At the mid-point of 2023, Gen Z consumers—born between 1995 and 2005—increasingly find themselves with new access to credit products, according to the Q2 2023 Quarterly Credit Industry Insights Report (CIIR) from TransUnion.

The report shows that, relative to the consumer population as a whole, Gen Z consumers continue to turn to bank cards and unsecured personal loans even though lenders have begun to tighten underwriting.

TransUnion’s most recent Consumer Pulse findings from July 2023 found that 50% of Gen Z consumers—compared to 32% for the entire population—are planning to apply for new credit or refinance existing credit (e.g., student loan, credit card, personal loan, car loan/lease, mortgage) within the next year.

“It makes sense to see Gen Z consumers’ use of credit cards and personal loans increase relative to consumers as a whole as they age into financial independence,” said Michele Raneri, VP of U.S. research and consulting at TransUnion. “Like the overall population, many Gen Z borrowers are facing the same financial challenges brought on by high interest rates and inflation. As a result, they are tapping into these available credit products to help them cope with rising expenses and the tightening of their monthly budgets.”

This percentage is a marked increase from the 41% of Gen Z consumers who said they planned to apply for credit or refinance in the July 2022 report.

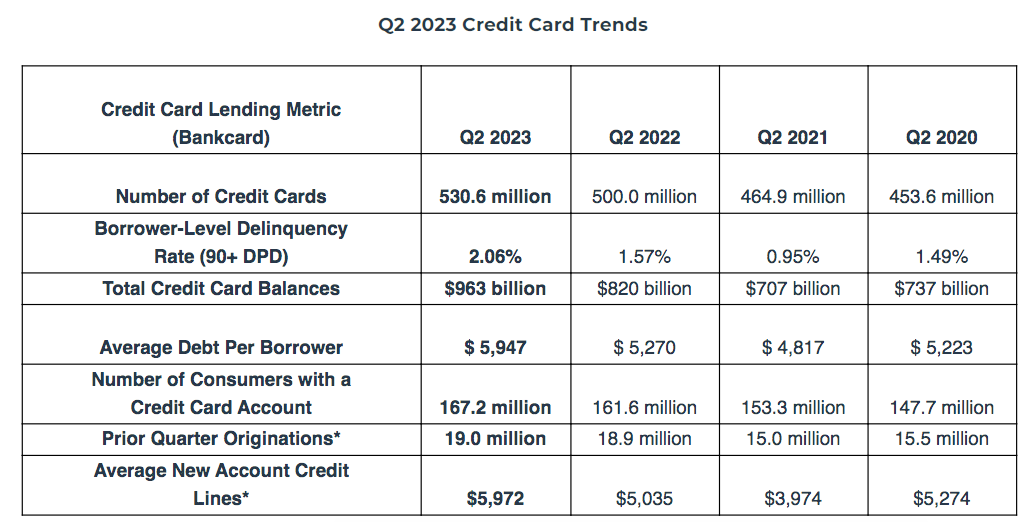

Bankcard balances once again reached a new record high of $963 billion in Q2 2023, up 17.4% year-over-year. Among Gen Z consumers, total balances increased 51.9% year-over-year and now stands at $55 billion, representing 5.7% of all balances.

“Bankcard balances continue to grow; however, consumers are distributing those balances across more cards than they have in the past, which has resulted in balances per account remaining within normal limits," said Paul Siegfried, Senior VP and credit card business leader at TransUnion. "Lenders have seemingly made a clear shift in acquisition strategy as, following two consecutive quarters of record originations, subprime’s share has declined significantly for the second quarter in a row, while super prime’s share has increased to that of pre-pandemic levels.”

Unsecured personal loan originations fell overall year-over-year for the second consecutive quarter, down 16.1%. Within the overall population, originations among Gen Z consumers were 493,000 in Q1 2023, representing a smaller 7.6% decrease year-over-year.

New research found that lenders are continuing to increasingly focus on less risky credit tiers when considering new originations across a number of credit products, particularly impacting subprime borrowers.

Auto originations in Q1 2023 were down 11.6% among subprime borrowers year-over-year—and down 21.3% as compared to pre-pandemic 2019. Among unsecured personal loans, subprime originations for Q1 2023 were also down 26.1% year-over-year.

“Unsecured personal loan balances continue to increase, driven by strong growth in the super prime segment. Growth continued to slow, however, as lenders steered towards less risky borrowers," said Liz Pagel, Senior VP of Consumer Lending at TransUnion. "Q1 originations were down 15.5% compared to record originations in Q1 2022. Subprime delinquencies backed off their Q1 2023 highs, leading to a decrease in overall delinquency that, while still high, inched closer to levels seen pre-COVID. Lenders can still find opportunities with consumers supported by high employment levels despite inflation and other challenges.”

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news