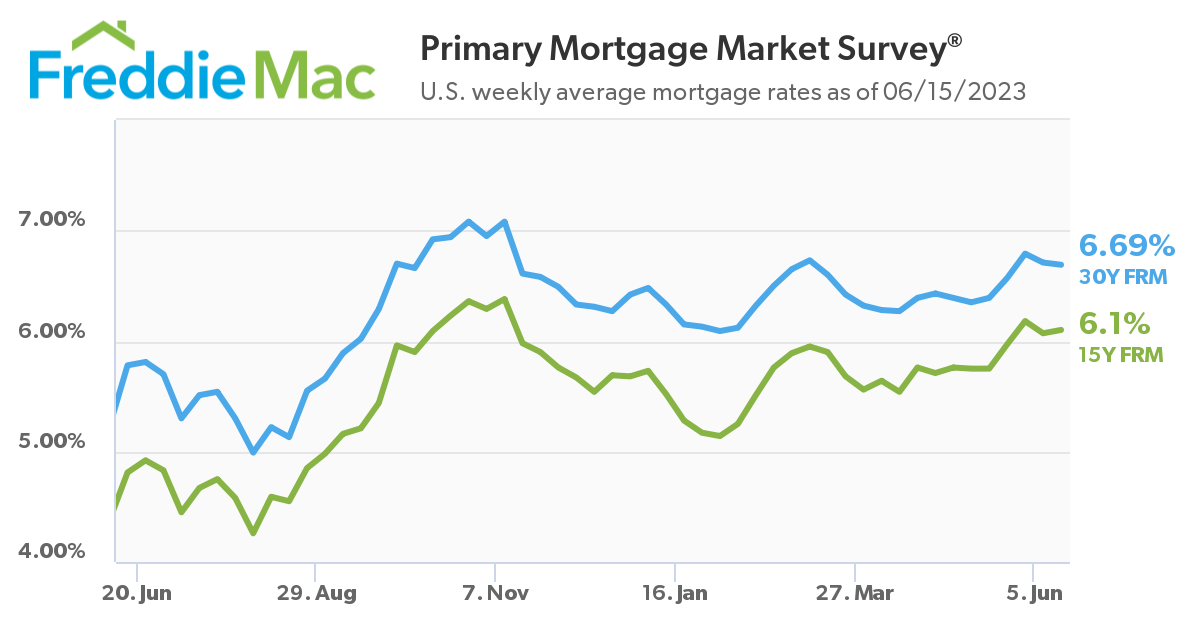

The 30-year fixed-rate mortgage (FRM) has fallen for the second consecutive week, as Freddie Mac has reported in its latest Primary Mortgage Market Survey (PMMS) that the FRM averaged 6.69% as of June 15, 2023, down from last week when the FRM averaged 6.71%. A year ago at this time, the 30-year FRM averaged 5.78%.

The 30-year fixed-rate mortgage (FRM) has fallen for the second consecutive week, as Freddie Mac has reported in its latest Primary Mortgage Market Survey (PMMS) that the FRM averaged 6.69% as of June 15, 2023, down from last week when the FRM averaged 6.71%. A year ago at this time, the 30-year FRM averaged 5.78%.

“Mortgage rates decreased slightly this week in anticipation of the pause in rate hikes by the Federal Reserve," said Sam Khater, Freddie Mac’s Chief Economist. “As inflation continues to decelerate, economic growth is slowing and the tightening cycle of monetary policy is reaching its apex, which means mortgage rates are expected to decrease later this year and into next.”

Also this week, the 15-year FRM averaged 6.10%, up from last week when it averaged 6.07%. A year ago at this time, the 15-year FRM averaged 4.81%.

Rates cooled ahead of news from the Federal Reserve Board, as the Fed ended the most aggressive series of rate hikes in history at the conclusion of its June meeting, holding the nominal interest rate at a range of 5% to 5.25%. The Fed’s actions concluded the most aggressive series of consecutive hikes in history, which consisted of 10 consecutive rate hikes over the past 15 months.

The dip in rates brought new life into overall mortgage application volume, as the Mortgage Bankers Association (MBA) reported that overall mortgage application volume rose 7.2% week-over-week. The dip in rates added some life into a recently dormant refi market, as the MBA’s Refinance Index increased 6% over the previous week, yet was still 41% lower than the same week one year ago.

“Mortgage applications increased last week as borrowers responded to the small decline in rates,” said MBA President and CEO Robert D. Broeksmit, CMB. “Elevated rates and the lack of housing supply continue to impact many prospective homebuyers, but we have seen an uptick of first-time homebuyers entering the market, which is a positive sign of renewed activity.”

Realtor.com reports that the number of homes for sale continues to grow, but year-over-year, the pace is slowing.

“While today’s shoppers still have many more homes to consider than last year’s shoppers did, worries about high inflation, rising interest rates, and escalating home prices have caused many prospective buyers to postpone their plans to purchase a home,” said Realtor.com Economist Jiayi Xu. “This, in turn, has contributed to an increase in the number of homes listed for sale. However, the ongoing decrease in new listings has restrained the growth of active inventory, and there is a possibility of further deceleration in the upcoming weeks.

And as mortgage rates have fallen, they have yet to reach a level where many would-be buyers are comfortable making a move, as Redfin reports many would-be sellers are staying put rather than listing their home to avoid taking on a much higher mortgage rate when they purchase their next house. This “lock in” effect has pushed inventory down to record lows this spring, with Redfin reporting new listings of homes for sale and the total number of listings both dropping to their lowest level on record for this time of year, which is fueling homebuyer competition in some markets, and preventing home prices from falling further even amid tepid demand.

“High mortgage rates are a double whammy because they’re discouraging both buyers and sellers–and they’re discouraging sellers so much that even the buyers who are out there are having trouble finding a place to buy,” said Redfin Deputy Chief Economist Taylor Marr. “The lock-in effect is unlikely to go away in the near future. Mortgage rates probably won’t drop below 6% before the end of the year, and most homeowners wouldn’t be motivated to sell unless rates dropped further. Some of them simply don’t want to take on a 6%-plus mortgage rate and some can’t afford to.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news