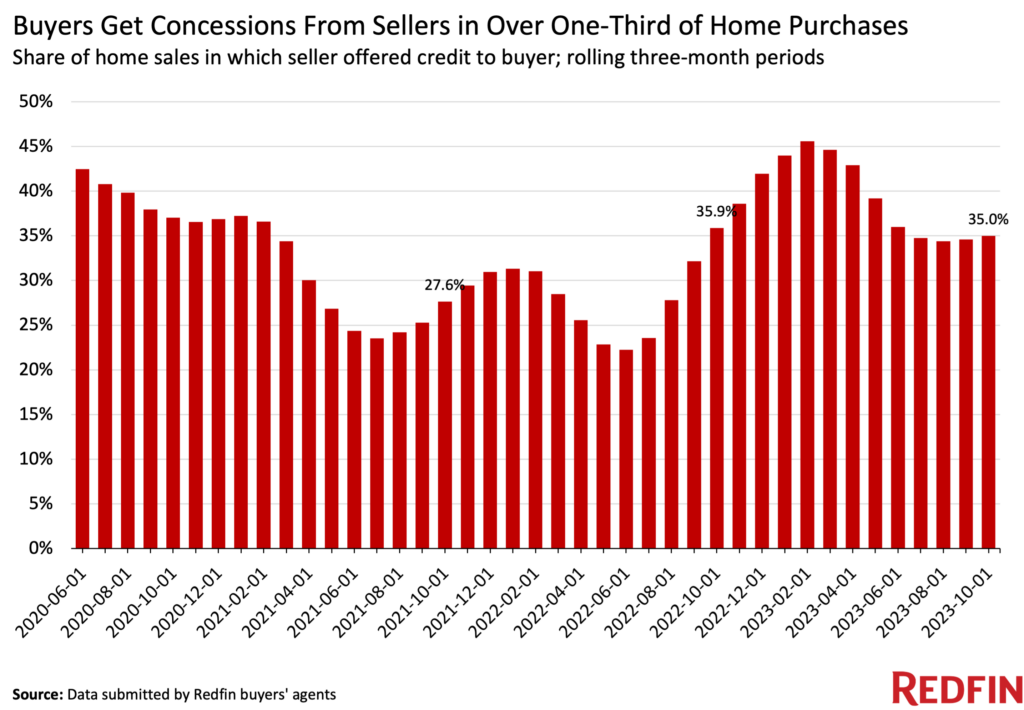

Home sellers gave concessions to homebuyers in 35% of U.S. home sales during the three months ending October 31, according to a new report from Redfin, representing a little change from 35.9% a year earlier but up from 27.6% two years earlier.

This is according to data submitted by Redfin buyers’ agents across the country, going back through 2020. A concession is recorded when an agent reports a seller provided something that helped reduce the buyers’ total cost of purchasing the home. That could include money toward repairs, closing costs and/or mortgage-rate buydowns. It does not include situations in which the seller lowered the list price of their home or lowered the price due to a negotiation with a buyer.

Mortgage rates hit the highest level in 23 years in October, which cooled homebuyer demand, driving some sellers to throw in freebies to attract bidders. That marks a reversal from the pandemic homebuying frenzy, when fierce buyer competition made concessions more rare.

“Sellers have become more open to the idea of giving out concessions like cash for repairs and mortgage-rate buydowns, in part because many of them want to get their homes sold quickly due to major life events like divorces and new jobs. Homeowners who don’t have to move are staying put and holding onto their low mortgage rates,” said Seattle Redfin Premier Real Estate Agent David Palmer. “The good news for buyers, aside from more concessions, is that contingent offers are also more feasible in a market like this, meaning house hunters don’t have to waive inspections and other important safeguards.”

Roughly 53,000 U.S. home-purchase agreements were canceled in September, equal to 16.3% of homes that went under contract that month—the highest percentage since October 2022, when mortgage rates surpassed 7% for the first time in two decades.

Another reason the share of sellers offering concessions has climbed from pandemic lows is that homebuilders, who are offering deals so they can offload inventory, are taking up a growing portion of the market. Nationwide, 30.6% of U.S. single-family homes for sale in Q3 were new construction. That’s the highest share of any third quarter on record, in large part because there has been a decrease in the number of individual homeowners putting their houses up for sale.

Concessions would likely be even more common today if it weren’t for historically low housing inventory, which is fueling competition in some areas. Inventory is tight because many homeowners are reluctant to put their homes on the market since selling and buying another house would mean giving up their ultra low mortgage rate.

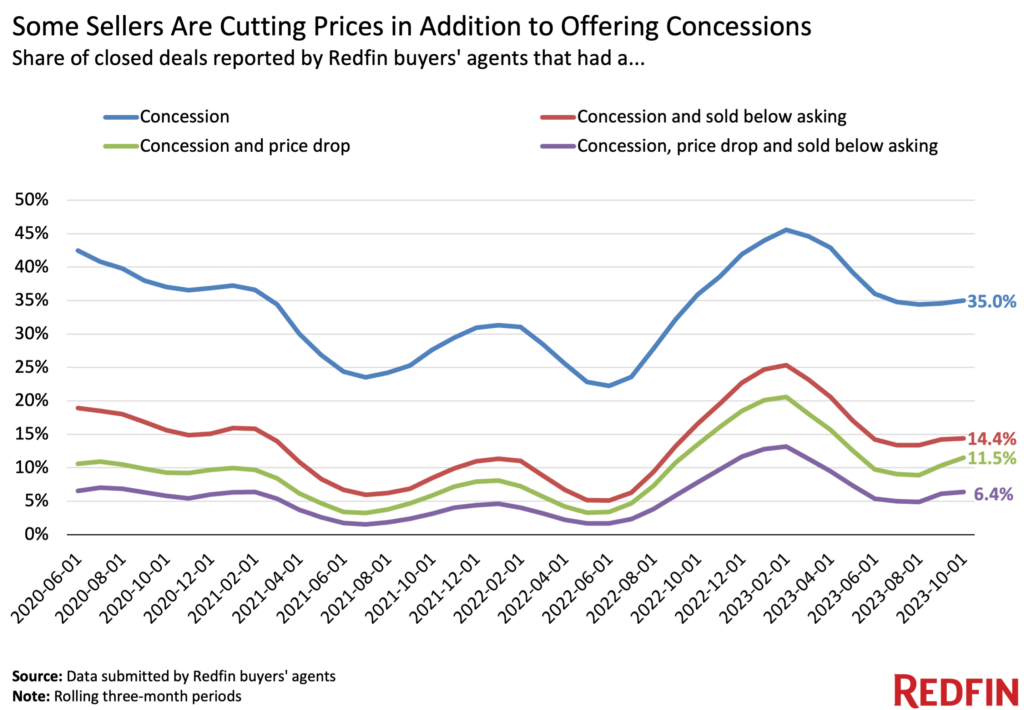

Some home sellers are lowering their prices in addition to offering concessions in hopes to sell their homes quickly.

Some sellers are giving out concessions and getting less money than they hoped for their homes, which can occur when a seller cuts their asking price, accepts an offer below their asking price or both.

“House hunters are pickier than ever before," said Palmer. "It’s really expensive to buy a home today, so they want to make sure they find the right one. Buyers have become increasingly likely to terminate a deal if they don’t get the concessions they want.”

One in seven (14.4%) homes that sold during the three months ending October 31 had a final sale price below the asking price in addition to a concession. Just over one in 10 (11.5%) homes that sold during the period had a price cut and a concession. And 6.4% had all three—a concession, a price drop and a final sale price below the original list price.

Concessions are most common in Salt Lake City and least common in Boston.

Sellers in Salt Lake City gave concessions to buyers in 63.3% of home sales in the three months ending October 31, the highest share among the metros Redfin analyzed. Rounding out the top five are San Diego (60.9%), Denver (56.6%), Las Vegas (54.3%) and Raleigh, NC (51.4%).

Many of the metros above saw homebuyer demand soar during the pandemic as remote workers sought out relatively affordable parts of the country. That caused home prices to skyrocket, leaving many people priced out. Cooling demand has prompted more sellers to pull out the stops to attract buyers.

Boston sellers only provided concessions in 11.1% of home sales, the lowest share of the metros in Redfin’s analysis. Next come San Jose, CA (14.4%), New York (14.5%), Philadelphia (15.7%) and Chicago (19%).

Concessions rose most in Salt Lake City and fell most in Chicago.

Salt Lake City saw a bigger year-over-year jump in seller concessions than any other metro Redfin analyzed. Sellers there gave concessions to buyers in 63.3% of home sales during the three months ending October 31, up 25.2 percentage points from a year earlier. The next-biggest increases were in Tampa, FL (+23.5 ppts to 43.1%), Charlotte, NC (+11.6 ppts to 50.8%), Minneapolis (+11.4 ppts to 35.3%), and Dallas (+10.6 ppts to 49.3%).

The share of sellers giving out concessions fell most in Chicago (-21.6 ppts to 19%), followed by Phoenix (-7.8 ppts to 51%), Philadelphia (-6.8 ppts to 15.7%), San Diego (-6.1 ppts to 60.9%), and Washington, D.C. (-5.8 ppts to 32.2%).

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news