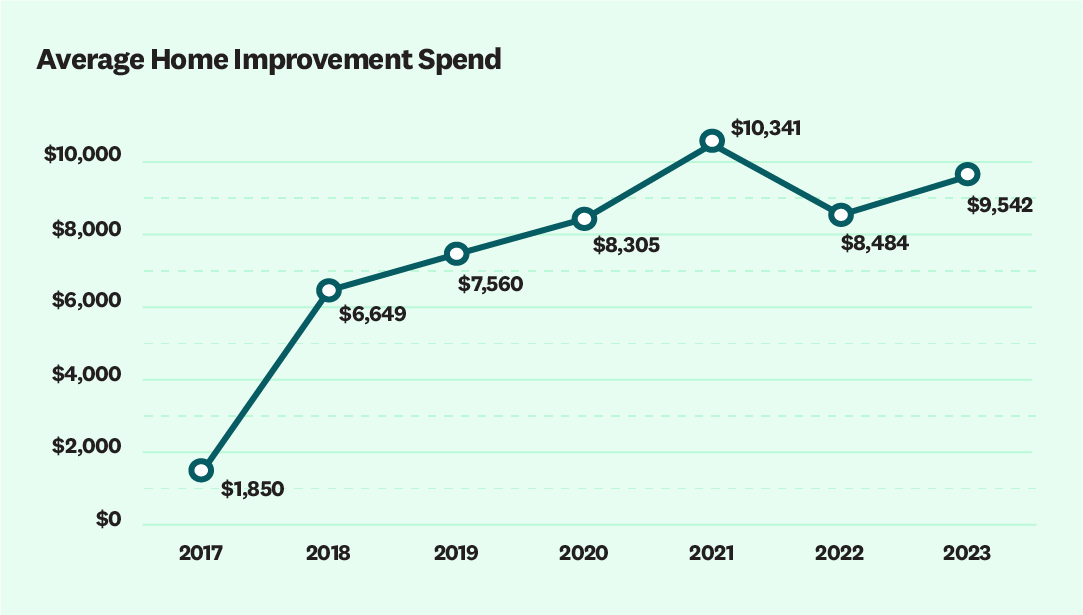

Angi’s annual State of Home Spending report revealed an increase in spending on home improvement projects in 2023.

The report found that homeowners, despite a year of rising mortgage rates and recession fears, increased their spending on home services motivated by their love of their homes and a desire to maintain and improve this fundamentally important space.

“While many speculated that spending would shift away from the home this year as the pandemic era restrictions were rolled back, that is not what we see, homeowners love their homes and continue to invest in them,” said Angie Hicks, Chief Customer Officer at Angi. “Pandemic era home services spending continues post pandemic as the role our homes play in our daily lives changed."

This annual report focuses on trends in home spending, including drivers, obstacles, top projects, and forecasts for the years ahead.

Highlights from the 2023 report include:

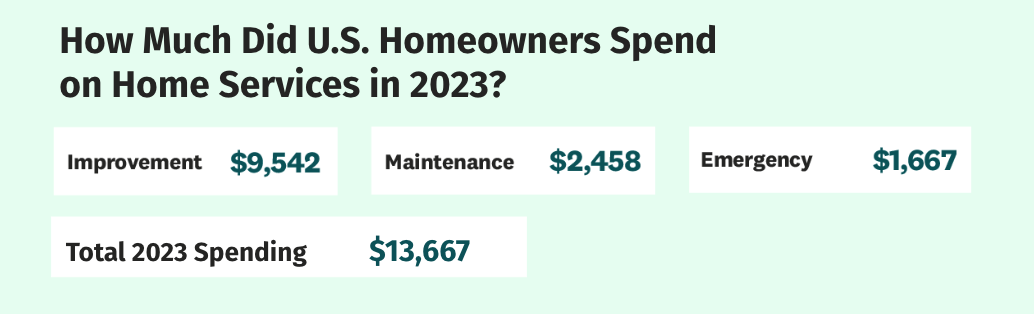

- Across all three categories of home spending—improvement, maintenance, and emergencies—total average spending in 2023 was $13,667 across an average of 11.1 projects. Total spending increased roughly 6% compared to 2022.

- For the first year since 2020, COVID-19 is no longer one of the most common reasons for projects not being completed, down 55% year-over-year. Common issues (permitting delays, material shortages) in the home improvement space over the past 3 years are not impacting home improvement projects like in previous years. This year, homeowners who went over time or budget with projects cited design choices as the core reason, not material prices or shortages.

- Millennials were the top spending age cohort in 2023, spending an average of $16,136 on home improvement, maintenance, and repairs combined. This stands in contrast to the Baby Boomers and Silent Generation, who spend less on home improvement in all categories combined than other generations.

- This year, the top three projects were regular maintenance (39%), like lawn care and gutter cleaning, followed by interior painting (30%) and new appliance installation (27%). Bathroom remodels dropped to fourth place at 26%, breaking a two-year streak in the top three most popular projects by a slim margin.

- This year, the top motivator was to maintain the condition of my home (35%), followed by the desire to make their home better suited to their lifestyle and needs (23%). In contrast, ROI was only 5% of American homeowners' top motivation. This year marks the fourth year that return on investment (ROI) as the primary motivator of home improvement spending has declined.

Overall spending on home improvement grew 6% to $13,667, and an average of 11.1 projects per household in 2023. Rising mortgage rates was a primary driver of home improvement spending, as an estimated 40% of homeowners say they spent more on home projects as opposed to moving due to high interest rates.

This year's primary motivation for homeowners was to maintain the condition of their properties, making their homes better suited for current lifestyle needs. Those who took on home projects last year spent an average of $13,667 on home improvement, home maintenance, and emergency repairs this year, a 6% increase compared to 2022, across an average of 11.1 projects.

According to new data from the 2023 State of Home Spending report, rising mortgage interest rates influenced the way people thought about and took on home improvement projects this year.

This year 40% of homeowners said they took on more home improvement work due to rising interest rates making moving or finding a new home a less feasible option.

"This year, the spending trend continued and we learned more about why people are investing in home improvement, maintenance and repair work," said Hicks.

Looking forward, the report found that an estimated 30% of homeowners plan to take on more home projects in 2024 versus moving.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news