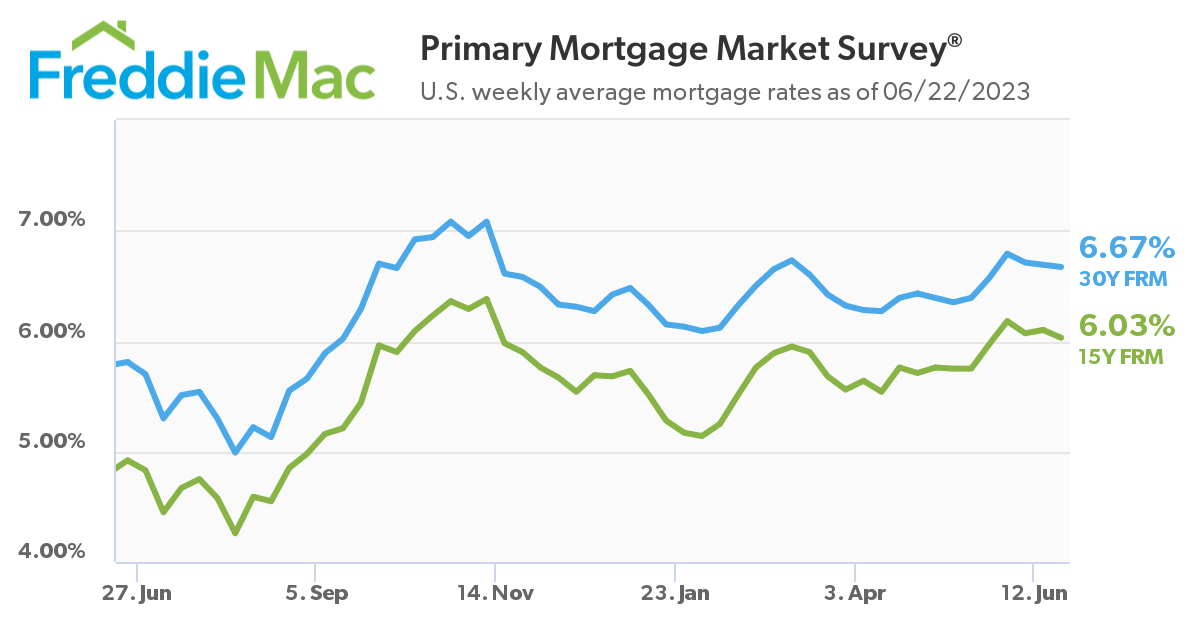

Freddie Mac, in its latest Primary Mortgage Market Survey (PMMS), has reported that the 30-year fixed-rate mortgage (FRM) slid for the third consecutive week, down two basis points from last week’s reading of 6.69% and falling to 6.67%. One year ago at this time, the 30-year FRM averaged nearly a full percentage point lower, at 5.81%.

Freddie Mac, in its latest Primary Mortgage Market Survey (PMMS), has reported that the 30-year fixed-rate mortgage (FRM) slid for the third consecutive week, down two basis points from last week’s reading of 6.69% and falling to 6.67%. One year ago at this time, the 30-year FRM averaged nearly a full percentage point lower, at 5.81%.

“Mortgage rates slid down again this week, but remain elevated compared to this time last year,” said Sam Khater, Freddie Mac’s Chief Economist. “Potential homebuyers have been watching rates closely and are waiting to come off the sidelines. However, inventory challenges persist as the number of existing homes for sale remains very low. Though, a recent rebound in single-family housing starts is an encouraging development that will hopefully extend through the summer.”

Also this week, Freddie Mac reported the 15-year FRM at 6.03%, down from last week when it averaged 6.10%. A year ago at this time, the 15-year FRM averaged 4.92%.

“The Fed opted not to raise short-term rates at June’s FOMC meeting, choosing to wait for additional data and see how recent rate increases are influencing price growth and the real economy,” noted Realtor.com Economist Jiayi Xu. “In the coming months, we may see a faster slowdown in inflation because the growth in the shelter index, the largest contributor to inflation growth, has passed its peak and started to trend down in April. Nevertheless, as the inflation is well-above the 2% target and the labor market is still strong, FOMC signaled that the Federal Funds rate will be half a point higher than previously expected at the end of 2023, which is also half a point higher than the current rate. In other words, borrowing, including home purchases, will likely remain expensive through the remainder of the year.”

Just last week, ending the most aggressive series of rate hikes in history at the end of the June 13-14 meeting of the Federal Reserve’s FOMC paused raising the nominal interest rate, letting it stand at a range of 5.00% to 5.25% due to the continued easing—but not taming—of inflation which the FOMC is “strongly committed” to returning inflation to its 2% objective.

Still a challenge for potential buyers is the lack of inventory available, May 2023’s existing-home sales numbers from the National Association of Realtors (NAR) found that U.S. home sales increased by 0.2% to a seasonally adjusted annual rate of 4.3 million units. However, May’s gain is on a month-to-month basis—year-over-year existing-home sales are down by 20.4%.

NAR reported that total for-sale housing inventory at the end of May rose to 1.08 million units, or 3.8%, from April—but on a yearly basis, this number is down 6.1% from one year ago when inventory stood at 1.15 million units. At the current sales pace, that is a three-month supply, up from 2.9 months in April and 2.6 months year-over-year.

"Available inventory strongly impacts home sales, too," NAR Chief Economist Lawrence Yun added. "Newly constructed homes are selling at a pace reminiscent of pre-pandemic times because of abundant inventory in that sector. However, existing-home sales activity is down sizably due to the current supply being roughly half the level of 2019."

The dip in rates forced a slight rise in overall mortgage application volume, as the Mortgage Bankers Association (MBA) reported an increase in app volume of 0.5% from one week earlier for the week ending June 16, 2023.

Rates are still high enough to keep refi seekers on the sidelines, as the MBA reported the refinance share of mortgage activity decreased to 26.9% of total applications, down from 27.3% the previous week. Redfin found that an estimated 91.8% of U.S. homeowners with mortgages have an interest rate below 6%—down just slightly from the record high of 92.9% hit in mid-2022.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news