The unpredictable, unexpected rollercoaster that was the pandemic was followed by another period of unbelievable inflation: rising mortgage rates, uncontrollable price increases, and heightened anxiety surrounding anything and everything about homeownership.

While the U.S. housing market isn't for the faint-hearted, some brave homebuyers have decided to take the plunge, according to a new Point2 analysis. Despite historic high mortgage rates, many jumped at the opportunity to buy in a desperate attempt to finally become homeowners. In September 2023, all they really got was homes that are losing value. Because of the year-over-year price drops in many of the largest U.S. cities, new homeowners would have to sell their homes for less money than they bought them for.

Zooming in on the year-over-year changes in condo and single-family home prices in the 100 largest U.S. cities, Point2 analysts discovered that price corrections are pummeling condo owners in 36 cities and single-family owners in 25 markets.

Single-family homeowners in these cities have been losing up to $223 in value every day since they bought their homes last year, while condo owners have been bleeding even more money: The $336 that the average San Francisco condo owner lost daily would add up to a total of $122,500, which is perilously close to the city’s median income (nearly $182,000).

Key Highlights:

- As mortgage rates choke homebuyers’ attempts at homeownership, home prices ground to a halt in many cities, and they’re dropping fast in others. In fact, it’s the markets that rose the fastest that are now entering correction territory at the highest speed.

- This could mean that homebuyers who were determined to secure a home at the height of the pandemic buying frenzy are now feeling the market’s one-two punch: first by overpaying, and now in home value loss.

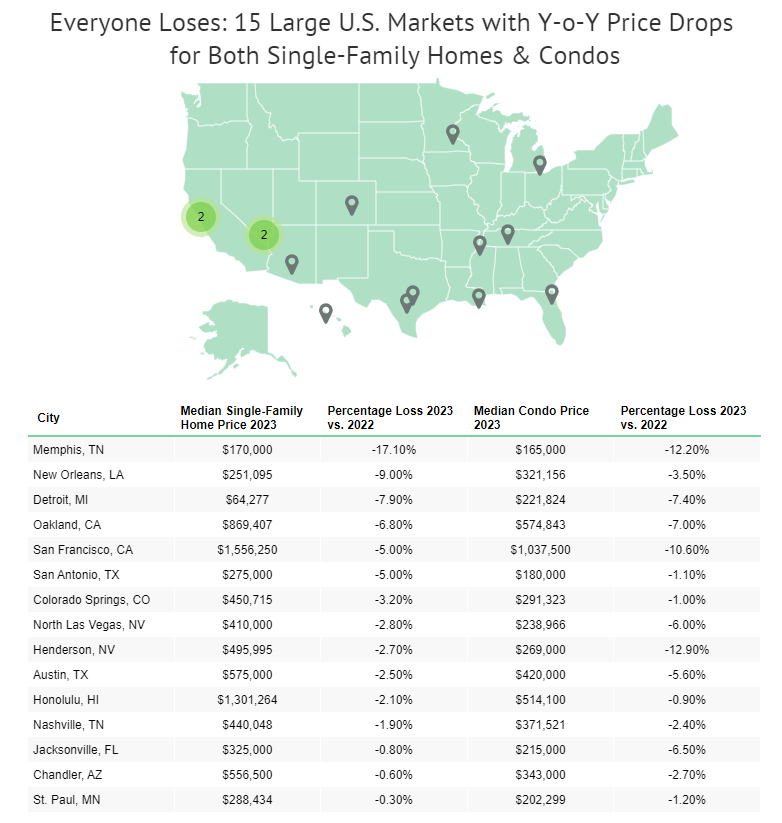

- Now, falling prices are affecting condo owners in 36 cities and single-family homeowners in 25 cities. What’s more, 15 cities are getting the worst of both worlds: Here, both condos and single-family home prices are moving in the wrong direction.

- Single-family homeowners: Prices fell in 25 cities, with eight more staying put for the whole year. Memphis leads the way with the biggest percentage drop (-17.1%), while San Francisco saw the largest net price decrease (-$81,250), followed by Oakland, CA (-$62,988).

- Condo homeowners: Prices plunged in 36 cities, with Henderson, NV; Memphis, TN; New York City; and San Francisco, all seeing drops of more than -10%. Again, San Francisco recorded the most significant net loss, at -$122,500 in just one year.

The Biggest Bust: In 15 Cities, Both Single-Family & Condo Owners on a Downward Spiral

In 15 of the largest U.S. cities, it wasn’t just the condo owners or just the single-family homeowners that saw their homes lose value. It was both. The year-over-year decline is substantial enough in some cities that it poses a real risk of negative equity for homeowners who bought a home last year (not to mention at the height of the pandemic).

Although it was only the condos or just the single-family homes that recorded price drops in many of the largest markets, owners can’t win in these 15 cities: Whether they had a more generous budget and could afford a single-family home or they simply decided to take the plunge and go for (generally) the more affordable option, a condo, they are currently in the same boat.

Top 10 Large U.S. Markets with YoY Price Drops for Single-Family Homes:

- Memphis, TN (-17.10%)

- New Orleans (-9.00%)

- Detroit (-7.90%)

- Oakland, CA (-6.80%)

- San Francisco (-5.00%)

- San Antonio (-5.00%)

- Colorado Springs, CO (-3.20%)

- North Las Vegas, NV(-2.80%)

- Henderson, NV (-2.70%)

- Austin, TX (-2.50%)

In many of the largest U.S. cities, the housing market started slowing down. After the unexpected COVID-related effervescence, the successive mortgage rate hikes pushed buyers to the sidelines and prices straight into correction mode. This double-blow market means that the most newly minted owners were first hit by the highest home prices in history, only to be cut off from building wealth by the current falling prices.

Memphis Owners Hardest Hit: Median Condo Slides Back 12% & Median Single-Family Home Drops 17%

San Francisco saw the biggest net losses, as the median single-family home price decreased by $223 per day while the median condo lost $336 every day for the past year.

Memphis, TN, recorded the most significant single-family price drop as well as the second-biggest condo price drop. This could be due to the fact that rising inventory is transforming Memphis into a buyers’ market. With a 24% year-over-year increase in inventory, Memphis is second only to El Paso, TX, where supply jumped 36% year-over-year.

When it comes to net losses, the slowdown seems to have hit San Francisco condo owners the hardest. The median condo here is now worth $122,500 less than last year. Unfortunately, single-family homes aren't far behind. Their prices dropped by $81,250, the highest amount of the 100 largest U.S. cities.

While San Francisco owners might be the biggest losers, plenty of other cities have also seen their property prices plunge.

Single-family home prices in 16 cities saw price slashes of more than $10,000, with nine other cities recording more subdued drops. In seven other cities, single-family home prices didn't even budge, but that's barely good news for those who bought a house a year ago.

Condo prices are making owners in 37 cities hold their breath. Aside from San Francisco, where condos are depreciating at the fastest pace, condos in Henderson, NV; Oakland, CA; and New York City have lost $110, $118, and $219 every day since September 2022, totaling $40,000, $43,000, and $80,000 in losses, respectively.

Manhattan Condo Owners Would Have to Sell for Nearly $70,000 Less

Owners in the Bronx and Queens have also taken a hit from the plunge in home prices.

Despite a slightly tighter inventory (the number of homes on the market in NYC decreased 4% year-over-year), the boroughs still saw home price declines, whether for both condos and single-family homes or just one of the two types of housing.

Given that it's one of the more expensive housing markets, the Big Apple had plenty of room for corrections. Plus, even the smallest percentage changes translate to hard-hitting losses in net amounts.

Following a 4% drop in price, it's the Manhattan condo owners who were the hardest hit. Those who bought a condo last year would have to sell at a loss one year later. And, even though single-family homeowners didn't see their homes lose value, they didn't gain much either. The 1% increase in single-family home prices translates to $50,000, which unfortunately looks like pennies given the immense median.

Manhattan condo owners would see the biggest losses, but they're far from alone. Single-family homes and condos in the Bronx both recorded price drops, followed by single-family home prices in Queens, which also depreciated in the past months. This means that buyers here, if forced to sell, would simply lose money.

Some homes in Brooklyn are also worth less today than they were one year ago. Just like San Francisco and many other cities that experienced unsustainable housing markets or saw an explosion in demand following the changes brought on by the pandemic, NYC is also seeing an unavoidable correction.

Unfortunately, these price drops, despite being pretty tough on owners' wallets and general state of mind, might mean very little to those still looking and waiting for the perfect home. Just like the drop in mortgage rates might still be too insignificant to bring about real change in homebuyers' attitudes, home prices ticking down could be the beginning of a shift, but not the change that home seekers are waiting for.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news