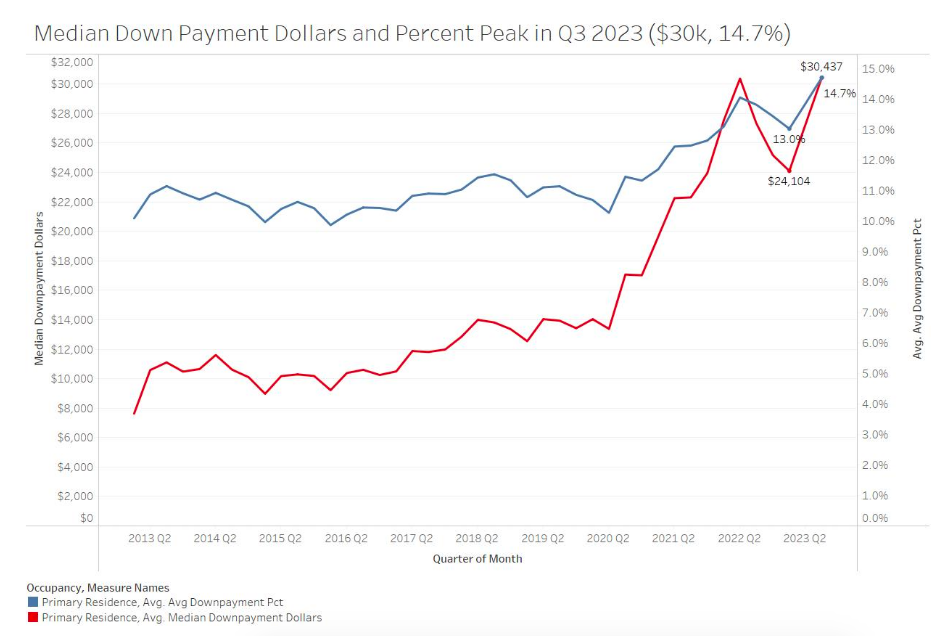

In a new Realtor.com report, new data showed down payments reached a new peak in Q3 of 2023 with an average 14.7% down payments and a median down payment amount of $30,000. Homebuyers and sellers faced challenges, making for a toned down ‘homebuying season’, especially compared to the red-hot pandemic-era market.

Home sales prices fell compared to the previous year from November 2022 through June 2023. As sale prices fell, so did the typical down payment, though the decline was shorter-lived, with annual declines in down payment dollar amount falling just in January through May 2023. However, the median U.S. down payment dollar amount climbed to a new peak in July 2023, as home prices steadied and the typical down payment as a percent of purchase price peaked in August.

Key Findings:

- Sale amounts and down payments remain higher than pre-pandemic. Both climbing mortgage rates and general market dynamics are driving buyers to put more down.

- Down payments on second homes and investment properties, which have typical down payments of 28.2% and 28.3%, respectively, in Q3 2023 are roughly double the typical share of down payments on primary residences. Measured in dollars, down payments for second and investment homes are more than two times larger than for primary homes.

- Locally, popular pandemic destinations such as metros in the South and West, as well as military communities where VA loans have become more common saw down payments shrink while well-located Northeast metros where housing markets remain more competitive saw down payment growth.

Down payments climbed nationwide as mortgage rates increased.

In general, at the state-, metro- and country-level, buyers increased down payments in Q3 of 2023 over the previous quarter and previous year. During the pandemic, down payments climbed as home prices grew and buyers used down payments to compete in multiple-bid situations.

However, home price growth slowed over the last year as mortgage rates continued to rise and buyer demand fell, making growing down payments somewhat counter-intuitive, but consumer savings trends and housing market competitiveness help explain the finding.

Home shoppers faced limited for-sale inventory as homeowners opted to stay put rather than list their homes for sale amid elevated mortgage rates. Fewer homes for sale meant more buyer competition, which led to higher down payments as buyers utilized their pandemic-era savings to win multiple-bid scenarios. High mortgage rates also drove buyers to consider larger down payments to minimize the size of their mortgage loan at today’s elevated rate.

Accumulated savings continued to be a factor despite that savings rates are below historic averages.

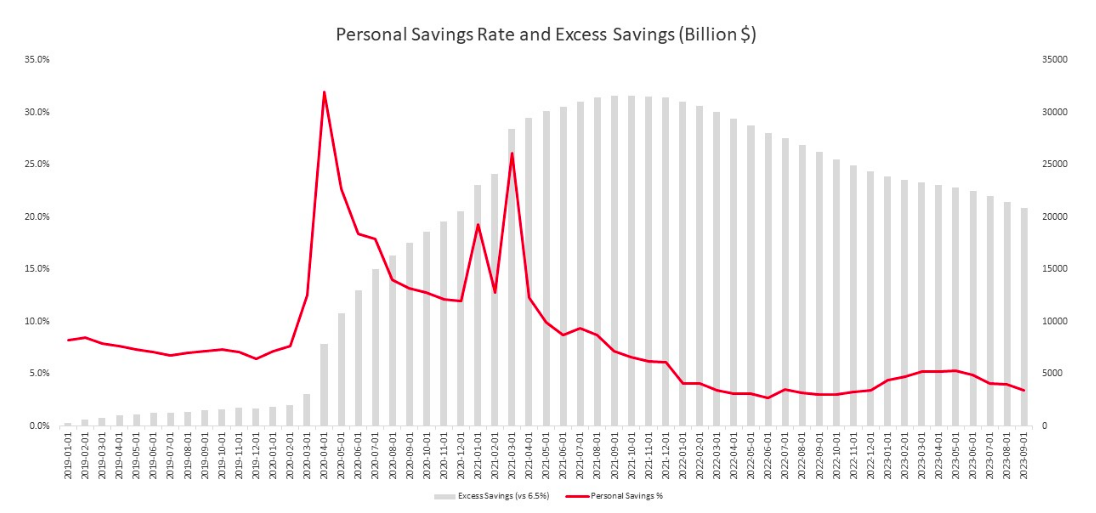

In the three years before the pandemic, the US personal savings rate averaged 6.5%, meaning that on an aggregate basis, consumers saved 6.5% of their disposable income. The relatively high personal savings rate during the pandemic–which spiked to over 30% and was above the pre-pandemic norm for 20 months–contributed to a build up in savings which in turn fueled consumer spending as well as larger down payments.

Although the personal savings rate fell through 2022 as high housing costs and high inflation weighed on consumers, eventually dipping below the pre-pandemic norm as consumers right-sized their savings. However, in the first three quarters of 2023, this savings rate recovered from the previous year’s low, but still remained at an average 4.6%, lower than pre-pandemic.

A lower savings rate over the last two years suggests that buyers would have a harder time saving for a large down payment. However, on average year-to-date, the typical down payment dollar amount was more than double the pre-pandemic median, and the typical down payment as a share of purchase price was 2.9 percentage points higher. Still-large accumulations of pandemic savings likely help some homebuyers.

Mortgage Rates Restrict Housing Supply Alongside Demand, Keeping Many Markets Competitive

In the third quarter of 2023, mortgage rates ascended to multi-decade highs, which pushed more buyers out of the market and convinced homeowners to hold off on listing their home for sale. As a result, many of the buyers left in the market were in a better position to buy, whether due to high income or existing home equity. Additionally, the low inventory environment put pressure on buyers to compete via higher down payments, a practice that became popular during pandemic times.

Nationwide down payments hit new peaks in Q3.

At the U.S. level, in 2019 and in 2020, homebuyers were paying an average 11.0% down payment on primary residences. In 2021, this grew to an average 12.3% down payment, and in 2022, buyers paid an average 13.6% as a down payment. By Q3 2023, buyers were paying an average 14.7% down for a primary residence, almost one percentage point more than just one year prior. The sustained down payment size in 2023 is especially significant when considering the 25.4% median sale price growth in Q3 2023 compared to Q3 2020.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news