According to the J.D. Power 2023 U.S. Mortgage Origination Satisfaction Study, many lenders have had to pivot in the past year to meet the needs of a purchase-heavy market, and have successfully delivered on key elements of the borrowing experience, resulting in significantly higher overall customer satisfaction.

According to the J.D. Power 2023 U.S. Mortgage Origination Satisfaction Study, many lenders have had to pivot in the past year to meet the needs of a purchase-heavy market, and have successfully delivered on key elements of the borrowing experience, resulting in significantly higher overall customer satisfaction.

That said, this improved service level could be hard for most to maintain as the effect of aggressive cost-cutting is starting to take a toll and market conditions are unlikely to improve in the foreseeable future.

“With a purchase heavy market, lenders tend to default back to a heavy reliance on real estate agents,” said Craig Martin, Executive Managing Director and Global Head of Wealth and Lending intelligence at J.D. Power. “While it’s important to have a strong partner network, for lenders to set themselves apart they need to elevate their role in the homebuying process.”

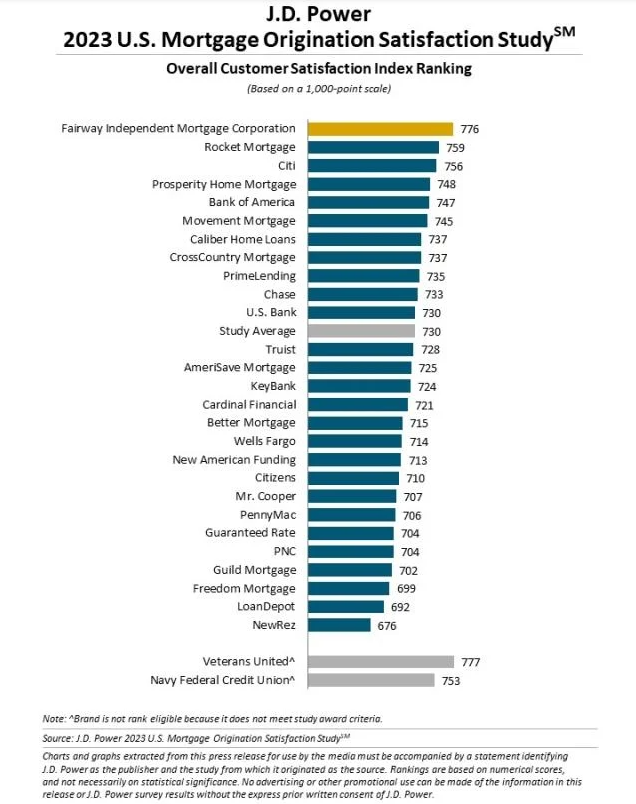

Fairway Independent Mortgage Corporation ranked the highest in mortgage origination satisfaction, with a score of 776, followed by Rocket Mortgage (759) at second, and Citi (756) ranking third. Rounding out the top five, Prosperity Home Mortgage ranked fourth with a score of 748, and coming in at fifth was Bank of America with a score of 747.

The U.S. Mortgage Origination Satisfaction Study measures overall customer satisfaction based on performance in six factors (in alphabetical order): communication; digital channels; level of trust; loan offering meets my needs; made it easy to do business with; and people. The 2023 study was fielded from November 2022 through August 2023 and is based on responses from 9,191 customers who originated a new mortgage or refinanced within the past 12 months.

“While the most frequently cited factor influencing first-time homebuyers’ consideration of lender was a real estate agent recommendation, it was only one percentage point higher than recommendations from other friends and family,” added Martin. “Among first-time buyers who said that the real estate agent was the largest influence, nearly six in 10 said they applied to multiple lenders. We also find that when the average trust in the lender is well below average, the primary reason for selection is a real estate agent. This isn’t to imply that real estate agents aren’t good partners, but if you are seeking to be a true lending partner to customers as opposed to a transactional product provider, it’s imperative to show the value you bring. In this year’s study, satisfaction for first-time buyers was down by a significant 25 points, from 725 last year to 700 now. First-time buyers are frustrated with the process and eager to get assistance, and having a trusted real estate agent may be one way to do it.”

Following are some key findings of the 2023 study:

- Overall satisfaction rises despite record high rates: Overall customer satisfaction with mortgage lenders is 730 (on a 1,000-point scale), up 14 points from a year ago, even as the average mortgage rate has climbed to its highest level in 23 years and overall lending volume has declined.

- Nearly one-third (31%) of mortgage customers say they selected their lender solely because they offered the lowest interest rate. More than two-thirds (69%) chose lenders for other reasons, such as personalized service and ability to help navigate the loan market.

- Many lenders are finding that by engaging with borrowers earlier in their shopping journey, they can retain those customers throughout the process. Overall, 38% of mortgage customers say they started working with a lender when they first thought about buying. The percentage of borrowers who say their loan rep should have been more involved has risen to 40% from just 29% a year ago.

- While overall customer satisfaction with the lending process is up this year, the increase has been driven primarily by repeat buyers. Overall satisfaction among first-time homebuyers, however, is down significantly. This reflects the complex lending environment and considerable challenges customers are facing.

“The value equation for mortgage originators has shifted from instant approvals and lightning-fast processing to helpful advice and creative problem solving,” said Bruce Gehrke, Senior Director of Wealth and Lending Intelligence at J.D. Power. “Lenders that manage this transition well have a great opportunity to build customer goodwill and limit defection by showing customers they understand their unique needs and the challenges of the current market.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news