New-homes sales fell 1.6 percent in February to a seasonally adjusted annual rate of 313,000, the second straight monthly decline, the Commerce Department and HUD jointly reported Friday. Sales for January were revised downward from 321,000 to 318,000. The median price of a new home in February jumped to $233,700 from $215,700. The median price in February was the highest since last June when the median price hit $240,200.The median price in February was 6.2 percent higher than figures for the same seen in February last year.

Read More »Expect Home Prices to Fall Further in 2012: Zillow

Economists redrew their expectations for home prices for 2012, slashing forecasts from 0.2 percent to 0.7 percent. Real estate Web site Zillow.com partnered with Pulsenomics LLC to project prices in a Home Price Expectations Survey it released earlier Wednesday. More than 100 economists and real estate experts said in their survey responses, with the more optimistic saying that prices could lift 1.4 percent next year, down from 1.8 percent. Drawing on a Standard & Poor├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós/Case-Shiller Index, Zillow projected that home prices would climb by 1.39 percent next year.

Read More »Single-Family Starts Plunge, Permits Increase in February

Housing starts fell 1.1 percent in February to 698,000, compared with market expectations for a smaller decline, the Census Bureau and HUD jointly reported Tuesday. Single-family starts plunged 9.9 percent to 457,000, the steepest decline in a year, according to the agencies. The starts suggest strongly January's unexpectedly strong report was influenced by unseasonably warm weather, which pulled starts forward. Single-family starts have been weak for the past three years. Housing permits, unaffected by weather, rose 5.1 percent in February.

Read More »Higher Mortgage Rates Unlikely to Drown Housing: Group

The potential for a lift in mortgage rates is unlikely to spell trouble for the housing recovery, according to a recent report. Paul Diggle, a property economist with Capital Economics, said in a note Monday that still-low home prices will help cushion the blow from interest rates. Mortgage rates continue to linger near record lows, with 30-year and 15-year fixed-rate mortgages hovering at or below 4 percent for the past several weeks. Waning confidence in Europe├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós ability to halt the debt crisis in Greece drives investors to U.S. Treasury debt.

Read More »Nearly 100 Housing Markets Improve in March: NAHB

Fewer declines in housing permits, strengthening job numbers, and stabilizing home prices helped field improvements in nearly 100 housing markets in March, according to the National Association of Home Builders. The trade group released results to show that 31 metropolitan markets joined the First American Improving Markets Index, canceling departures from the list by 30 others. The total number of improving markets settled at 99. New additions signaled improvements in 33 states, with Texas outpacing other states with 12 entrants.

Read More »CoreLogic: Home Prices Show Sixth Consecutive Decline

National home prices declined 1.0 percent between December 2011 and January 2012, according to the latest home price index from CoreLogic. It represents the sixth consecutive month the company has recorded a month-over-month drop in residential property values. The stretch of depreciation is much longer when comparing year-over-year numbers. Based on data through the end of January, annual declines in home prices have continued for 18 months straight by CoreLogic's assessment.

Read More »More Americans Feel Confident About Housing: Survey

More Americans feel confident about their household finances, the housing recovery, and the prospect of an economic upturn, Fannie Mae said Wednesday. The mortgage giant drew on poll data from some 1,000 respondents to sketch a blend of guardedness and hopefulness in a National Housing Report. Thirty-five percent of Americans now believe the economy is on the right track, an increase from 19 percent in November, compared with 57 percent who still feel damp about the state of recovery. Fewer respondents fielded layoff concerns.

Read More »Falling Loan Applications Tilt Toward Still-Nascent Recovery

In signs that a stable housing rebound may still be ways off, mortgage applications contracted by 1.2 percent last week, even while the Home Affordable Refinance Program offered a still-steady buttress for refinance activity. The Mortgage Bankers Association found in a weekly survey that mortgage application volume also declined by 10.2 percent on a seasonally adjusted basis. The Purchase Index went up by a seasonally adjusted 2.1 percent from last week, while it climbed by 14.7 percent on a seasonally unadjusted basis.

Read More »Group: Euro Crisis Could Choke ‘Healing’ Housing Market

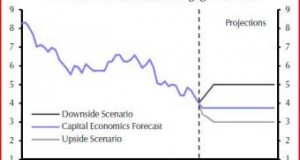

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »Home Prices Expected to Continue Stabilizing: Fitch

Lower unemployment figures and higher GDP growth continue to help stabilize home prices amid a still-steady recovery, Fitch Ratings said Monday. The ratings agency found in a report that home prices may plunge 9.1 percent nationally but that the figures remain below estimates of 13.1 percent from the fourth quarter. Fitch said that declines may contract by around 6 percent in lieu of inflation and benefit from improvements in macro-economic indicators, such as unemployment and GDP growth. The report said that still-anemic mortgage volume remains a problem.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news