Consumer Financial Protection Bureau director Richard Cordray told a gathering of the nation's editors and journalists Friday that the agency needs their help to make consumers more aware of predatory lending hurdles. He highlighted efforts by the CFPB to increase transparency in the markets, underscored the role undertaken by lenders in the crisis, and played up the need for more regulation for servicers. The address by Cordray is the latest in a round of public appearances by the CFPB director, newly appointed by President Barack Obama in January.

Read More »Mortgage Rates Rise With Higher Treasury Yields

The days of record-low mortgage rates may be in our rearview mirror. Rates for all loan products headed higher this week - and by more than just the incremental 1 or 2 basis points. Analysts attribute the rise to increasing bond yields, driven by investors' growing confidence in the economy and recent evidence from the Federal Reserve's stress tests that indicates banks have strengthened capital levels enough to maintain operations and continue lending through another hypothetical recession.

Read More »More Americans Feel Confident About Housing: Survey

More Americans feel confident about their household finances, the housing recovery, and the prospect of an economic upturn, Fannie Mae said Wednesday. The mortgage giant drew on poll data from some 1,000 respondents to sketch a blend of guardedness and hopefulness in a National Housing Report. Thirty-five percent of Americans now believe the economy is on the right track, an increase from 19 percent in November, compared with 57 percent who still feel damp about the state of recovery. Fewer respondents fielded layoff concerns.

Read More »Report Slams FHFA, Freddie for Poor Servicer Oversight

The inspector general of the Federal Housing Finance Agency released a report Tuesday that criticizes the agency, Fannie Mae, and Freddie Mac for a series of ongoing oversight problems with mortgage servicers. The document charges that the FHFA failed to implement service guidelines for the mortgage company last year and portrays today├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós environment as one in which the agency, GSEs, and servicers all punt responsibility down the ladder. It also alleges that Fannie Mae and Freddie Mac routinely fail to swap servicer information.

Read More »Falling Loan Applications Tilt Toward Still-Nascent Recovery

In signs that a stable housing rebound may still be ways off, mortgage applications contracted by 1.2 percent last week, even while the Home Affordable Refinance Program offered a still-steady buttress for refinance activity. The Mortgage Bankers Association found in a weekly survey that mortgage application volume also declined by 10.2 percent on a seasonally adjusted basis. The Purchase Index went up by a seasonally adjusted 2.1 percent from last week, while it climbed by 14.7 percent on a seasonally unadjusted basis.

Read More »Group: Euro Crisis Could Choke ‘Healing’ Housing Market

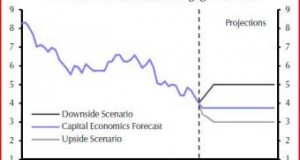

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »Mortgage Rates Ride Rollercoaster Ahead of Greek Deadline

All-time highs for housing affordability persisted this week as interest rates for fixed-rate mortgages hovered near their record-breaking lows, a sign that Europe continues to ward off investors. Real estate Web site Zillow found only a minor shift for the 30-year fixed-rate mortgage, which lingered between 3.70 percent and 3.75 percent before nestling at 3.69 percent Tuesday. The 15-year loan stayed near 2.95 percent, along with rates for 5-year and 1-year adjustable-rate mortgages that averaged 2.65 percent, according to the Web site.

Read More »Obama Touts Lower FHA Premiums, Vet Homeowner Relief

The Obama administration revealed recently it will relieve veterans wrongly foreclosed upon by servicers, as well as slashing refinancing rates for FHA loans.

Read More »NAHB Proposes Plan to Overhaul Secondary Market

A prominent housing trade group joined a growing roster of policy makers by outlining ways to take the GSEs off federal conservatorship, reintroduce private mortgage-backed securities, and charge existing government entities with stewardship of the new system. The National Association of Home Builders released a white paper Monday that calls on lawmakers to slowly transition a system dominated by Fannie Mae and Freddie Mac to one that shares and balances responsibility. The proposal comes as others arrive from lawmakers and policy makers to replace the GSEs.

Read More »Last Year’s Housing Doldrums Dampen Obama Scorecard

A troubled year for housing surfaced in a February housing scorecard from the Obama administration Friday, underscoring a still-unsteady pace for home prices, mortgage origination volume, and housing supply. Jointly released by HUD and the Treasury Department, the scorecard reflects an industry still in transition from crisis to recovery. The scorecard cited a National Association of Realtors Home Affordability Index, showing that it moved from 179.1 February last year to 194.9 this year, not far from the level seen in January.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news