Builder confidence was flat in March, matching a downwardly revised February index of 28, the first time in six months the index has not increased, the National Association of Home Builders reported Monday. The builder assessment of present home sales conditions actually dipped in March, falling to 29, the first decline since last September. The outlook for home sales in the next six months rose to 36 ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô the highest level since June 2007 - from 34 in February. Buyer traffic was flat in March at 22. The drop in the index in the West census region was precipitous.

Read More »More Americans Feel Confident About Housing: Survey

More Americans feel confident about their household finances, the housing recovery, and the prospect of an economic upturn, Fannie Mae said Wednesday. The mortgage giant drew on poll data from some 1,000 respondents to sketch a blend of guardedness and hopefulness in a National Housing Report. Thirty-five percent of Americans now believe the economy is on the right track, an increase from 19 percent in November, compared with 57 percent who still feel damp about the state of recovery. Fewer respondents fielded layoff concerns.

Read More »Group: Euro Crisis Could Choke ‘Healing’ Housing Market

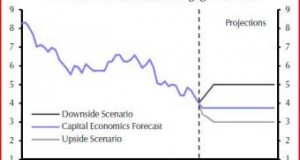

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »House Prices Hit Lows Not Seen Since 2002: Case-Shiller

Home prices reached fourth-quarter lows not seen since 2002, with the Standard & Poor├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós/Case-Shiller Index yielding 3.8 percent in declines for December last year. The index found that prices fell 4 percent year-over-year, alongside 1.1 percent in month-over-month declines for 10- and 20-city composite measures. Eighteen of 20 metropolitan areas monitored by S&P bore the brunt of monthly price declines, with figures up 0.2 percent and 0.8 percent for only Miami and Phoenix, respectively. Atlanta slouched into the negatives at 12.8 percent. Detroit offered the only positive annual return at 0.5 percent.

Read More »Pending-Home Sales Eclipse 2011 Figures by 8%: NAR

Pending-home sales shot up by 8 percent year-over-year in January, according to the National Association of Realtors. The trade group found that pending-home sales ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô contract signings for homes that have not yet closed ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô rose from 89.8 in January last year, which it indexes on a monthly basis. NAR said that the Pending Home Sales Index also climbed by 2 percent to 97 in January, reaching the highest figure since the homebuyer tax credit lifted it to 111.3 in April 2010. Regionally, the index gained by 7.6 percent to reach 78.2 for the Northeast, reflecting a 9.8-percent year-over-year increase.

Read More »Mortgage Rates Up on Greek Bailout 2.0: Zillow

Signaling the still-steady role played by eurozone affairs in U.S. markets, real estate Web site ZIllow found interest rates for mortgage loans by and large rising this week. The Web site found the 30-year fixed-rate mortgage ticking up to land somewhere between 3.67 percent and 3.76 percent before arriving at the latter rate Tuesday. For the 15-year loan, the rate hovered around 3 percent, while rates for 5-year and 1-year adjustable-rate mortgages stayed near 2.75 percent.

Read More »Mortgage Rates Stay at Record Lows as Europe Fears Linger

The story for mortgage rates stayed the same Thursday, with the specter of sovereign default keeping investors close to Treasury debt and interest for home loans at all-time lows. Both GSE Freddie Mac and finance Web site Bankrate.com reported yet more troughs for fixed-rate mortgages, failing to break with more than two months of low interest rates for home loans. For Freddie, the 30-year loan remained unchanged from last week at 3.87 percent, even while Bankrate.com found new record-breaking lows for the same at 4.10 percent, down from 4.14 percent last week.

Read More »Housing Market Index Highest in Nearly Five Years: NAHB

The National Home Builders Association released a housing market index that improved to 29 in February, its highest level since May 2007, with all three of the components showing new strength. The trade group said that it was the fifth consecutive monthly increase, the longest stretch of consecutive monthly increases since April- October 1995. The current conditions index rose to 30, a five-point jump, the largest month-over-month gain since April 2010. The forecast component, assessing conditions six months out.

Read More »Nearly 30% Believe Home Prices Will Rise in 2012: Fannie Mae

More Americans expect that home prices will recover over the course of 2012, just as they believe that mortgage rates will remain at all-time lows and more think the economy will enter an upswing. Mortgage giant Fannie Mae said in a January National Housing Survey that 28 percent of Americans believe that home prices will rise over the next year by 1 percent, up from 2 percent last month. Of the survey respondents, 8 percent said that interest rates for mortgage loans will decline in 2012, down 2 percent from December.

Read More »Builder Confidence Up for Q4 Single-Family Home Sales

Homebuilder confidence in the single-family market ended the fourth quarter last year on a climb uphill as the wider economy showed improvement. The National Association of Home Builders released a market index Tuesday that recorded a four-point increase year-over-year to 18 for homebuilders in the single-family sector. The index fielded improvements across the board year-over-year, with confidence about current sales ticking up four points to 17 and anticipated sales for the next six months up two points to 26.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news