Mortgage applications increased 1.3 percent on a seasonally adjusted basis in May, according to the Mortgage Bankers Association's latest mortgage application survey released Wednesday. The survey measured application data for the week ending June 1 and included an adjustment for the Memorial Day holiday. On a non-seasonally adjusted basis, application rates were not as strong, falling more than 9 percent from the previous week. Refinances continue to make up a large portion of mortgages, taking up 78 percent of activity for the week, up 1 percent from the previous week.

Read More »Group: Housing Finds Sustainable Recovery Amid Threats

In its latest monthly report released Monday, Capital Economics painted a positive picture of the housing market, insisting the market has moved from bottoming-out to recovering. To those wondering whether Capital Economics' positive prophesies are merely a mirage soon to be dispersed much like the short-lived positive movement the market experienced in 2009 and 2010, the analytics firm pointed out a substantial difference between what occurred in 2009-2010 and what is occurring today.

Read More »Home Prices Rise for First Time Since March 2010: LPS

Home prices rose by a seasonally adjusted 0.2 percent in February, the first increase since March last year, according to Lender Processing Services. The analytics and data provider said that several other indicators posted solid gains in February. Home prices averaged $195,000, the same as seen in June 2003. LPS also projected a 0.3 percent increase in national home prices on the whole come March. Of 26 metro areas surveyed by LPS and the Labor Department, only cities in California ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô Los Angeles, San Diego, and San Francisco ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô observed price declines.

Read More »Capital Economics Sees Improvement Ahead for Housing

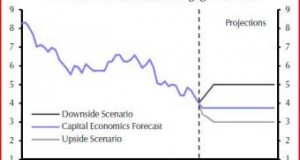

Noting some recent strengthening in demand in the housing market, Capital Economics suggests housing prices "are close to, or already through, their trough," and recovery will continue through the coming months. While acknowledging the decline in home sales in March, Capital Economics├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ó analysts remain optimistic due to the recent increases in pending home sales. The National Association of Realtors' latest Pending Home Sales Index in March reached 101.4, its highest level since April 2010. Recent data on mortgage applications also point toward a strengthening market.

Read More »Homeownership Rate Plummets to 15-Year Low

Homeownership rates dropped to 65.4 percent in the first quarter, reaching lows not seen in fifteen years, the Census Bureau said Monday. According to government data, the homeowner vacancy rate also fell to 2.2 percent nationwide, down from 2.6 percent in the first quarter of 2011 and the rental vacancy rate dropped to 8.8 percent from 9.7 percent one year earlier. The median asking sale price for a vacant home fell to $133,700 ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô the lowest level since second quarter 2005 ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô from $133,800 in the fourth quarter and $143,700 one year earlier.

Read More »Home Prices Fall to Lowest Level Since 2002

The Case-Shiller Home Price Indexes fell for the sixth straight month in February, with the 10- and 20-city indices each dropping 0.8 percent from January, according to Standard & Poor's. The 10-city index slid to its lowest level since May 2003 and the 20-city index dropped to its lowest level since October 2002. Prices fell in 16 of the 20 cities surveyed, improving month-over-month in only Miami, Phoenix, and San Diego. Prices were down year-over-year in 15 of the 20 cities, improving only in cities like Denver, Detroit, and Minneapolis.

Read More »Mortgage Applications Tick Up 4.8% Last Week: MBA

Scheduled increases for government premiums and springtime for a still-steady recovery helped drive up mortgage application volume by 4.8 percent last week, the Mortgage Bankers Association said Wednesday. The trade group also found mortgage applications headed up by 5 percent on a seasonally unadjusted basis. The Refinance Index ticked up 4 percent from last week, with the refinance share of mortgage activity on a decline to 71.2 percent of total application volume, down from 71.9 percent from the week before.

Read More »Higher Mortgage Rates Unlikely to Drown Housing: Group

The potential for a lift in mortgage rates is unlikely to spell trouble for the housing recovery, according to a recent report. Paul Diggle, a property economist with Capital Economics, said in a note Monday that still-low home prices will help cushion the blow from interest rates. Mortgage rates continue to linger near record lows, with 30-year and 15-year fixed-rate mortgages hovering at or below 4 percent for the past several weeks. Waning confidence in Europe├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós ability to halt the debt crisis in Greece drives investors to U.S. Treasury debt.

Read More »Falling Loan Applications Tilt Toward Still-Nascent Recovery

In signs that a stable housing rebound may still be ways off, mortgage applications contracted by 1.2 percent last week, even while the Home Affordable Refinance Program offered a still-steady buttress for refinance activity. The Mortgage Bankers Association found in a weekly survey that mortgage application volume also declined by 10.2 percent on a seasonally adjusted basis. The Purchase Index went up by a seasonally adjusted 2.1 percent from last week, while it climbed by 14.7 percent on a seasonally unadjusted basis.

Read More »Group: Euro Crisis Could Choke ‘Healing’ Housing Market

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news