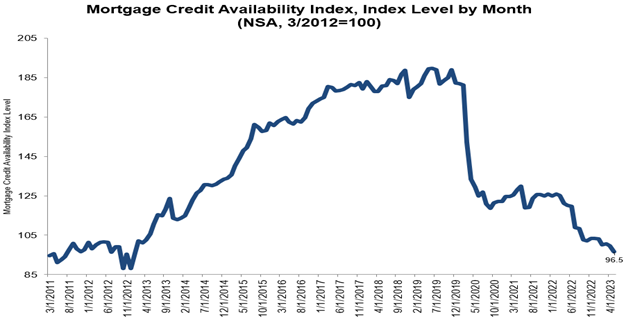

Mortgage credit availability decreased in May according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology. The MCAI fell by 3.1% to 96.5 in May.

Mortgage credit availability decreased in May according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology. The MCAI fell by 3.1% to 96.5 in May.

April’s MCAI fell by 0.9% from March’s reading to 99.6 in April.

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The Index was benchmarked to 100 in March 2012.

By loan type, the Conventional MCAI decreased 2.3%, while the Government MCAI decreased by 3.8%. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 1.5%, and the Conforming MCAI fell by 3.9%.

“Mortgage credit availability decreased for the third consecutive month, as the industry continued to see more consolidation and reduced capacity as a result of the tougher market. With this decline in availability, the MCAI is now at its lowest level since January 2013,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “The Conforming index decreased almost 4% to its lowest level in the history of the survey, which dates back to 2011. The Jumbo Index fell by 1.5% last month, its first contraction in three months, as some depositories assess the impact of recent deposit outflows and reduce their appetite for jumbo loans.”

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for more than 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time.

“Additionally, lenders pulled back on loan offerings for higher LTV and lower credit score loans, even as loan applications continued to run well behind last year’s pace,” added Kan. “Both Conventional and Government Indices saw declines last month, and the Government Index fell by 3.8% to the lowest level since January 2013. In a market where a significant share of demand is expected to come from first-time homebuyers, the depressed supply of government credit is particularly significant.”

The typical U.S. home value grew by 1.4% month-over-month from April to May, the strongest monthly appreciation since last June as reported by Zillow, with the typical home value at $346,856—up 0.9% over last May, and up 3.4% from a low recorded in January.

And despite stringent credit standards, buyers are continuing to turn out for the limited supply available, as the nation’s housing inventory remains a challenge for buyers. Zillow reports that the flow of new listings was down 23% year-over-year in May—a more moderate drop than in April, but nearly equal to that reported in March of 2023.

"Many homeowners are still opting not to sell and give up historically low mortgage rates. But those who do have been rewarded with bidding wars as buyers compete for limited options," said Zillow Senior Economist Jeff Tucker. "Spring is traditionally the hottest time of year in the housing market, and 2023 has been no exception. Time will tell if seasonal price slowdowns arrive on time this year, later in summer."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news