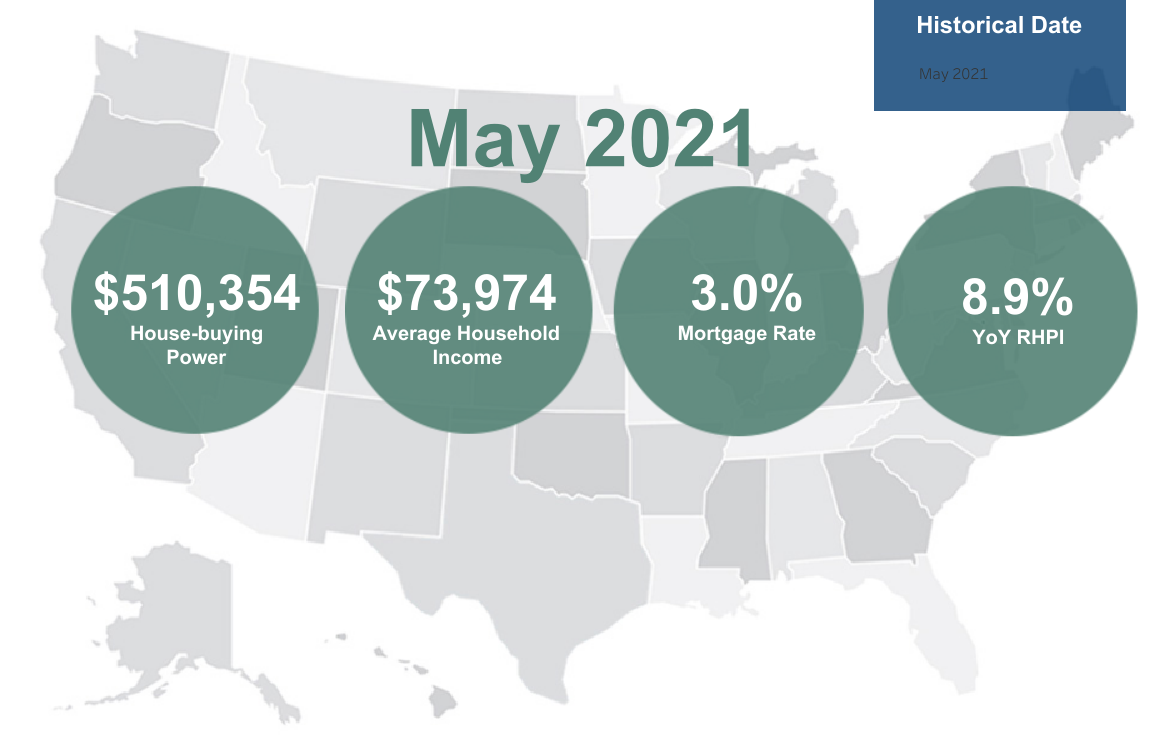

First American Financial Corporation has released its May 2021 First American Real House Price Index (RHPI), a measure of the price changes of single-family properties throughout the U.S., adjusted for the impact of income and interest rate changes on consumer homebuying power over time at national, state and metropolitan area levels.

First American Financial Corporation has released its May 2021 First American Real House Price Index (RHPI), a measure of the price changes of single-family properties throughout the U.S., adjusted for the impact of income and interest rate changes on consumer homebuying power over time at national, state and metropolitan area levels.

"Housing affordability declined on a year-over-year basis for the third month in a row in May, following a two-year streak of rising affordability,” said Mark Fleming, Chief Economist at First American. “The decline in May occurred even as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of greater affordability relative to one year ago.

The RHPI found that homebuying power increased by 8% in May, compared to a year ago, driven by continued record low rates and an improving U.S. economy and jobs market.

The three key drivers of First American’s RHPI are incomes, mortgage rates, and an unadjusted house price index. Incomes and mortgage rates are used to inflate or deflate unadjusted house prices in order to better reflect consumers' purchasing power and capture the true cost of housing.

Fleming added, “The affordability gains from house-buying power, however, were offset by the third component of the RHPI, nominal house price appreciation, which reached a record 18% in May, surpassing the previous peak from 2005. As always, real estate is local and national affordability trends are not necessarily reflected in local trends, as house-buying power and nominal house price gains vary greatly from city to city.”

Regionally, the five metros that saw the greatest year-over-year slide in affordability in May 2021 include:

- Phoenix, Arizona: -22.7%

- Seattle, Washington: -20.1%

- Kansas City, Missouri: -19.6%

- Tampa, Florida: -17.8%

- Las Vegas, Nevada: -17.2%

“In May, Phoenix had the greatest year-over-year decrease in affordability,” added Fleming. “While annual income growth was steady at 1.9%, Phoenix experienced the biggest annual increase in nominal house prices of any major market—29.3%. The steep increase in nominal house prices overshadowed any affordability gains from increased house-buying power. A similar dynamic played out in Tampa, as year-over-year nominal house price appreciation of 25.6% outpaced house-buying power.

Last week, Freddie Mac reported mortgage rates fell to 2.78%, remaining below the refi-friendly 3% mark. However, new home buyers continue to be priced out of the market, with asking prices of newly listed homes up 12% from the same time a year ago to a median of $361,700, according to a new Redfin study.

These higher listing prices are forcing more back to the drawing board, yet has slightly boosted inventory in the process. According to the latest Zillow Real Estate Market Report, housing inventory saw significant recovery for the second consecutive month in June. However, inventory remains low, and demand is still strong, sending home value appreciation to new record highs for both monthly and annual growth.

“Declining affordability may cause potential home buyers on the margin to be priced out, prompting fewer or less intense bidding wars, and causing house price appreciation to moderate,” noted Fleming. “The increase in housing inventory may likewise ease pressure on nominal house price growth, though the increase remains small relative to historic levels and the broader housing supply shortage is likely to take years to reverse. Affordability trends in the coming months will depend on the supply and demand dynamics behind nominal house price appreciation—dynamics which will play out differently in each market.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news