Even as the country barrels closer and closer to the fiscal cliff at the end of the year, Capital Economics is maintaining its projection for modest economic growth in 2013. In the firm's latest US Economics Update, economists Paul Ashworth and Paul Dale take a peek into what they believe is America's likely economic future: GDP growth of 2.0 percent in 2013 followed by 2.5 percent the following year. Of course, there are some major factors that could seriously stifle growth.

Read More »Personal Income Soars in November, Q4 Still Looks Weak

Personal income jumped 0.6 percent in November--twice what economists forecast--improving $85.8 billion, while spending rose a hefty 0.4 percent, the Bureau of Economic Analysis (BEA) reported Friday. The growth in spending matched economists├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ó forecasts. The jump in spending reversed a $6.6 billion decline in October but fell short of the $86.2 increase in consumption recorded in September.

Read More »GDP Growth Revised to 3.1% for Q3, Corporate Profits Surge

Real GDP growth for the third quarter was revised up again, the Bureau of Economic Analysis reported Thursday, reaching a 3.1 percent annualized growth rate. The report on GDP was the third of three monthly reports tracking the broadest measure of the nation's economic health. GDP growth of 3.0 percent is considered "trend," with above-trend growth suggesting favorable conditions for hiring. In the same report, BEA said corporate profits rose $45.7 billion in the third quarter, more than double the increase in the second quarter.

Read More »Fannie Mae: Economic Growth to Slow, Housing to Strengthen

After rising economic growth in the third quarter, overall economic growth is expected to decline this quarter and in early 2013, according to Fannie Mae. However, the GSE anticipates further strengthening in the housing market. Economists anticipate economic growth of less than 2 percent for the first half of 2013 followed by more accelerated growth for the remainder of the year. However, while the overall economy remains dismal, Fannie's economists finds a bright spot in the housing market.

Read More »Stagnant Price Growth Drags Down Consumer Spending

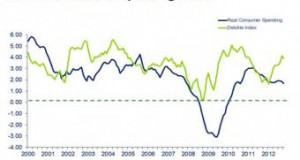

Consumer spending turned down in November after nearly a year of steady gains, according to Deloitte's Consumer Spending Index. The index, which tracks consumer cash flow as an indicator of future spending, comprises four components: tax burden, initial unemployment claims, real wages, and real home prices. The index dipped from 4.14 in October to 3.89 in November, turning around several months of improvement. The index reflects data through October but does not yet show the complete impact of superstorm Sandy.

Read More »New Findings from FMI Forecast $1T in CPIP by 2014

North Carolina-based FMI has released the results of its 2013 U.S. Markets Construction Overview, and the company is heralding more than $1 trillion in construction-put-in-place (CPIP) by 2014. Noting near-term projections, FMI stated that CPIP is anticipated to hit $826 to $884 billion to end 2012, with the growth rate remaining slightly ahead of gross domestic product (GDP) growth rates in 2013.

Read More »Mortgage Rates Mixed as Markets Await Jobs Report, Fiscal Cliff News

Fixed mortgage rates stayed relatively calm this week as economic indicators showed improved strength.

Read More »GDP Growth for Q3 Revised to 2.7%

Real GDP growth for the third quarter was revised up significantly, reaching a 2.7 percent annualized growth, the Bureau of Economic Analysis (BEA) reported Thursday. Economists had forecast a 2.8 percent growth rate from the first estimate of 2.0 percent reported last month. Residential fixed investment accounted for $12.2 billion in the third quarter, according to the revised report, virtually unchanged from the $12.3 billion in the advance report of the third-quarter GDP increase and up from the $7.2 contribution in the second quarter.

Read More »NAR Releases Projections on Housing, Economy

The National Association of Realtors (NAR) offered market projections into 2014 during a forum at the 2012 Realtors Conference and Expo.

Read More »Residential Investment Growth Boosts Q3 GDP

Led by increases in personal consumption, government spending, and residential investment, the US economy grew 2.0 percent in the third quarter, the Bureau of Economic Analysis reported Friday, faster than economists expected and a strong rebound from the 1.3 percent growth rate in the second quarter. While not an absolutely strong performance, the improvement over the second quarter bolsters arguments that current economic policies are working. Growth is below the longer-term 2.5 percent average, though, indicating a still-weak economy.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news