Morgan Stanley may have sold its servicing sector off, but it's still going to be under a watchful eye for its previous practices. The Federal Reserve issued a consent order against Morgan Stanley Tuesday to address servicing and foreclosure issues from the company├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós former subsidiary Saxon Mortgage Services. According to the Fed, Saxon was ranked the 34th largest residential servicer and serviced a portfolio of more than 225,000 residential loans. The Fed stated Saxon initiated at least 60,313 foreclosure actions from January 1, 2009 to December 31, 2010.

Read More »Senate Banking Committee Clears Five Obama Nominees

Lawmakers seated on the Senate Banking Committee slated five nominees to head up regulatory agencies for full-chamber votes Friday. Committee Chairman Tim Johnson led the voice vote that cleared nominees for boards responsible for the Federal Reserve System, FDIC, and Troubled Asset Relief Program, among others. The nominees set for votes include Jerome Powell and Jeremy Stein for governorships with the Fed; Jeremiah Norton, for a board role with the FDIC; Richard Berner, for directorship of the Office of Financial Research; and Christy Romero, for service as TARP├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós next special inspector general.

Read More »Mortgage Rates Climb as Economy, Europe Improve

Good news about the economy and better results in Greece helped reverse declines for still-low mortgage rates for the first time in five months, according to Zillow. The real estate Web site delivered a Mortgage Marketplace report that fielded 3.97 percent for the 30-year fixed-rate mortgage, up 23 basis points from 3.74 percent last week. The interest rate for a 15-year loan climbed to 3.16 percent, just as rates for 5-year and 1-year adjustable-rate mortgages hovered near 2.85 percent. Interest rates for mortgage loans stayed near record lows as a result of the ongoing debt crisis in Europe.

Read More »Mortgage Rates Rise With Higher Treasury Yields

The days of record-low mortgage rates may be in our rearview mirror. Rates for all loan products headed higher this week - and by more than just the incremental 1 or 2 basis points. Analysts attribute the rise to increasing bond yields, driven by investors' growing confidence in the economy and recent evidence from the Federal Reserve's stress tests that indicates banks have strengthened capital levels enough to maintain operations and continue lending through another hypothetical recession.

Read More »Group: Euro Crisis Could Choke ‘Healing’ Housing Market

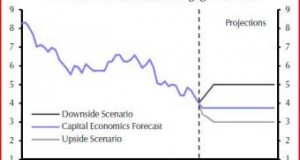

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »Still Falling, Mortgage Rates Read From the Same Script

This week mortgage rates played by the same script seen for the last few months, furthering a season for all-time high affordability while fears for Europe drove investors across the Atlantic. Finance Web site Bankrate.com, mortgage giant Freddie Mac, and real estate Web site Zillow.com delivered a dearth for rates across the board. Bankrate.com likewise offered declines for loans across the board. For its part, Greece remains in the clutch of a debt crisis that drew $172 billion in bailout funds from eurozone finance ministers last week.

Read More »Housing Looms Large, As Ever, For Bernanke, Lawmakers

A hearing held by House lawmakers Wednesday with Federal Reserve Chairman Ben Bernanke recast housing and the Dodd-Frank Act as issues critical to the economic recovery. The central banker said that 30 percent of home sales recently consisted of foreclosures and properties in distress, reflecting ongoing trouble for a market underpinned by high home vacancy rates and downward pressure for home prices. The underwriting process, down payments, and pending regulations also took center-stage during the discussion, with House members spotlighting recent servicer consent orders.

Read More »Beige Book Sees Continuing Economic Improvement

Overall economic activity continued to increase at a modest to moderate pace in January and early February, the Federal Reserve said Wednesday in the Beige Book. The report ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô an anecdotal review of conditions in each of the 12 Federal Reserve districts ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô showed economic improvement varying across the country. Residential real estate activity increased modestly in most parts of the country, while home prices declined or held steady in many areas. Reports on banking conditions were generally positive across the country. Demand for residential mortgage loans increased in New York and Richmond.

Read More »House Prices Hit Lows Not Seen Since 2002: Case-Shiller

Home prices reached fourth-quarter lows not seen since 2002, with the Standard & Poor├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós/Case-Shiller Index yielding 3.8 percent in declines for December last year. The index found that prices fell 4 percent year-over-year, alongside 1.1 percent in month-over-month declines for 10- and 20-city composite measures. Eighteen of 20 metropolitan areas monitored by S&P bore the brunt of monthly price declines, with figures up 0.2 percent and 0.8 percent for only Miami and Phoenix, respectively. Atlanta slouched into the negatives at 12.8 percent. Detroit offered the only positive annual return at 0.5 percent.

Read More »Discounts Drive Cash Buyers to Market: Survey

More homebuyers are scooping up properties with cash only, even in an environment for record-low mortgage rates, according to a recent survey. Campbell Surveys and Inside Mortgage Finance jointly released the HousingPulse Tracking Survey, collecting responses from about 2,500 real estate agents around the industry. The survey said that cash buyers will account for roughly half of all homebuyers in 2012 if current trends continue. The survey also attributed the rise in all-cash transactions to hefty discounts and late appraisals.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news