According to the Mortgage Bankers Association (MBA), mortgage credit availability increased in September, a report from the MBA that analyzes data from ICE Mortgage Technology.

According to the Mortgage Bankers Association (MBA), mortgage credit availability increased in September, a report from the MBA that analyzes data from ICE Mortgage Technology.

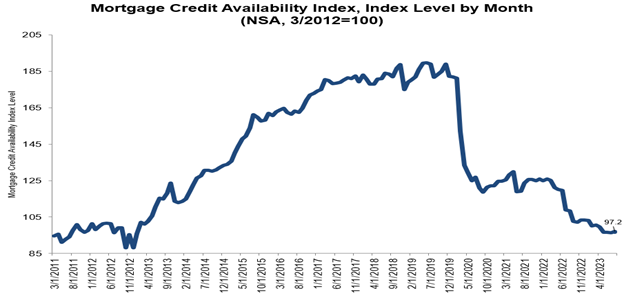

The MCAI rose by 0.6% to 97.2 in September. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The MCAI was benchmarked to 100 in March 2012.

“Credit availability increased slightly in September, as lenders increased their loan offerings marginally to meet the changing needs of borrowers who are facing higher mortgage rates,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “There were more loan programs for ARM loans for borrowers seeking lower initial monthly payments, and also some increases in non-QM product offerings. Credit availability increased across all loan categories, with the Jumbo Index increasing for the second straight month, driven by the expansion of ARM and non-QM offerings.”

By loan type, the Conventional MCAI increased 0.6%, while the Government MCAI increased by 0.6%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 0.8%, and the Conforming MCAI rose by 0.2%.

“Industry capacity has declined significantly since the peak originations months in 2021, and MBA expects to see further declines in originations volume, given the high interest rate environment and typical seasonal slowdown,” added Kan.

Fannie Mae’s latest Home Purchase Sentiment Index (HPSI) decreased by 2.4 points in September to 64.5, with elevated mortgage rates further dampening pessimistic consumers. The HPSI’s six components decreased month-over-month, including the components measuring perceived homebuying and home-selling conditions. According to Fannie Mae, in September, some 16% of consumers reported that it is a good time to buy a home, matching the all-time survey low set last year. Additionally, an estimated 63% felt it was a good time to sell a home, down 3 percentage points compared to the prior month. Only 17% of consumers indicated that they expect mortgage rates to go down over the next 12 months. Overall, the full index is up 3.7 points year-over-year.

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI, and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits. The Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted “base levels” in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news