Though the slow rate of household formation among millenials has been cause for alarm among some economists, analysts at Moody's Investors Service say reports of a "lost generation" are overblown.

Read More »One in Four Sellers Forced to Scale Back Listing Prices

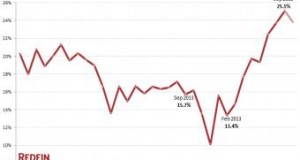

With reports showing home prices reaching five-year highs coming out on a near-monthly basis, home sellers this year have been aggressive in pricing their listings on the market. However, new data from technology-powered broker Redfin shows more and more sellers have had to dial back their expectations. Only about one in seven sellers had to resort to reducing their listing price in order to move their property, Redfin reported. However, that number has steadily risen to one in four as of September.

Read More »Loan Officer Survey Shows ‘Moderate’ Easing in Credit Standards

On net, a "moderate fraction" of banks polled in the Fed's Senior Loan Officer Survey reported easing standards on prime residential mortgages from August to October, with a net 8.8 percent saying credit standards have "eased somewhat." Among large banks, a net 26.5 percent reported somewhat looser standards. Meanwhile, however, demand has declined for both prime and nontraditional mortgages as mortgage rates bounce upward. Among all respondents, a net 7.2 percent reported moderately or substantially weaker demand.

Read More »Buyer Demand Rebounds as Government Returns to Business

Homebuyers shook off their fears and returned to the market in force following the re-opening of the government in October, according to data presented by Redfin's Research Center. Despite reports of consumer confidence waning, Redfin customers seemed relatively unfazed. "My clients think the ugly showdown we saw in October is unlikely to happen again," reported Philip Gvinter, a Redfin agent based in Washington, D.C. "After putting their home search on hold during the shutdown, they are ready to get back out there."

Read More »Survey: Americans Prefer Mixed-Use Communities

The majority of Americans are willing to sacrifice on living space if it means living closer to their most-visited spots, according to findings released by the National Association of Realtors (NAR).

Read More »Home Sellers Concerned About Economy, But Not Enough to Delay Plans

In the aftermath of the federal government shutdown, Redfin Research Center finds home sellers harbor concerns about the state of the economy and declining optimism toward selling their homes. "Almost certainly due to the U.S. government shutdown and debt ceiling battle in October, sellers this quarter were most worried about the state of the U.S. economy, with 39 percent naming 'general economic conditions' as a concern about listing their home," Redfin stated Thursday in its Real-Time Seller Survey.

Read More »Competition Cools Again as Washington Drama Deters Buyers

Redfin's Real-Time Bidding Wars report shows 58.3 percent of offers written by Redfin agents across the country faced bidding wars in September, down from 60.5 percent in August. Last September, 62.7 percent of offers faced competing bids. With competition diminishing, Redfin has also observed a fall in the number of homes selling at above asking price. On average across all tracked markets, buyers paid 0.4 percent below asking price (compared to 0.3 percent in August).

Read More »Despite Mortgage Concerns, Hispanics Likely to Provide Most Demand

Despite a decline in homeownership rates since the recession, Hispanics are even more likely to view homeownership favorably than the general population, according to Fannie Mae. The downside is that Hispanics are also more likely to anticipate difficulties in obtaining mortgage loans. Forty percent of homeowners in the overall population expressed concern about their ability to obtain a mortgage loan, but among the Hispanic population, 63 percent have concerns.

Read More »Consumer Uncertainty Impacts Demand in September

Homebuyer interest picked up slightly in September, but the number of customers willing to pull the trigger on purchasing declined substantially, Redfin reported in its latest Real-Time Demand Pulse. The number of buyers requesting home tours from Redfin agents rose 0.2 percent from August, turning up from a steady downward spiral that started in May. Meanwhile, the number of homebuyers submitting offers fell 11.8 percent, the largest monthly drop Redfin has recorded all year.

Read More »Commentary: Congress’ Deadliest Weapon? Uncertainty.

While many analysts cite varying reasons for the tepid, start-stop nature of this recovery, we attribute much of the lethargy to the heightened level of uncertainty that has gripped consumers.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news