Mortgage rates continue to slide, however overall mortgage application volume slide this week as well.

Mortgage rates continue to slide, however overall mortgage application volume slide this week as well.

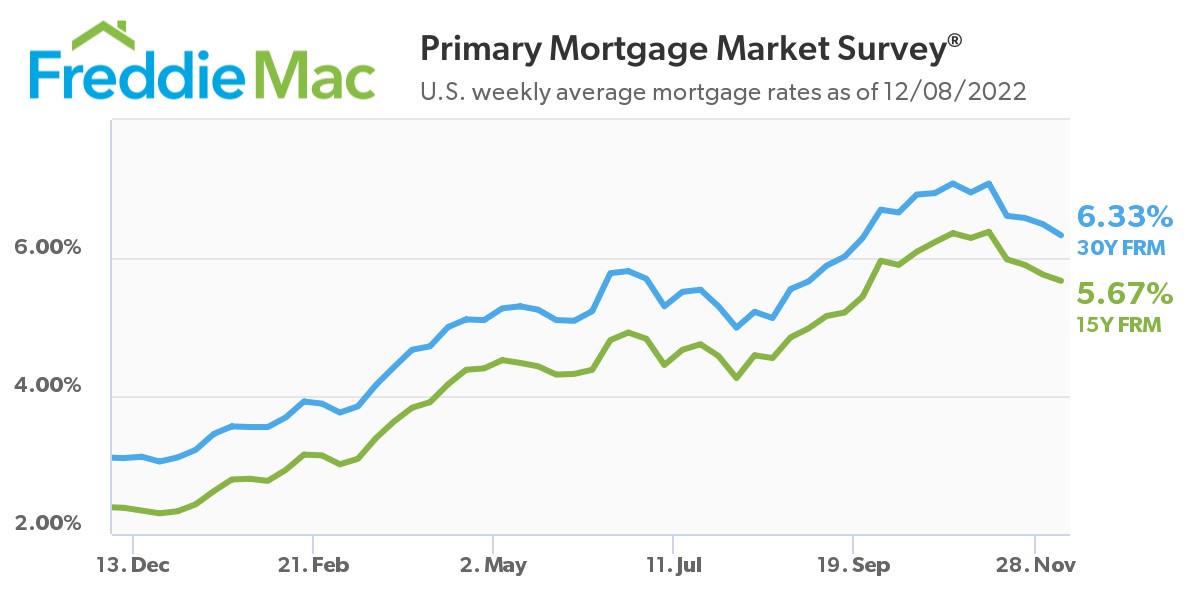

Freddie Mac, in its latest Primary Mortgage Market Survey (PMMS), reports that the 30-year fixed-rate mortgage (FRM) averaged 6.33% for the week ending December 8, 2022, down yet again from last week when the FRM averaged 6.49%. A year ago at this time, the 30-year FRM averaged 3.10%. This marked the fourth consecutive week of declines of the 30-year FRM.

“Mortgage rates decreased for the fourth consecutive week, due to increasing concerns over lackluster economic growth,” said Sam Khater, Freddie Mac’s Chief Economist. “Over the last four weeks, mortgage rates have declined three quarters of a point, the largest decline since 2008. While the decline in rates has been large, homebuyer sentiment remains low with no major positive reaction in purchase demand to these lower rates.”

Also this week, the 15-year FRM averaged 5.67%, down from last week when it averaged 5.76%. A year ago at this time, the 15-year FRM averaged just 2.38%.

And despite the month-long decline in mortgage rates, the Mortgage Bankers Association (MBA) reported that overall mortgage application volume fell week-over-week, decreasing 1.9% from last week, according to the MBA’s Weekly Mortgage Applications Survey.

The MBA’s Refinance Index rose 5% from the previous week, yet was 86% lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3% from one week earlier. The unadjusted Purchase Index increased 31% compared to the previous week, and was 40% lower than the same week one year ago.

“Mortgage applications decreased 2% compared to the Thanksgiving holiday-adjusted results from the previous week, even as mortgage rates continued to trend lower,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “Additionally, the pace of refinancing remained around 80% lower than a year ago.”

The steady decline in rates is spurring renewed interest in the refi market as the refinance share of mortgage activity increased to 28.7% of total applications from 26.1% the previous week. The adjustable-rate mortgage (ARM) share of activity fell to just 7.6% of total applications.

By loan type, the FHA share of total applications increased to 13.7% from 12.2% the week prior, while the VA share of total applications increased slightly to 11.4% from 11.2% the week prior. The USDA share of total applications increased to 0.6% from 0.5% the week prior.

“Purchase activity slowed last week, with a drop in conventional purchase applications partially offset by an increase in FHA and USDA loan applications,” added Kan. “The average loan size for purchase applications decreased to $387,300–its lowest level since January 2021. The decrease was consistent with slightly stronger government applications and a rapidly cooling home-price environment.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news