A new study by SelfStorage.com has found that in the Commonwealth of Massachusetts, it takes the longest amount of time to save for a house.

A new study by SelfStorage.com has found that in the Commonwealth of Massachusetts, it takes the longest amount of time to save for a house.

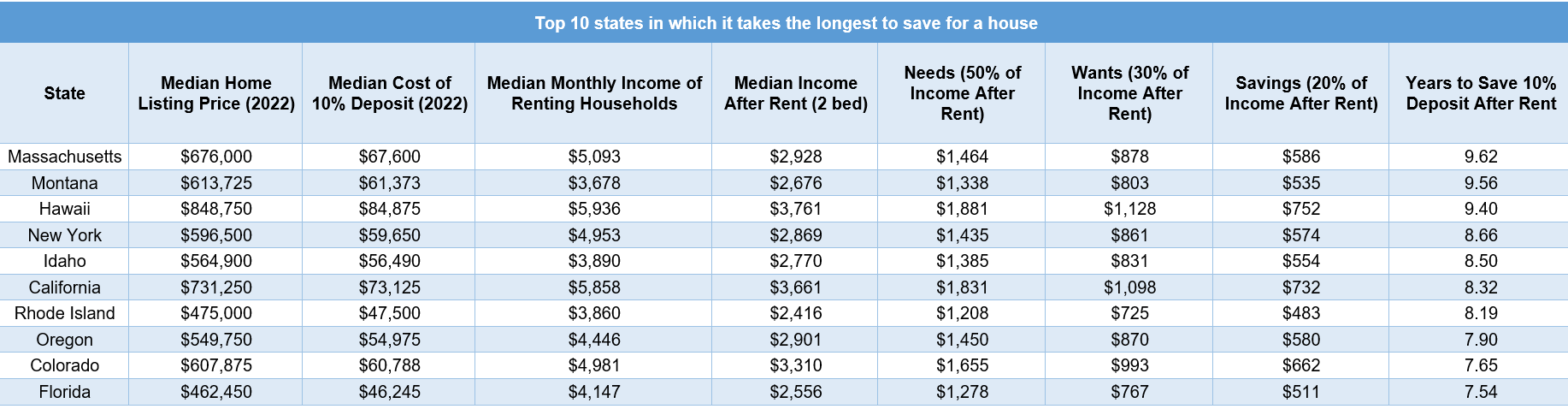

The study sourced the median household income of renters and fair market rent costs from the National Low Income Housing Coalition (NLIHC) for each state, and, using the 50/30/20 rule (50% on needs, 30% on wants, and 20% on savings), and calculated the time it takes to save for a 10% deposit on a home.

Massachusetts took first place, as it would take almost 10 years to save for a 10% down payment using the rule above. In Massachusetts, the median monthly household income is $5,093, while the median home listing price for a house is $676,000.

Using the 50/30/20 rule, Massachusettsans would have, after paying rent, $1,464 for needs, $878 for wants and $586 for savings. By saving all $586 each month, the $67,600 needed for the deposit can be reached in nearly 10 years’ worth of time, the highest number on the list.

Placing second on the list was the state of Montana, where it would take 9.56 years to save $61,377, corresponding to the 10% deposit of a house's median home listing price of $613,725. This can be reached by saving $535 monthly, an average of 20% of Montanans income after rent.

Hawaii placed third, as it would take 9.40 years to save for a 10% deposit to buy a house, which corresponds to $84,875—possible if, from the median monthly income of $5,936, the 20% assigned to savings corresponding to $752 is put aside.

Further down the list, New York occupied fourth place with 8.66 years’ worth of savings needed for a house deposit, while Idaho closes the top five at 8.50 years. The monthly savings to reach this goal are $574 and $554 respectively.

On the other side of the list, the states in which it takes the least time to save for a down payment included Ohio, with 3.79 years, North Dakota and Kansas both at 4.02 years, and Illinois with 4.25 years.

According to Freddie Mac’s latest dataset, the 30-year, fixed-rate mortgage (FRM) stands a shade below the 8% mark at 7.76%. This marked a slight week-over-week three basis point decline, as the Federal Reserve decided not to raise the nominal interest rate and hold steady at 5.25%-5.5%, the second straight pause in rate hikes.

“The time it takes to save for a house deposit in each U.S. state varies significantly, reflecting the diverse economic landscapes across the country,” said Al Harris, Content Manager of SelfStorage. “In states with higher living costs like Massachusetts, Montana, Hawaii or New York, the duration to save for a deposit can stretch to almost a decade, making homeownership a daunting prospect for many. Regardless, the prospect of one day owning a home is a landmark in one’s life that does push people forward and makes them willing to make all the manageable sacrifices it takes.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news