 owner-occupied housing units:

- Alaska

- Louisiana

- Mississippi

- Texas

- New Mexico

- Wyoming

- West Virginia

- Illinois

- Arkansas

- Oklahoma

No. 1: Alaska

- Number of owner-occupied housing units: 488,761.

- Number of home improvement loans for every 100,000 owner-occupied housing units: 60.6.

- Share of home improvement loans that are second-lien mortgages: 72.6%.

- Share of home improvement loans that are first-lien mortgages: 27.4%.

- Overall average loan amount for home improvement loans: $107,906.

- Overall average monthly payment for home improvement loans: $664.

While relying on a loan to finance home improvements can be a good opportunity for some, there are instances where a homeowner has no choice but to use a loan to pay for something important, like fixing faulty plumbing or wiring.

According to LendingTree experts, would-be borrowers should make the carefully and thoroughly when considering their options before rushing to get a loan to pay for home improvements.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news