Mortgage application volume continued to decline last week, according to the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending February 15. The survey's Market Composite Index, a measure of application volume, fell 1.7 percent on a seasonally adjusted basis from the previous week. On an unadjusted basis, the index fell 1.0 percent. According to the MBA's measure, the average contract interest rate for a 30-year fixed-rate mortgage was 3.78 percent last week, the highest rate since August 2012.

Read More »Refinance Share Climbs to 73 Percent in January, Time to Close Falls

Refinance loan share jumped to its highest level in at least a year and a half, according to Ellie Mae's Origination Insight Report for January 2013. According to the report, refinances made up 73 percent of loans closed in January--the highest level recorded since Ellie Mae began tracking the data in August 2011. January's refinance figure is 4 percentage points higher than December's. Despite the rise in refinance share, the time it took to close a refinance loan declined in January, falling to 54 days.

Read More »Total HARP Volume Surpasses 2M as of November

As of November 2012, Fannie Mae and Freddie Mac have refinanced more than 2 million loans through the Home Affordable Refinance Program (HARP), the Federal Housing Finance Agency (FHFA) reported Tuesday. According to FHFA, nearly 130,000 homeowners refinanced their mortgages through HARP in November alone, making it the second biggest month for HARP activity in 2012 (behind June's 137,000 HARP refinances). In addition, HARP volume represented 23 percent of total refinance volume in November.

Read More »Freddie Mac Sees Room for Growth in Housing

Well housing activity remains near historical lows, Freddie Mac is taking a more optimistic view: There's still plenty of room to grow. This glass-half-full viewpoint was reflected in the GSE's forecast for housing in 2013, especially for housing starts, which are projected to increase to 950,000 units this year--22 percent higher than 2012 levels. The GSE also expects prices to increase 3 percent in 2013 and 2014, while sales are forecast to rise to an annual rate of 5.45 million and 5.80 million, respectively.

Read More »President Addresses Housing Concerns, Demands Congressional Action

In his State of the Union address, President Obama acknowledged the progress that has been made in the housing market with rising prices, increasing home purchases, and an uptick on construction. However, "even with mortgage rates near a 50-year low, too many families with solid credit who want to buy a home are being rejected," he said. Obama also proclaimed his support for expanding access to refinancing, calling on Congress to pass a refinance bill currently in the pipeline.

Read More »Mortgage Application Volume Falls as Rates Climb

Mortgage applications dipped last as long-term rates reached a five-month high, according to the Mortgage Bankers Association (MBA). MBA's weekly Market Composite Index showed a 6.4 percent drop for the week ending February 8. On an unadjusted basis, the index was down 5 percent. After showing some strength in the previous week, purchase application activity also dropped, falling by an adjusted 10 percent (or an unadjusted 4 percent). Year-over-year, however, volume was still up 15 percent.

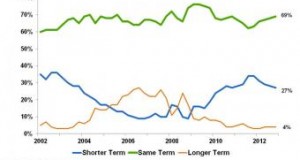

Read More »Freddie Mac: 27% of Q4 Refinancers Shortened Loan Terms

Data released by Freddie Mac shows more than a quarter of borrowers who refinanced in Q4 2012 chose to shorten their loan terms.

Read More »Senators Revive Refinance Bill

Two U.S. senators reintroduced legislation designed to open up competition and limit barriers to refinance for qualified homeowners.

Read More »Mortgage Activity Rises 22%, Government Business Leads

Loan originators saw a 21.9 percent rise in the number of "locked-in" loans last week, according to Optimal Blue and Mortgage Daily.

Read More »Freddie Mac: Q4 Refinancers Saved Average 33% in Interest Rate

Homeowners who refinanced their mortgages in the fourth quarter of 2012 reduced their interest rates by an average of 33 percent.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news