According to a new report from CoreLogic, the housing market has shifted significantly in the past four years, particularly concerning mortgage rates. During the height of the pandemic, rates hit record lows, which benefitted homebuyers at the time.

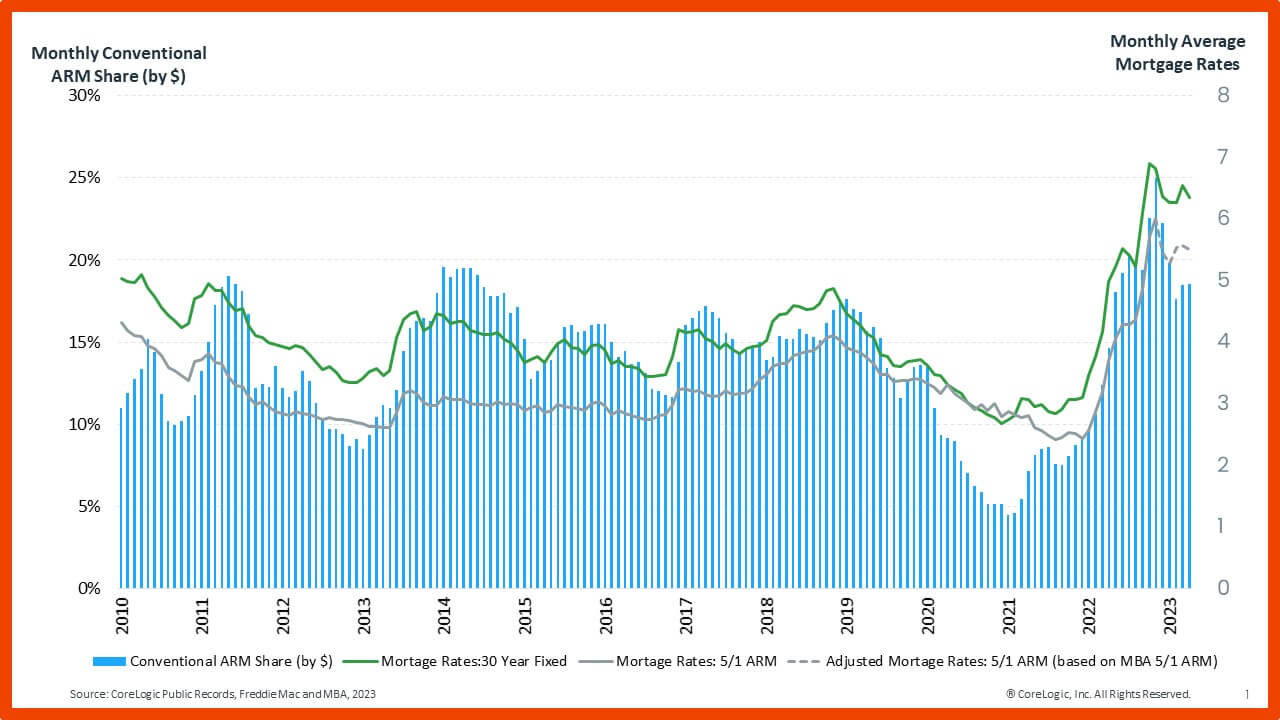

However, rates then increased to a 20-year high. From December 2020 to October 2022, the average 30-year fixed-rate mortgage (FRM) rose by 422 basis points, or 4.22 percentage points, according to Freddie Mac data. Meanwhile, rates on 5/1, adjustable-rate mortgages (ARMs) increased by only 292 basis points, or 2.92 percentage points during the same time.

The concurrent surge in mortgage rates and U.S. housing prices has led to a decline in affordability. As FRMs increase, some homebuyers are exploring alternatives like ARMs and buydown points to reduce their monthly payments, particularly in the initial period of the loan. Each percentage point rise in mortgage rate means additional monthly costs for homebuyers and results in higher monthly payments.

Since the housing bubble burst in 2007, FRMs have become more widespread compared with ARMs. The share of ARM dollar volume in mortgage originations declined from nearly 45% in mid-2005 to a low of 2% in mid-2009. Since then, the ARM share has fluctuated between approximately 8% and 18% of mortgage originations, depending on the prevailing FRM rate.

The ARM share declined during the pandemic and hit a 10-year low of 4% of mortgage originations in January 2021. However, as FRM interest rates increased from below 3% to levels recorded in April 2023, ARMs have gained renewed attention. As of April 2023, the ARM share accounted for 18.6% of the dollar volume of conventional single-family mortgage originations, quadrupling from its January 2021 low.

Comparing the ARM Share with Mortgage Rates: January 2010 to April 2023

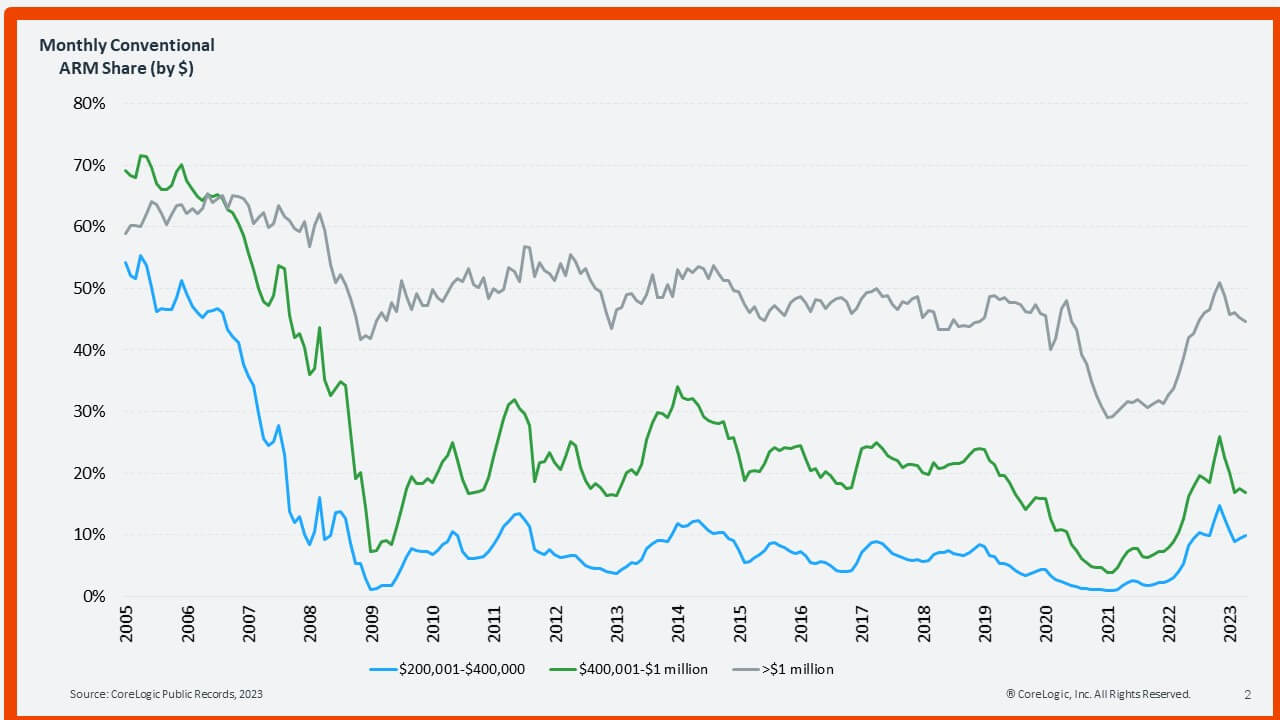

The ARM share varies significantly based on location and loan amount. ARMs are more common for homebuyers taking out large loans, especially jumbo loans, compared to borrowers with smaller loans. Among mortgage originations exceeding $1 million in April 2023, ARMs comprised 45% of the dollar volume, a 6 percentage-point increase from April 2022.

Among mortgages in the $400,001 to $1 million range, the ARM share was approximately 17%, up by 4 percentage points from April 2022. For mortgages in the $200,001 to $400,000 range, the ARM share was only 10% in April 2023, up by 4 percentage points from April 2022.

Conventional ARM Share by Loan Size: January 2005 to April 2023

Although the ARM share is rising with increasing mortgage rates, it remains below and different than pre-Great Recession levels. The most common ARMs today are the 5/1 and 7/1 types, which minimize risk.

By comparison, around 60% of ARMs that were originated in 2007 were low- or no-documentation loans, compared with 40% of FRMs. Similarly, in 2005, 29% of ARM borrowers had credit scores below 640, while only 13% of FRM borrowers had similar credit ratings. Currently, almost all conventional loans, including both ARMs and FRMs, require full documentation, are amortized, and are made to borrowers with credit scores above 640.

Since ARMs have lower initial interest rates than FRMs, homebuyers experience more significant monthly savings in the beginning, especially for larger loans. However, interest rate movements are unpredictable and tied to benchmarks such as Secured Overnight Financing Rate, which can fluctuate.

On the other hand, FRM homebuyers don’t need to worry about increased monthly mortgage payments. When fixed rates were low, ARMs decreased in popularity However, as fixed rates increase, ARMs are becoming more appealing to homebuyers who wish to keep their initial mortgage costs as low as possible. An ARM could be a suitable option if it aligns with the homeowner’s or homebuyer’s circumstances.

It’s important to note that there is no guarantee that mortgage rates will drop in the future, presenting an inherent interest risk that ARMs may lead to increased monthly payments.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news